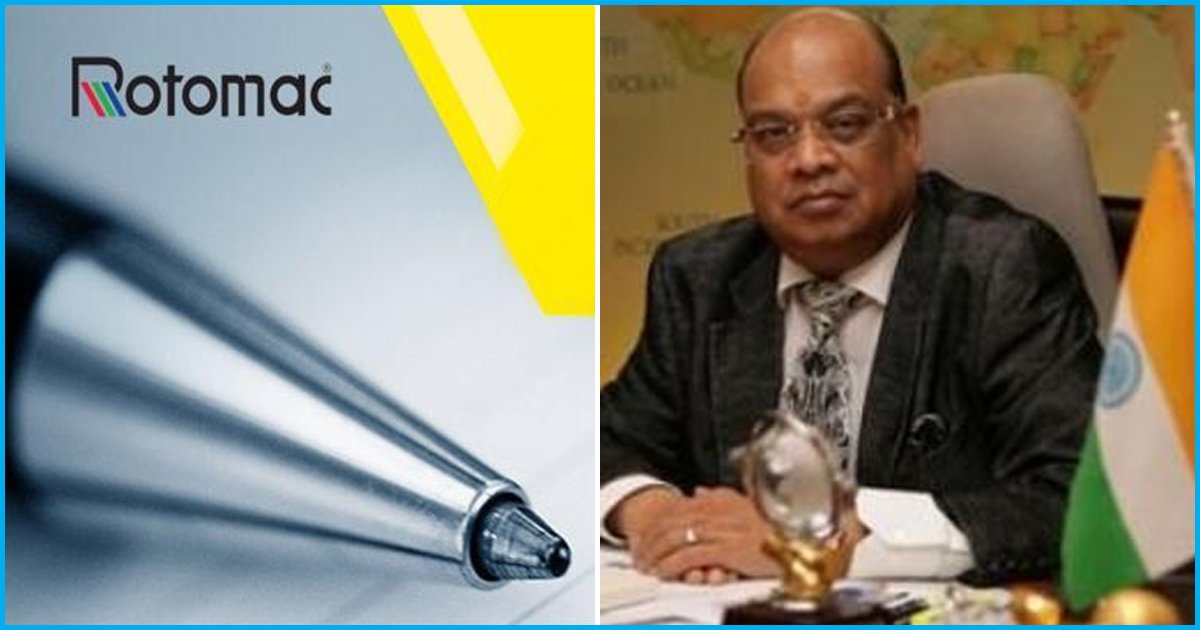

"Won't Leave India": Rotomac Owner Who Defaulted On Over Rs 800 Crore Loan

18 Feb 2018 12:35 PM GMT

Even as the country’s banking sector struggles to combat the bad loans crisis and address the mounting scam related to Nirav Modi and the Punjab National Bank (PNB), reports suggest that Vikram Kothari, the owner of Rotomac Pens, has with loans exceeding Rs 800 crore from various public banks.

According to News18, the banks involved are Allahabad Bank, Bank of India, Bank of Baroda, Indian Overseas Bank and Union Bank of India.

Kothari loaned Rs 485 crore from Union Bank of India and Rs 352 crore from Allahabad Bank. A year later, he reportedly has not paid back either the interest or the loaned amount.

Rotomac Pens, which is famous for its catchline “Likhte likhte love ho jaye”, is owned by Kothari, who is also Chairman and MD.

Kothari’s Kanpur office has been locked for the past week. Earlier reports suggested that he has left the country, however, Kothari issued a statement on Sunday saying that he is “very much in the country”, reported The Economic Times.

He also rejected that the matter is a ‘scam’. “First of all, don’t call it a scam. Also, I am not leaving the country and I am very much in Kanpur. Banks have declared my company nonperforming asset (NPA), but not a defaulter. The matter is still sub judice with National Company Law Tribunal (NCLT). I have taken loans and will repay it all soon,” the statement said.

Kothari also said he may have to travel to foreign countries for business purposes.

The CBI on Monday conducted raids on properties of Kothari and others in Kanpur.

Allahabad Bank manager Rajesh Gupta told the media he hoped the amount would be recovered by selling Kothari’s properties.

The Kothari scandal comes as the PNB scam unravels

The Punjab National Bank reported on Wednesday fraudulent transactions worth Rs 11,360 crore from a single branch in Mumbai. The fraud is equal to one-third of PNB’s total market capitalisation (value of the company that is traded on the stock market).

On February 5, the PNB said in a statement that its preliminary investigations showed it has come across a suspected fraud amounting to Rs 280 crore. Later, it was found that it was in connection with fraudulent activities of billionaire jeweller Nirav Modi who was being probed by the federal investigation agency.

India’s banking sector in crisis

Amid the PNB scam and the developing Kothari controversy, the country’s largest lender, SBI, wrote off bad loans worth Rs 20,339 crore in 2016-17 – the highest among public sector banks which has a collective write off of Rs 81,683 crore for the fiscal.

The figure has jumped almost three times in five years. The huge bad loans have caused SBI to register its first quarterly loss (Rs 2,416.4 crore) in 17 years.

For over three years, the RBI has been struggling to resolve its bad loan problem. In May 2016, former RBI Governor Raghuram Rajan initiated the Asset Quality Review (AQR) through which the RBI had asked the banks to report stressed loans or even non-performing ones (more details here).

It was revealed last year that only 12 accounts are responsible for about 25% of these bad loans. The gross bad debt that plagues India’s banking system as of March 2017 was at Rs 7.11 lakh crore, according to Business Standard. This means that the 12 accounts would be responsible for about Rs 1.78 lakh crore.

In October last year, the Union government unveiled a plan to infuse Rs 2.11 lakh crore into the country’s NPA-swamped public-sector banks (PSBs) over two years to boost credit and spending. This recapitalisation plan includes Rs 80,000 crore worth of recapitalisation bonds for 2017-18 and Rs 8,139 crore as budgetary support.

All section

All section