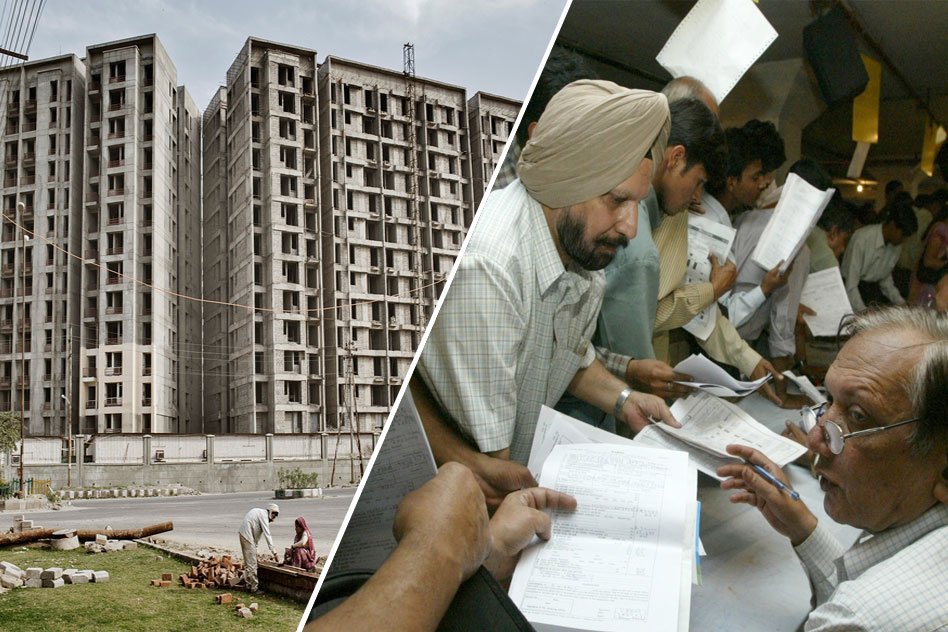

Pay Property Tax Dues Without Penalty Till Feb 2017

5 Dec 2016 6:49 AM GMT

On 17 November 2016, the three Municipal Corporations in Delhi announced the complete waiver of interest and penalty fees on property tax if the arrears are paid before 28th February 2017. This amnesty scheme has been available since 18 November and applies to both residential and commercial properties.

After 28 February of next year, there will be certain penalties to be paid for the outstanding property taxes. From 1 – 31 March, 50% interest will have to be paid on the arrears although the other penalties shall be waived off.

Keeping in mind the backlog of dues over the years, the scheme was launched by the BJP-ruled civic bodies in the national capital.

Although this news has resulted in joy and relief to a lot of people, the opposition claims that the scheme is a politically motivated to gain favours in the upcoming civic polls next year. But, as stated by the South Corporation mayor, Shyam Sharma, the opposition has also supported this amnesty scheme.

Property taxpayers owe a total of Rs 27,000 crores to the three municipal corporations. Shailendra Singh Monty, chairman of South Corporation’s standing committee, claimed that around 20% of defaulters were waiting for a scheme like this. “New buyers do not want to pay the penalty and interest of the properties whose taxes were not paid by the previous owners. They will use the amnesty scheme to make payments,” he said.

According to the Deputy Chairman of the North Corporation, Rajesh Bhatia, this scheme will reduce the debts of the North Corporation significantly and will help them pay pensions and meet other expenditure costs. This amnesty scheme is also popular among people because the North Corporation said it would accept the old Rs 500 and Rs 1000 notes until 24 November 2016.

There was quite a bit of disagreement in the three corporations on the scheme’s effectiveness. Without the penalty and interest, the total collected taxes will be much lower. “The waiver is not going to improve the financial health of the corporations. Without interests and penalty, the total dues collected would be low. Even after the waiver, not many people will come forward to pay the taxes,” said Leader of the Opposition in South Corporation, Farhad Suri as reported by The Times of India. The opposition based its criticism on the failure of past amnesty schemes. “In 2008 and 2009, only 3% and 15% dues were recovered, respectively,” said an official.

All section

All section