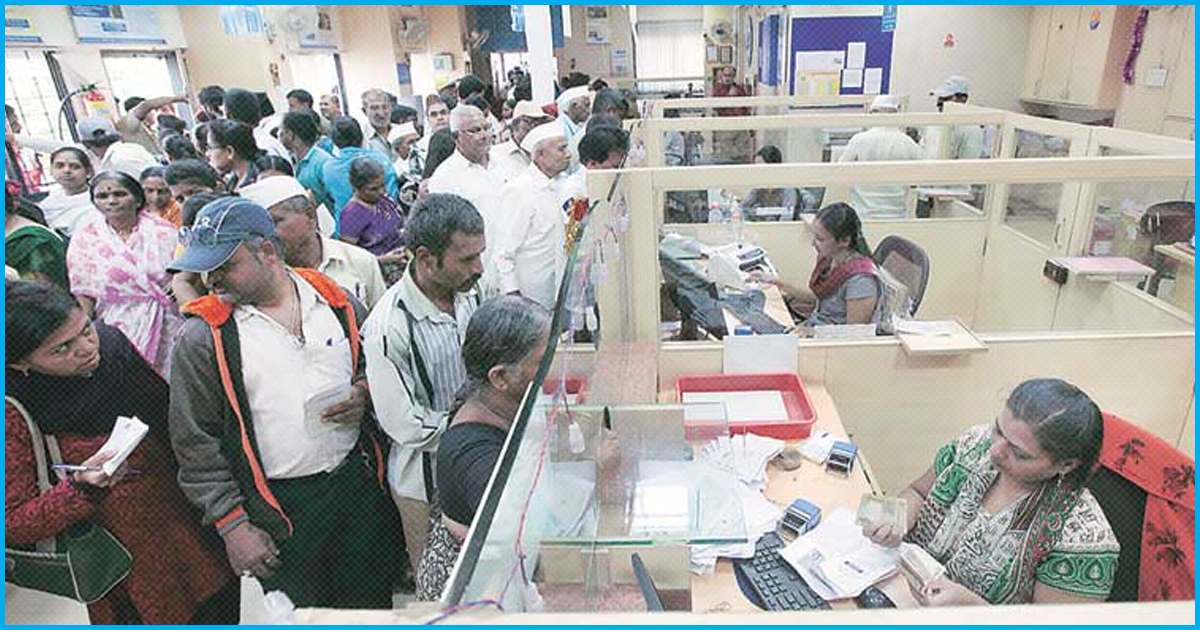

In The Last 4 Years, Banks Collected Rs 11528 Crores From Customers For Not Maintaining Minimum Balance

12 Sep 2018 5:05 AM GMT

As per data shared by the government in the Lok Sabha, Rs 11528 crore was collected as a penalty by major banks in the last 4 years, for not maintaining a minimum balance.

There was huge furore when it was revealed that the State Bank of India (SBI) collected more than Rs 2000 crore as penalty from the customers for not maintaining a minimum balance in their accounts. Following the furore, SBI revised the minimum balance norms in October 2017 which were further revised in April 2018. The government has now stated in the Lok Sabha that major banks collected a penalty of Rs 11528 crores from customers in the last 4 years (between 2014-15 & 2017-18) for not maintaining a minimum balance in savings accounts.

What is the penalty for not maintaining a minimum balance?

Reserve Bank of India (RBI)’s Master Circular on ‘Customer Service in Banks’ released on 1st July 2015 mentions that banks are permitted to fix service charges on various services rendered by them. Among them is the freedom to levy penal charges on non-maintenance of minimum balances with the approval of their Boards. The circular also stated that banks have to ensure that such penal charges are reasonable and in line with the average cost of providing the services. The charges are different for different banks.

In the same circular, RBI made it clear that the levy of penalty/charges for not maintaining minimum balance is subject to the following guidelines. These guidelines came into effect from April 1, 2015.

- If the balance in the savings bank account (other than the basic account) falls below the minimum balance/average as agreed to between the bank & the customer, the bank should notify the customer clearly by SMS/ email/ letter etc. that if the minimum balance is not restored in the account within a month from the date of notice, penalty will be levied.

- In case the minimum balance is not restored within a reasonable period, which shall not be less than one month from the date of the notice of shortfall, the penalty may be levied under intimation to the account holder.

- The penalty should be directly proportional to the extent of the shortfall. In other words, the charges should be a fixed percentage on the amount of difference between the actual balance maintained and the minimum balance as agreed upon at the time of opening of the account. A suitable slab structure for recovery of charges should be finalized.

- It should be ensured that the balance in the savings account does not turn into negative balance solely on account of levy of charges for not maintaining a minimum balance.

Such minimum balance restrictions not applicable to BSBD & Scholarship accounts

It has to be noted that such minimum balance restrictions are not applicable to the Basic Savings Bank Deposit accounts (BSBD), including accounts opened under Pradhan Mantri Jan Dhan Yojana (PMJDY). The RBI has made it clear through a circular issued in 2014 that accounts of all student beneficiaries under the various Central/State Government Scholarship Schemes should be free from restrictions of minimum balance and total credit limit.

The penalty of Rs 11528 crore collected in 4 years

As per data shared by the government in the Lok Sabha, The total amount of penalty collected by major banks (3 private & 21 public sector banks) has more than doubled in the year 2017-18 since SBI started collecting penal charges only from 2017-18. Between 2014-15 & 2016-17, the amount of penalty collected was at least Rs 2000 crore while it increased to Rs 4990 crore in 2017-18.

SBI followed by three major private banks collected the majority amount in penalty

SBI introduced penal charges in 2017-18 and in the very first year collected Rs 2433.9 crore as penalty. HDFC, one of the major private banks and one of the larger banks in India collected a penalty of at least Rs 500 crore in each of the years from 2014-15 to 2017-18. Both Axis bank & ICICI bank also collected a penal charge of at least Rs 300 crore individually in each of the 4 years. In 2017-18, eight different banks collected penal charges in excess of Rs 100 crore each.

Published with the permission from Factly

All section

All section