Money Minded

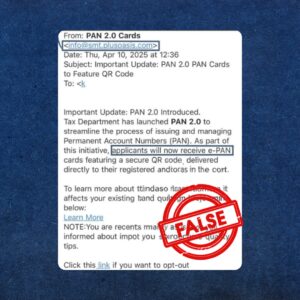

Fact Check: Fake Emails Claiming E-PAN Download Circulate; Government Issues Clarification

The government has warned about a phishing scam using fake emails to steal E-PAN details.

Personal Loan in Pune: How to Compare Offers, Understand Costs, and Borrow Responsibly

Pune’s 13.8% personal loan boom highlights urgent need for RBI-mandated KFS transparency to dodge hidden fees and high APRs.

Edelweiss Mutual Fund Strategies with a Focus on Mid-Cap Opportunities

Explore Edelweiss Mutual Fund’s flagship Mid Cap Fund, blending active research, strong performance, and risk management for long-term wealth creation in India’s dynamic markets.

List of Top 5 Digital Tools Available in Modern Current Accounts

Digital tools in current accounts like mobile banking, e-statements, and AI support streamline business finances, ensuring zero penalties and peak efficiency.

Emerging Trends in Financial Services: What Dubai Businesses Should Expect in 2025

A deep look into the digital, regulatory, and market shifts reshaping business setup in Dubai’s financial sector by 2026.

How Currency Fluctuations Impact Crypto Value for Local Investors

Currency swings distort Indian investors’ real Bitcoin returns, making the rupee as crucial as the crypto.

Understanding Gold Loan Interest Rate: Why it Changes and What Affects it the Most

Benefit from competitive gold loan interest rates and convenient features with Bajaj Finserv Gold Loan and you manage your financial needs with ease.

Fact Check: Old Video of Burqa-Clad Woman Threatening Railway Staff Resurfaces as Recent; Indian Railways Issues Clarification

An old video of a burqa-clad passenger threatening train officials over a ticket has resurfaced, misleading many.

Fixed Deposit Compound Interest Calculation: How FD Interest Rates Calculator Works

Learn how FD interest rate calculators and compound interest help you earn more from Bajaj Finance FDs.

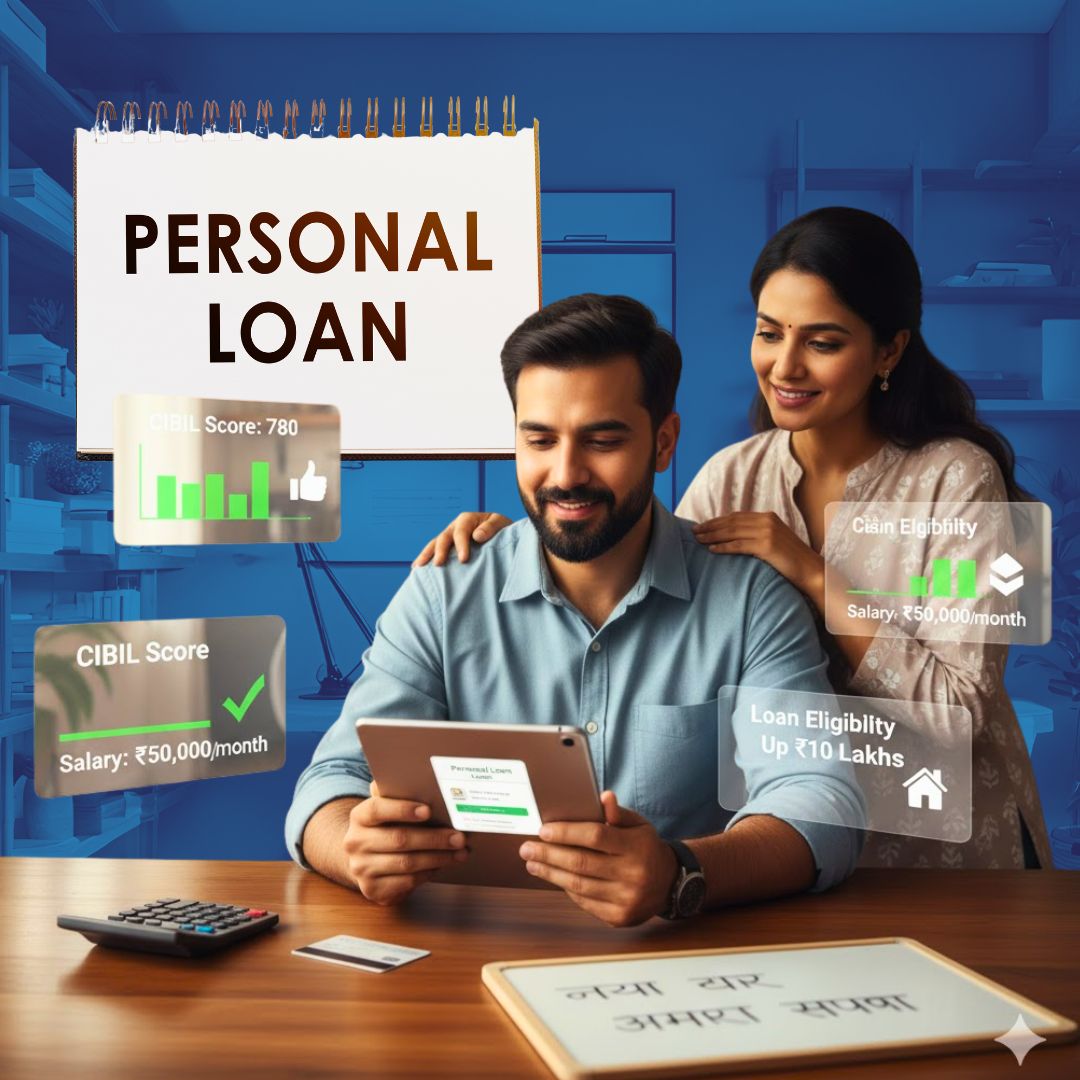

How Can I Calculate My Personal Loan Eligibility Based on Salary and Credit Score?

Learn how your income, credit score, and smart financial planning determine personal loan eligibility and approval.

Health Insurance Cost in India

Uncover how GST exemption, age, health history, and coverage choices impact your health insurance cost in India for 2025.

Loan Against Property Interest Rate – Understanding and Securing the Best Terms

Learn how pledging your property as collateral gets you substantial funds at low interest and convenient repayments.

Money Minded

- Save

- Invest

- Grow

Verified finance information cutting through the noise, helping you make smart decisions about saving, investing, and growing wealth.