Credits: Livejagran

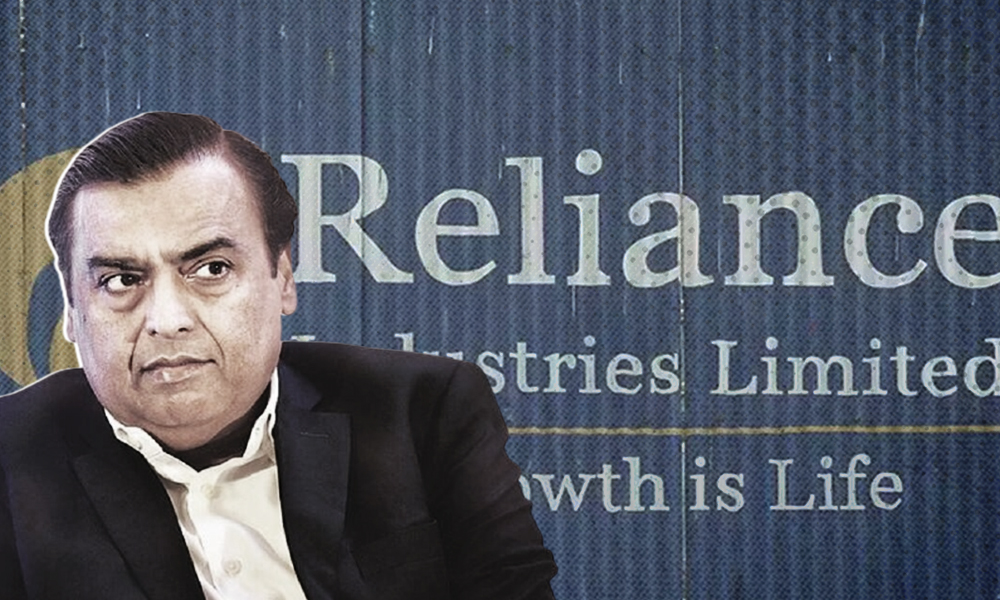

SEBI Fines Mukesh Ambani, Reliance ₹40 Crore For Manipulative Trading In 2007

Writer: Devyani Madaik

A media enthusiast, Devyani believes in learning on the job and there is nothing off limits when it comes to work. Writing is her passion and she is always ready for a debate as well.

India, 3 Jan 2021 9:02 AM GMT

Editor : Shubhendu Deshmukh |

Shubhendu, the quint essential news junky, the man who loves science and politics in equal measure and offers the complete contrast to it by being a fan of urdu poetry as well.

Creatives : Abhishek M

" An engineer by profession, Abhishek is the creative producer of the team, graphic designing is his passion and travelling his get away. In more ways than one, he makes the content visually appealing."

The case in which the SEBI has issued the penalty pertains to sale and purchase of Reliance Petroleum Ltd. (RPL) shares in the Cash and the F&O Segment in November 2007.

India's market regulator Securities and Exchange Board of India (SEBI) on Friday, January 1 imposed ₹25 crore penalty on Reliance Industries Ltd. (RIL) and a fine of ₹15 crores on chairman and Managing Director Mukesh Ambani, for allegedly violating trading rules and manipulating shares of Reliance Petroleum in 2007.

The regulator has fined two other entities, Navi Mumbai SEZ Pvt Ltd. with ₹20 crores and Mumbai SEZ ₹10 crores.

The case in which the SEBI has issued the penalty pertains to sale and purchase of Reliance Petroleum Ltd. (RPL) shares in the Cash and the F&O Segment in November 2007.

In its 95-page order, SEBI said that the company and its agents earned undue profits from the sale and purchase of RPL in the cash and the futures segments 13 years ago, and Ambani was liable for the alleged manipulative trading.

As of now, there has been no official statement by the company or Mukesh Ambani.

The Case

SEBI's order is related to the trading in the scrip of Reliance Petroleum Limited (RPL), that merged with RIL in 2007. At the time, the board of RIL had approved the operating plan for the year 2007-08. Later, in March the same year, the company decided to sell 4.1 per cent of stake in RPL, LiveLaw reported.

To undertake transactions, the company appointed 12 agents between October and November.

SEBI found that 12 Agents appointed by RIL took short positions in the F&O Segment on behalf of the company, while RIL undertook transactions in RPL shares in the cash segment. The following month, RIL undertook multiple transactions in the cash segment and through agents in the F&O Segment.

The short positions in the F&O Segment continuously exceeded the proposed sales of shares in the Cash Segment.

"On November 29 2007, RIL sold a total of 2.25 crore shares in the Cash Segment during the last 10 minutes of trading resulting in fall in RPL shares prices, which also lowered the settlement price of RPL November Futures in the F&O Segment. RIL's entire outstanding position of 7.97 crores in the F&O Segment was cash settled at this depressed settlement price resulting in profits on the said short positions. The agents transferred the said profits to RIL as per a prior agreement," the official statement as quoted.

The regulator observed that 12 entities earned a profit of more than ₹500 crores in the derivative Segment of RPL in November. Many investors were unaware that the entity behind F&O Segment trades was RIL.

SEBI stated that such fraudulent acts affect the trading price system and the interests of the investors.

All section

All section