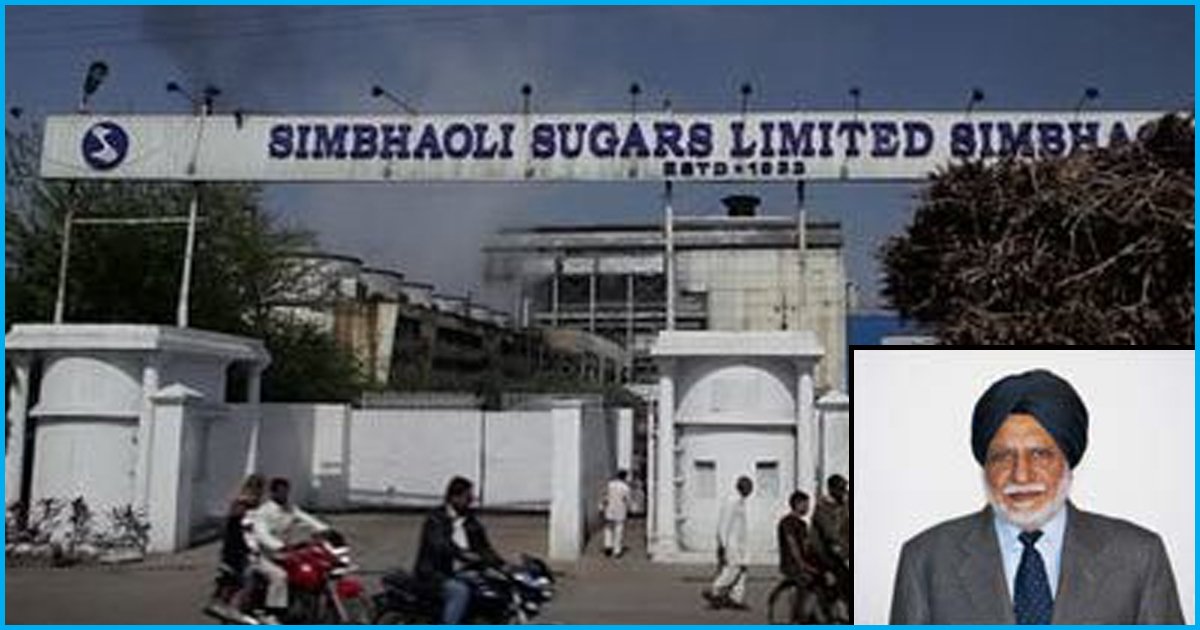

The Central Bureau of Investigation (CBI) has registered a case against Simbhaoli Sugars Ltd., a Uttar Pradesh-based private sugar company, for an alleged bank loan fraud of Rs 97.85 crore and loan default of Rs 110 crore, reported The Indian Express. Simbhaoli Sugars Ltd is the largest sugar mill in India.

The cases have been registered against top executives of the bank that include the Chief Executive Officer GSC Rao, CFO Sanjay Tapriya, Executive Director Gursimran Kaur Mann and five non-executive directors. Deputy General Manager Gurpal Singh, the son-in-law of Punjab Chief Minister Amarinder Singh, is also among the ones booked.

“Searches are being conducted at eight premises including residences of Directors, factory, corporate office and registered office of the company in Delhi, Hapur, and Noida,” CBI spokesperson Abhishek Dayal was quoted as saying by news agency IANS, reports The Indian Express.

How did it happen?

The probe focuses on two loans – Rs 97.85 crore that was declared fraudulent in 2015 and another corporate loan of Rs 110 crore that was used to repay the previous loan. The lender, Oriental Bank of Commerce, complained to the CBI on November 12, 2017, but an official case of criminal conspiracy was registered on February 22.

The bank was allegedly cheated to the tune of Rs 97.85 crore, but the total loss incurred by the bank is Rs 109.08 crore, the FIR read, as reported by Bloomberg Quint.

According to the FIR, the loan sanctioned by Oriental Bank of Commerce was of Rs 148.60 crore in 2011. The loan was sanctioned for financing 5,762 sugarcane farmers based on a tie-up agreement under an RBI scheme for supplying sugar produce to the company from January 25, 2012, to March 13, 2012.

“The loan was sanctioned for financing individual/ joint liability groups/self-help groups/sugarcane farmers, as per a tie-up arrangement under an RBI scheme, to 5,762 sugarcane farmers supplying sugar produce to the said private company during the period from January 25, 2012 to March 13, 2012, which was dishonestly and fraudulently diverted by said company for its own needs,” CBI spokesperson Abhishek Dayal said.

The account turned into a Non-performing asset in 2015, and RBI declared it as a fraud account for an amount of Rs 97.85 crore. Oriental Bank of Commerce alleged that in addition to the existing NPA, the bank, under multiple banking arrangements, sanctioned another corporate loan of Rs 110 crore to the company on 28 January 2015 to pay its outstanding loan of Rs 97.85 crore.

The bank adjusted the total liability of Rs 112.94 crore towards the company by way of deposit of the new corporate loan. “The corporate loan, too, turned NPA on 29 November 2016,” Dayal said.

This comes at a time when the country is coping with one of the largest bank frauds – the Punjab National bank Rs 11,400 crore fraud by Nirav Modi and Mehul Choksi and the Rotomac Fraud by Vikram Kothari.

All section

All section