Here Are The Items Taxed Separately Outside Of GST Or Are Exempted

10 July 2017 7:29 AM GMT

Editor : Pooja Chaudhuri

The only fiction I enjoy is in books and movies.

Since the rollout of the GST bill, a certain amount of confusion has been doing the rounds within the general population of India. The Goods and Services Tax was rolled out on July 1 and it sought to ensure an integrated tax on goods and services which would cover both state and central levies.

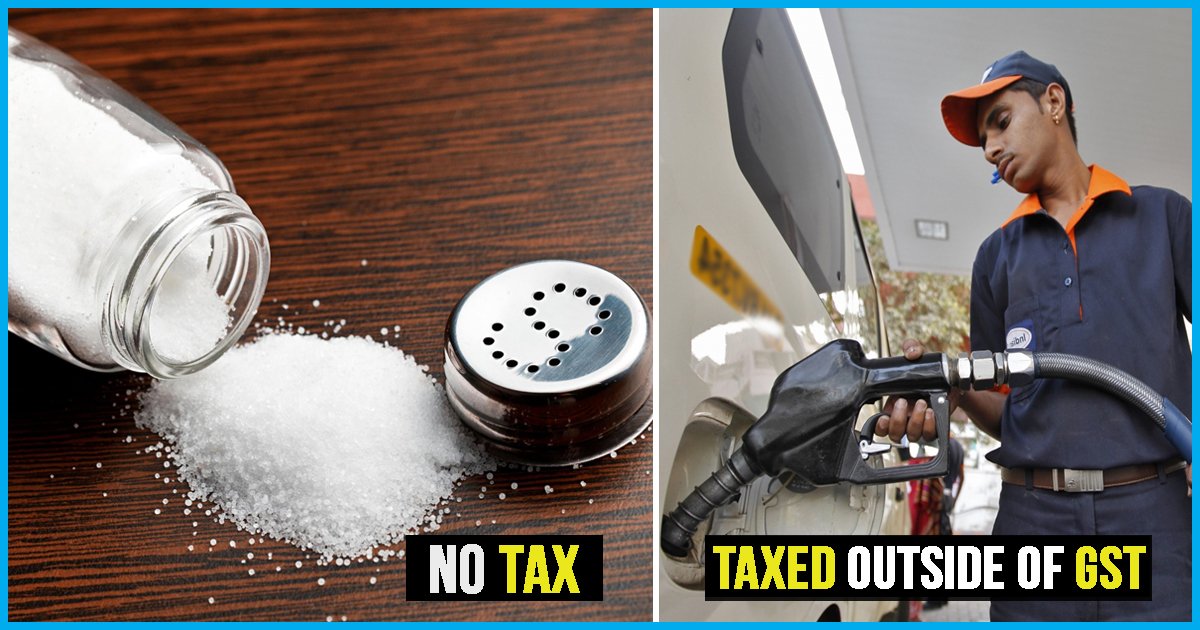

So far, the prices of a lot of regular commodities have been affected due to the GST Bill. However, here are several goods and services which are either exempted under GST or not covered under the tax.

Items not covered under GST and will be taxed separately

Certain items are beyond the scope of GST, i.e., GST will not apply to them. These are classified under Schedule III of the GST Act as “Neither goods nor services”.

- Services by an employee to the employer in relation to his employment – employee to still pay income tax

- Court/Tribunal Services including District Court, High Court and Supreme Court will not charge GST to pass judgements

- No GST on duties performed by:

-The Members of Parliament, State Legislature, Panchayats, Municipalities and other local authorities

-Any person who holds a post under the provisions of the Constitution

-Chairperson/Member/Director in a body established by the government or a local body and who is not an employee of the same

- There are no taxes on funeral services (funeral, burial, crematorium or mortuary including transportation of the deceased) for any religion

- Actionable claims (other than lottery, betting and gambling which attract 28% GST) are “neither products nor services” and can be considered as something in lieu of money.

Actionable Claims means claims which can be enforced only by a legal action or a suit, example a book debt.

- Apart from Schedule III, GST is also not applicable on alcohol for human consumption, electricity and petroleum. These will be subject to existing State levies.

Exempted goods

The goods that attract 0% tax under GST are:

- Live animals

All goods other than live horses, including:

-live asses, mules and hinnies

-bovine animals

-swine

-sheep and goats

-poultry that is to say fowls, ducks, geese, turkeys and guinea fowls

-other live animals such as mammals, birds and insects.

- Meat and edible meat offal

All goods other than in frozen state and put up in unit containers, meat of bovine animals (fresh or chilled)

-meat of swine (fresh or chilled)

-meat of sheep and goats (fresh or chilled)

-meat of horses, asses, mules or hinnies (fresh or chilled)

-Edible offal of (fresh or chilled)

-bovine animals

-swine

-sheep, goats, horses, asses, mules, hinnies

-meat and edible offal of the poultry of heading, fresh or chilled

-pig fat, free of lean meat and poultry fat, not rendered or otherwise extracted, fresh, chilled is also exempted

Exemption on fresh and pasteurised milk, including separated milk, milk and cream, not concentrated nor containing added sugar or other sweetening matter, excluding Ultra High Temperature (UHT) milk; eggs, birds’ eggs, in shell, fresh, preserved or cooked, curd, lassi, butter milk, chena or panneer other than put up in unit containers and bearing a registered brand name; Natural honey, other than put up in unit container and bearing a registered brand name.

