TLI Exclusive: Flourished During Lockdowns, Instant Loan Apps Had Over Rs 21,000 Crore Volume

India, 10 Jan 2021 9:41 AM GMT | Updated 10 Jan 2021 9:44 AM GMT

Editor : Shubhendu Deshmukh |

Shubhendu, the quint essential news junky, the man who loves science and politics in equal measure and offers the complete contrast to it by being a fan of urdu poetry as well.

Creatives : Abhishek M

" An engineer by profession, Abhishek is the creative producer of the team, graphic designing is his passion and travelling his get away. In more ways than one, he makes the content visually appealing."

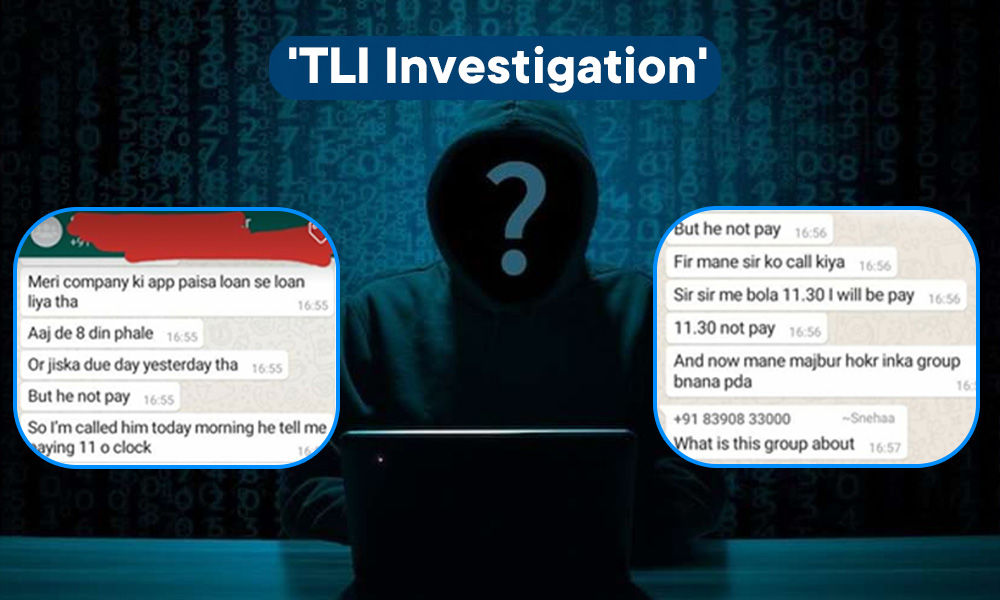

In the part-2 of The Logical Indian investigation into instant loan apps' we explain you the magnitude of the lending companies and how easy it is to get a loan from these apps.

Ashok (name changed) from Gujarat was pursuing graduation when he became a target of the instant app-based loan finance companies. He borrowed money from a number of apps, and that was it. He still regrets the "worst mistake of his life."

It was during the COVID-19 pandemic that he urgently needed money. "I came across the ads about instant loan lending apps and thought it would be a great idea to borrow money from them as they do not need any salary slip or collateral. I could not borrow money from anyone as everyone was running short of money due to lockdowns and job losses," he said.

As Ashok could not repay the loan on time, most of his friends and family members started getting recovery calls and abuses from the apps. "They abused my parents, close relatives and friends saying their boy has taken loan but hasn't repaid it," he added.

Ashok said that he got calls for some time even after he repaid the loan.

Hyderabad Additional Commissioner of Police (Crimes and SIT) Shikha Goel had recently made a statement that their business flourished during the lockdown when people ran out of money and looked up to lending apps. This statement came out at a time when four companies which were operating at least 30 apps with a ₹21,000 crore volume in over 1.40 crore transactions were identified in Telangana, recently.

These firms took an interest of at least 35 per cent, and the amount keeps increasing till the borrowers repaid the loan.

Another victim of the loan apps, Karthik (name changed) from Bengaluru filed a complaint with the police the apps started "torturing" him through recovery calls.

"The overall process of getting the loan was pleasant and quick. I wanted money during the pandemic as my salary was cut and I had daily demands to meet. I thought it would be easy to get money from these banks as they did not ask for collateral. I got a warning on the day of my deadline (in seven days of borrowing) that my relatives and parents will be called up and told me about my loan and humiliate me. I asked for time till that day's evening and could not repay it," Karthik said.

He added that the next day, they sent him a WhatsApp message saying threatening to call up everyone. The companies later did call some of his relatives and friends. After some days, he managed to pay back the loan. But the calls continued. "Hence, I filed a complaint with the police."

"Nobody called me twice. Every time I got a recover call, it used to be another one. I never spoke to one person twice," he said.

"They sent me a suggestion asking me to register in another instant loan app, borrow money and pay them that money. I did it, and that way, I became the customer of over seven apps," he added.

Another victim Shailesh (name changed) from Tamil Nadu said the ladies of his house got recovery calls threatening that he would be sent to jail. He had borrowed money from 15 apps and repaid it. And like everyone else, even he got calls despite repaying the money.

How Do These Apps Work?

People fall for the social media ads of these instant loan lending apps as they can get a loan without a 'salary slip' or any collateral. They download the app and register themselves. They will be asked to fill up the details, like name, residential address, KYC details, bank account number, salary details, etc., along with the loan amount one wants to take. In the end, they will be asked to upload a selfie.

Instant loan mobile apps allow you to borrow money from any bank in your country at an interest rate set by them. The apps allow the borrower to compare the interest rates and choose according to their needs. One that can lend you money for a specific period can be contacted.

While registering, the customers should allow access to their phone. If they deny, the loan will be cancelled. After all these formalities, within no time, money gets transferred into the account. Some apps will have a loan tenure of seven days, while some have 15 days. The starting limit of the amount for anyone to borrow is ₹1000.

All section

All section