Important Information You Need To Know About Tax Rebate For Taxpayers Earning Upto 5 Lakh

1 Feb 2019 1:46 PM GMT

Interim Finance Minister today announced the interim budget bringing a smile to both the middle class. The biggest tax sops were announced for the Middle class with a tax rebate for those earning up to 5 Lakh. Earlier for those earning below Rs 2.5 Lakh tax exemptions were there and those earning between Rs 2.5 Lakh to Rs 5 Lakh, 5% of the income was paid as tax. Earlier during the budget speech of FM Piyush Goyal, it was not clear that how the tax exemption will be applicable but once the Financial bill was put online.

But there are many ifs and buts and conditions one should be aware of.

What is the current tax system and what are the changes?

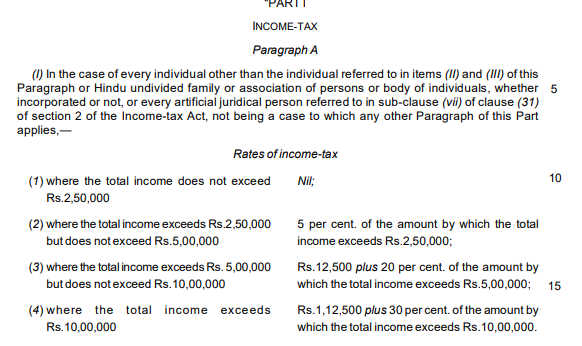

Income: Rs 0 to Rs Rs 2.5 Lakh -> No Tax

Income: Rs 2.5 Lakh to Rs 5 Lakh -> 5% Tax

Income: Rs 5 Lakh to Rs 10 Lakh -> 20% tax

Income: Rs 10 Lakh and above -> 30% tax

Changes

Income: Rs 0 to Rs Rs 2.5 Lakh -> No Tax

Income: Rs 2.5 Lakh to Rs 5 Lakh -> 5% Tax [Earlier for Rs 5 Lakh, the tax was Rs 12,500 which can now be rebated under section 87A of the income tax]

Income: Rs 5 Lakh to Rs 10 Lakh -> Rs 12,500 + 20% tax on the income above Rs 5 Lakh

Income: Rs 10 Lakh and above -> Rs 1,12,500 plus 30% tax above Rs 10 Lakh

There is no straight exemption on income up to Rs 5 Lakh. It is a rebate so the benefit is for only those who are between Rs 2.5 lakh to Rs 5 Lakh. The current tax of 20% on Income-tax being paid by those earning between Rs 5 lakh to Rs 10 lakh will remain the same. Similarly for those earning above 10 lakh has to pay 30% of their income. Section 87A of the income tax will not be applicable to those earning above Rs 10 lakh. Section 87A provides for a marginally lower payment of taxes to individuals earning an income below the specified limit.

Earlier maximum tax rebate under Section 87A was Rs 2,500 which has now been raised to Rs 12,500. Earlier 87A was applicable to those earning up to Rs 3.5 lakh but now it is applicable to those who earn up to Rs 5 lakh.

From when will it be applicable?

As of now, it is an announcement. The bill can only be passed in July Budget under the new government. But according to the Central Board of Direct Taxation (CBDT) Chairman Sushil Chandra, it will be applicable from April 1, 2019.

CBDT chairman Sushil Chandra, clarifies exemption relief for taxable income upto Rs 5 lac kicks in from the 1st of April. Not post June as is being reported. #BudgetSession2019 #Budget2019 #ThePollBudget pic.twitter.com/2tBQq5ZMnb

— editorji (@editorji) February 1, 2019

Any other relief?

No need to pay tax if you earn up to Rs 6.5 lakh income if one invests the rest of amount in provident fund and other methods suggested. “Even those earning ₹6.5 lakh can pay zero tax if they invest in specified savings. In fact, with additional deductions such as home loan deductions and medical insurance and expenditure deductions, even persons with higher income will not have to pay tax,” said FM Piyush Goyal.

Also Read: Budget 2019: Key Announcements Made In BJP’s Interim Budget

All section

All section