TLI Exclusive: Friends 'Harassed', Women Relatives 'Targeted', How Instant Loan Apps Are Recovering Money

India, 7 Jan 2021 10:34 AM GMT | Updated 11 Jan 2021 8:43 AM GMT

Editor : Shubhendu Deshmukh |

Shubhendu, the quint essential news junky, the man who loves science and politics in equal measure and offers the complete contrast to it by being a fan of urdu poetry as well.

Creatives : Abhishek M

" An engineer by profession, Abhishek is the creative producer of the team, graphic designing is his passion and travelling his get away. In more ways than one, he makes the content visually appealing."

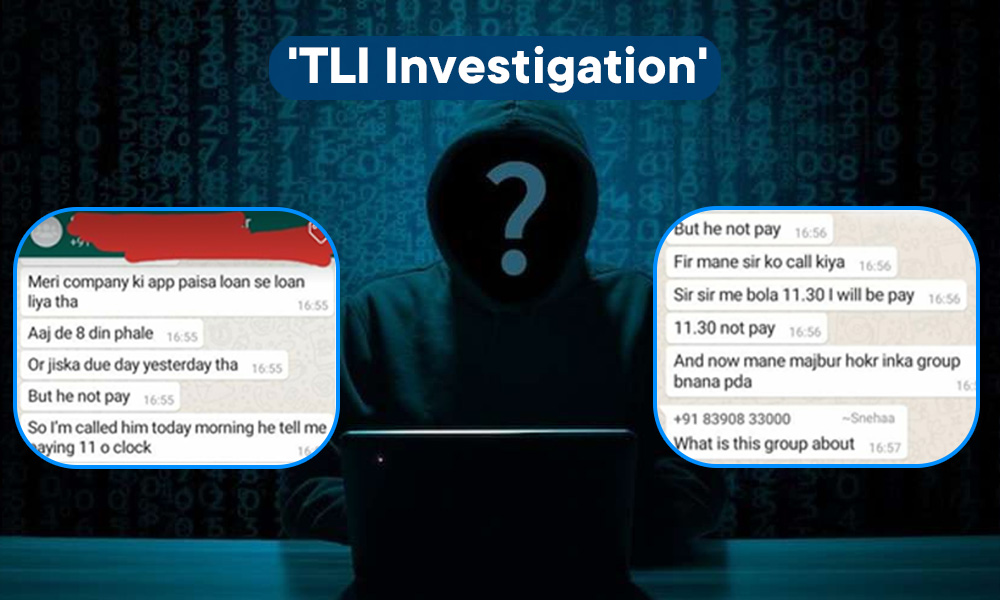

In the part-1 of The Logical Indian investigation into instant loan apps' recovery process, we tell you how the lenders target women in the borrower's family.

When Ramesh (name changed) borrowed money from one of the instant app-based loan finance companies a few months back, little did he know that his life would turn into misery? Having failed to repay the loans on time, his wife started receiving "calls threatening her husband's imprisonment " from the lenders.

Yes, the lender's target 'women' to recover the loan, he claimed. "The online lending apps generally call up the ladies at defaulters' home, as they think they can be easily threatened and frightened. As I could not pay back the loan I borrowed from some of the apps on time, they called up my wife and told her that her husband will be put in jail if he doesn't return the money," Ramesh told The Logical Indian, from Tamil Nadu's Trichy.

"It was a time when the pandemic was raging, I needed money the most. I had no other source and hence chose these apps. I had borrowed money from over 50 apps, thinking I will be able to return the money soon. But to my bad, I couldn't and hence I had to face the torture from their recovery calls," he added. He still gets calls from the lenders despite paying back their loans.

A money lending mobile app allows you to borrow money at an interest rate that has been set by them. These apps allow you to compare the interest rates and see which one suits you best and the one that can lend you money for a specific period can be contacted.

Explaining how the instant loan lending apps work, Ramesh said that people fall for the social media ads of these instant loan lending apps as they can get a loan without a 'salary slip' or any collateral. They download the app and register themselves. They will be asked to fill up the details, like name, residential address, KYC details, bank account number, salary details, etc., along with the loan amount one wants to take. In the end, they will be asked to upload a selfie.

While registering, the customers should allow access to their phone. If they deny, the loan will be cancelled. After all these formalities, within no time, money gets transferred into the account. Some apps will have a loan tenure of 7 days while some will have 15 days. The starting limit of the amount can anyone can borrow is ₹1000. Once the deadline approaches, the customers start getting recovery calls.

"On the day of the deadline, they just call us and ask to repay the loan within half an hour. If we do not pay back in that time, they send a list of contacts of family members and relatives on What's App and threaten us saying they will call them up if they do not return the money, which they eventually do."

He added, "If we still do not pay back the loan, they will send a suggestion of another loan lending app and ask us to register in it and get a loan so that we can repay them. Likewise, we become customers to a chain of lending apps."

After going through all this, he, and some of his friends who included the victims of these apps started a Facebook campaign with a hashtag #BanOnlineApps in December last year creating awareness about the apps and urging people "not to use them at all."

Failure to repay the loan borrowed from instant app-based loan finance companies and their repeated recovery calls are forcing customers to eventually end their lives.

On Saturday, December 2, G. Chandra Mohan (36) supervisor of a private warehouse, killed himself at his residence at Gundla Pochamma village in Medchal-Malkajgiri district, about 30 km from Hyderabad. This is the fifth such incident due to harassment by these companies existing only as mobile applications.

Another person, Mathew (name changed) from Tamil Nadu shared the story of his minor friend who was also a victim of the torture from these apps. "He was studying in Class 12 and got loans from over 15 apps without the knowledge of his parents. The loan amount came up to ₹80,000. He could not obviously payback the money in time as he was still a student who was not working. I don't know what he used the money for, but the lenders called his mother and started abusing her. They even called his father and other relatives," said Mathew.

"Why do these apps lend money to minors, without any collateral? They lend money just like that without even asking for valid ID proofs, address proofs etc. This guy could borrow money by using just his college ID card. Imagine the kind of effect it would have had on his parents," added Mathew.

A former journalist who worked in Bengaluru's top newspapers said she got calls from these apps as her sister had borrowed money from them. "They called up my whole family including relatives. She returned the money borrowed from them but still, we all used to get calls. They said, 'your sister hasn't paid the loan, ask her to pay back'. This is despite paying back the loan. They called us from different numbers and when we called back, those numbers were not reachable or did not exist," she said.

All section

All section