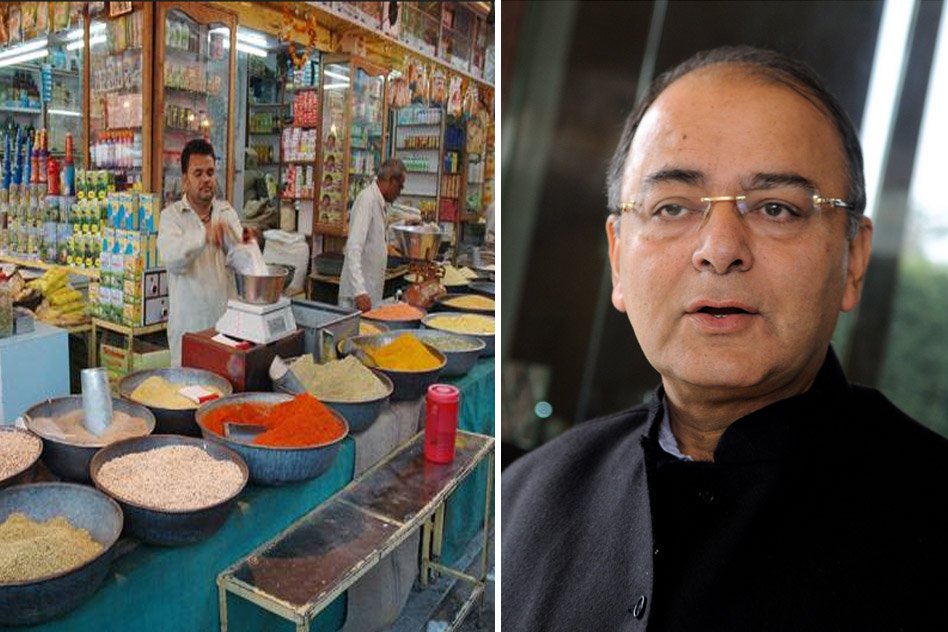

Know About The 4 GST Bills Cleared By The Cabinet, Could Become Part Of Taxation From July 1

20 March 2017 11:34 AM GMT

The Union Cabinet has cleared four bills related to the Goods and Services Tax (GST), ahead of their introduction in Parliament this week to enable roll out of the tax reform from July 1.

Approval of the bills by Parliament and a separate one by all state Assemblies will complete the legislative process for roll out of the GST, the one-nation-one-tax system that merges central taxes like excise duty and service tax and state levies like VAT.

The GST

The GST is an indirect tax that brings most of the taxes imposed on goods, services, manufacturing, and consumption of goods and services under a single domain at the national level. It will change the taxation that is levied separately on goods and services and will introduce a consolidated tax based on a uniform rate of tax fixed for both goods and services. It will be payable at the final point of consumption.

Under GST, all the taxes will be integrated, hence, it will be possible to bring a transparency in the levying of taxes and the burden of taxation will be shared equally between manufacturing and services. According to experts, by implementing the GST, India will gain $15 billion a year. This is because, it will promote more exports, create more employment opportunities and boost growth.

The entire Indian market will be a unified market which may translate into lower business costs. It can facilitate seamless movement of goods across states and reduce the transaction costs of businesses. Companies that are under unorganised sector will come under the tax regime.

What were the four bills approved by the Cabinet today?

The Union Cabinet chaired by the PM Shri @narendramodi approves 4 #GST related bills today. pic.twitter.com/ebpQLMxlgl

— Ministry of Finance (@FinMinIndia) March 20, 2017

The Cabinet approved the following bills:

- The Integrated Goods and Services Tax Bill 2017: Levy and collection of tax on inter-state supply or goods or services or both by the Central Government;

- The Goods and Services Tax (Compensation to the States) Bill 2017: Compensation to the states for loss of revenue arising on account of implementation of the GST for a period of five years;

- The Union Territory Goods and Services Tax Bill 2017: Levy and collection of tax on intra-UT supply of goods and services in the Union Territories without legislature;

- The Central Goods and Services Tax Bill 2017: Levy and collection of tax on intra-state supply or goods or services or both

The GST legislations were the only agenda in the meeting of the Union Cabinet, chaired by Prime Minister Narendra Modi.

A source told The Times of India, “The GST legislations have been cleared by the Cabinet. These would be introduced in Parliament this week, could be even today.”

The four legislations would be taken up for discussion in Parliament. Once approved by Parliament, the states would start taking their SGST bill for discussion and passage in the respective state assemblies.

Approval of the bills by Parliament and a separate one by all states will complete the legislative process for roll out of the GST.

The GST would be the biggest tax reform since independence and is expected to be rolled out by July 1.

All section

All section