In A Relief To Small Businesses: GST Exemption Limit Hiked To Rs 40 Lakh From Rs 20 Lakh

11 Jan 2019 1:14 PM GMT

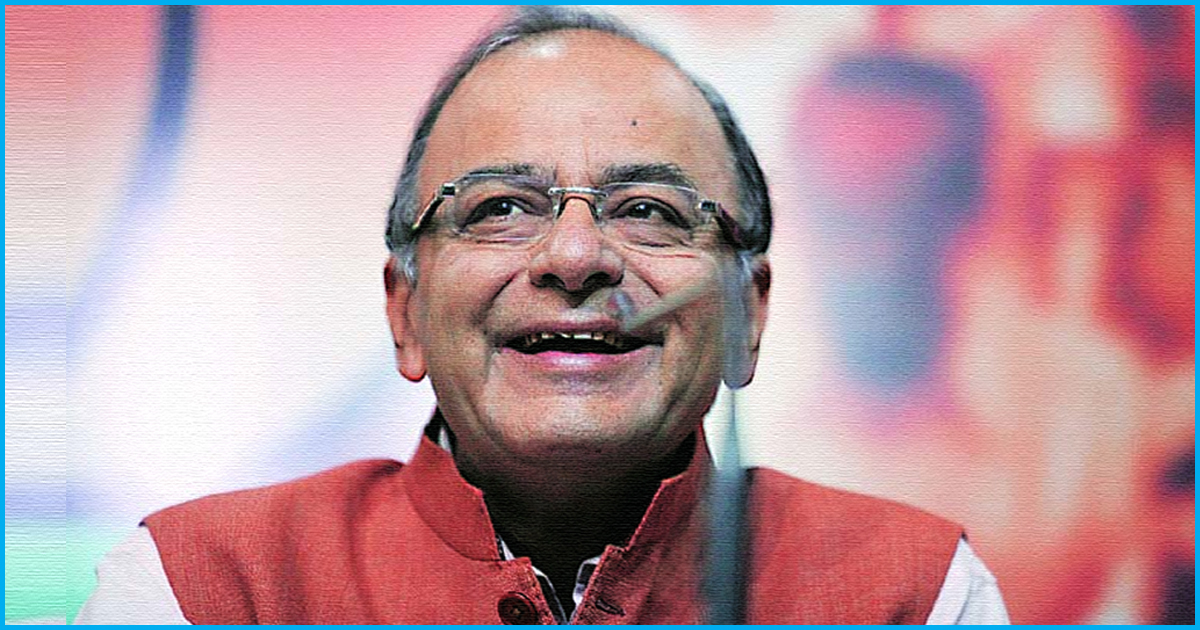

Bringing a major relief to the micro, small and medium enterprises(MSME), Goods and Services Tax(GST) Council took many decisions including reducing the tax burden on the enterprises on 10 January, reported Livemint. Chairperson of the council and Finance Minister Arun Jaitley announced the decisions which include doubling of exemption limit, extending composition scheme to small service providers and allowing Kerala to collect cess for disaster relief.

GST exemption limit has been doubled to 40 lakh for most states and 20 lakh for north-eastern and hill states. Currently, the limit is 20 lakh for most states and 10 lakh for north-eastern and hill states. This means that businesses having an annual turnover of up to 40 lakh in most states and 20 lakh in other states are exempt from paying GST if they choose to do so. States who fear that this may lead to a substantial dip in revenue and erosion of tax base can choose to stay at the present 20 lakh exemption limit if they notify the GST Council Secretariat within a week.

Limit for GST composition scheme under which small traders and businesses pay 1 per cent tax based on turnover has been increased to 1.5 crores from the current limit which is 1 crore, effective from April 1 onwards. Small service providers with an annual turnover of up to 50 lakh can also avail the composition scheme at 6% tax rate.

As per Business Standard, Jaitley told reporters after the meeting “A very large of GST comes from formal sector and large companies. Each of these decisions is intended to help the SME(Small and Medium Enterprises). You have given them various options. If they are in the services sector, they can get 6 per cent compounding, if they are in manufacturing and trading up to Rs 1.5 crore they can get 1 per cent compounding. They can make use of exemption of up to Rs 40 lakh”.

Revenue Secretary Ajay Bhushan Pandey made it clear that increased exemption limit is not applicable for intra-state transactions. He added that doubling of exemption limit would not necessarily lead to a major decrease in revenue as even when the limit was 20 lakh, about 10.93 lakh taxpayers below 20 lakh used to pay taxes.

Keeping in mind the massive damages caused by the Kerala floods, the council also allowed Kerala to levy a cess of up to 1% for up to two years on inter-state supplies for financing the disaster relief funds, reported The Hindu.

As no consensus could be reached about the tax rate on real estate and lotteries, a Group of Ministers(GoM) was formed to look into the matter and present their assessment to the council.

Also Read: GST Council Meet: Government Cuts GST Rate On 88 Items, Makes Sanitary Napkins Tax-Free

All section

All section