- Fish, crustaceans, molluscs & other aquatic invertebrates

-Fish seeds, prawn / shrimp seeds whether or not processed, cured or in frozen state

-All goods, other than processed, cured or in frozen state

-Fish, fresh or chilled, excluding fish fillets and other fish meat of heading

-Fish fillets and other fish meat (whether or not minced), fresh or chilled.

-Crustaceans, whether in shell or not, live, fresh or chilled; crustaceans, in shell, cooked by steaming or by boiling in water, chilled.

-Molluscs, whether in shell or not, live, fresh, chilled; aquatic invertebrates other than crustaceans and molluscs, live, fresh, chilled.

-Aquatic invertebrates other than crustaceans and molluscs, live, fresh or chilled.

- Human hair, unworked, whether or not washed or scoured, waste of human hair. Semen including frozen semen.

- All goods under live trees and other plants, bulbs, roots and the like; cut flowers and ornamental foliage

- Edible vegetables, roots and tubers

-Potatoes, fresh or chilled.

-Tomatoes, fresh or chilled

-Onions, shallots, garlic, leeks and other alliaceous vegetables, fresh or chilled

-Cabbages, cauliflowers, kohlrabi, kale and similar edible brassicas, fresh or chilled

-Lettuce (Lactuca sativa) and chicory (Cichorium spp.), fresh or chilled.

-Carrots, turnips, salad beetroot, salsify, celeriac, radishes and similar edible roots, fresh or chilled.

-Cucumbers and gherkins, fresh or chilled

-Leguminous vegetables, shelled or unshelled, fresh or chilled

-Other vegetables, fresh or chilled.

-Dried vegetables, whole, cut, sliced, broken or in powder, but not further prepared.

-Dried leguminous vegetables, shelled, whether or not skinned or split [other than put up in unit container and bearing a registered brand name]..

-Manioc, arrowroot, salep, Jerusalem artichokes, sweet potatoes and similar roots and tubers with high starch or inulin content, fresh or chilled; sago pith.

- Exemption on fresh fruits other than in preserved or frozen state.

- Coffee, tea, mate and spices. (Mate a bitter infusion of the leaves of a South American shrub)

-All goods of seed quality.

-Coffee beans, not roasted.

-Unprocessed green leaves of tea.

-Fresh ginger and fresh turmeric other than in processed form exempted.

- Cereals

-Exemption on all goods (other than those put up in unit container and bearing a registered brand name).

- Products of milling industry; malt; starches; inulin; wheat gluten

-Flour Aata, maida, besan etc. (other than those put up in unit container and bearing a registered brand name)

-Wheat or meslin flour.

-Cereal flours other than of wheat or meslin i.e. maize (corn) flour, Rye flour, etc.

-Cereal groats, meal and pellets, other than those put up in unit container and bearing a registered brand name.

-Flour, of potatoes

-Flour, of the dried leguminous vegetables of heading (pulses), of sago or of roots or tubers of heading or of the products of Chapter 8 i.e. of tamarind, of singoda, mango flour, etc

- Exemption on all seeds of good quality under oil seeds and oleaginous fruits, miscellaneous grains, seeds and fruit; industrial or medicinal plants; straw and fodder

- Water [other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container], non-alcoholic Toddy, Neera

- Tender coconut water put up in unit container and bearing a registered brand name .

- Common salt, by whatever name it is known, including iodized and other fortified salts, sendha namak [rock salt], kala namak

- Human Blood and its components and all types of contraceptives under Pharmaceuticals

- Municipal waste, sewage sludge, clinical waste

- Firewood or fuel wood and wood charcoal

- Judicial, Nonjudicial stamp papers, Court fee stamps when sold by the Government Treasuries or Vendors authorised by the Government, Postal items, like envelope, Postcard etc., sold by Government, rupee notes when sold to the Reserve Bank of India & Cheques, loose or in book form

- Printed books, including Braille books and newspaper, periodicals & journals, maps, atlas, chart & globe (Newspapers, journals and periodicals, whether or not illustrated or containing advertising material. 4905 Maps and hydrographic or similar charts of all kinds, including atlases, wall maps, topographical plans and globes, printed.)

- Agricultural implements manually operated or animal driven, hand tools, such as spades, shovels, mattocks, picks, hoes, forks and rakes; axes, bill hooks and similar hewing tools; secateurs and pruners of any kind; scythes, sickles, hay knives, hedge shears, timber wedges and other tools of a kind used in agriculture, horticulture or forestry

- Organic manure, other than put up in unit containers and bearing a brand name

- Kumkum, Bindi, Sindur, Alta under Essential Oils and Resinoids

- Hearing aids under Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof

- Passenger baggage, slate pencils and chalk sticks.

All section

All section