Know How You Can Claim Your Medical Expenditure For TAX Benefits

25 Oct 2015 12:03 AM GMT

Article originally published on factly.in|Author: Rakesh Dubbudu

In continuation of the commitment made during the Budget Speech of 2015-16, the government has now made certain changes to the process of claiming medical expenditure under Sec 80DDB of the IT Act. The process has been made easier now.

In his budget speech for the year 2015-16, Finance Minister Arun Jaitley announced certain benefits in claiming medical expenditure under section 80DDB of the Income Tax Act (IT Act). He announced increase in the limits of the amount that can be claimed under this section.

This particular section allows a deduction for expenditure incurred on treatment of specified ailments for self or a dependent. The government has now issued a notification amending rule 11DD of the IT Rules making it easier to claim such expenditure.

Claiming Medical Expenditure under Sec 80DDB

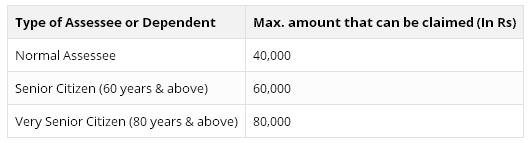

Under this section, the assessee will now be allowed a deduction of actual amount or Rs 40,000 (whichever is less) in case of normal citizens for certain ailments. These limits are higher for Senior & Very Senior citizens as noted below.

The following ailments or diseases will be eligible for the purpose of this section

- Neurological Diseases where the disability level has been certified to be of 40% and above

- Dementia

- Dystonia Musculorum Deformans

- Motor Neuron Disease

- Ataxia

- Chorea

- Hemiballismus

- Aphasia

- Parkinsons Disease

- Malignant Cancers

- Full Blown Acquired Immuno-Deficiency Syndrome (AIDS)

- Chronic Renal failure

- Hematological disorders

- Hemophilia

- Thalassaemia

Process made easier

The government has now issued a notification amending rule 11DD of the IT Rules making it easier to claim such expenditure. Earlier, the prerequisite condition for claiming expenditure under this section was obtaining a certificate from a specialist working in a Government hospital. Now this condition is relaxed and henceforth, it will not be mandatory to obtain a certificate from a specialist working in a Government hospital.

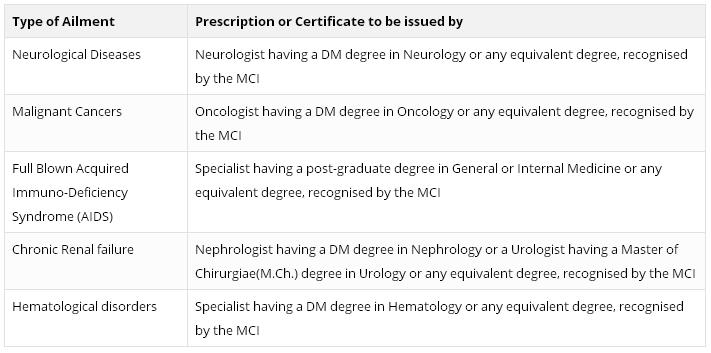

As per the amended rules, it will be enough if the certificate is obtained from a doctor with a relevant Doctorate of Medicine (DM) degree recognized by the Medical Council of India (MCI).

If the patient is receiving the treatment in a Government hospital, the prescription or certificate may be issued by any specialist working full-time in that hospital and having a post- graduate degree in General or Internal Medicine or any equivalent degree, which is recognized by the MCI.

The Prescription or the certificate issued should contain the following,

- Name and Age of the patient

- Name of the disease or ailment

- Name, address, registration number and the qualification of the specialist issuing the prescription

- Name and address of the Government hospital if the treatment is being received in a government hospital.

All section

All section