Image Credit: Twitter, Wikipedia/PM Modi, Wikibio/Manmohan Singh

Viral Graphic Comparing Taxes Under Congress Govt And Modi Govt Is Misleading

India, 26 July 2022 11:11 AM GMT

Editor : Bharat Nayak |

As the founding editor, Bharat had been heading the newsroom during the formation years of the organization and worked towards editorial policies, conceptualizing and designing campaign strategies and collaborations. He believes that through the use of digital media, one could engage the millennial's in rational conversations about pertinent social issues, provoking them to think and bring a behavioral change accordingly.

Creatives : Jakir Hassan

A journalist at heart loves the in-depth work of reporting, writing, editing, research, and data analysis. A digital and social media enthusiast.

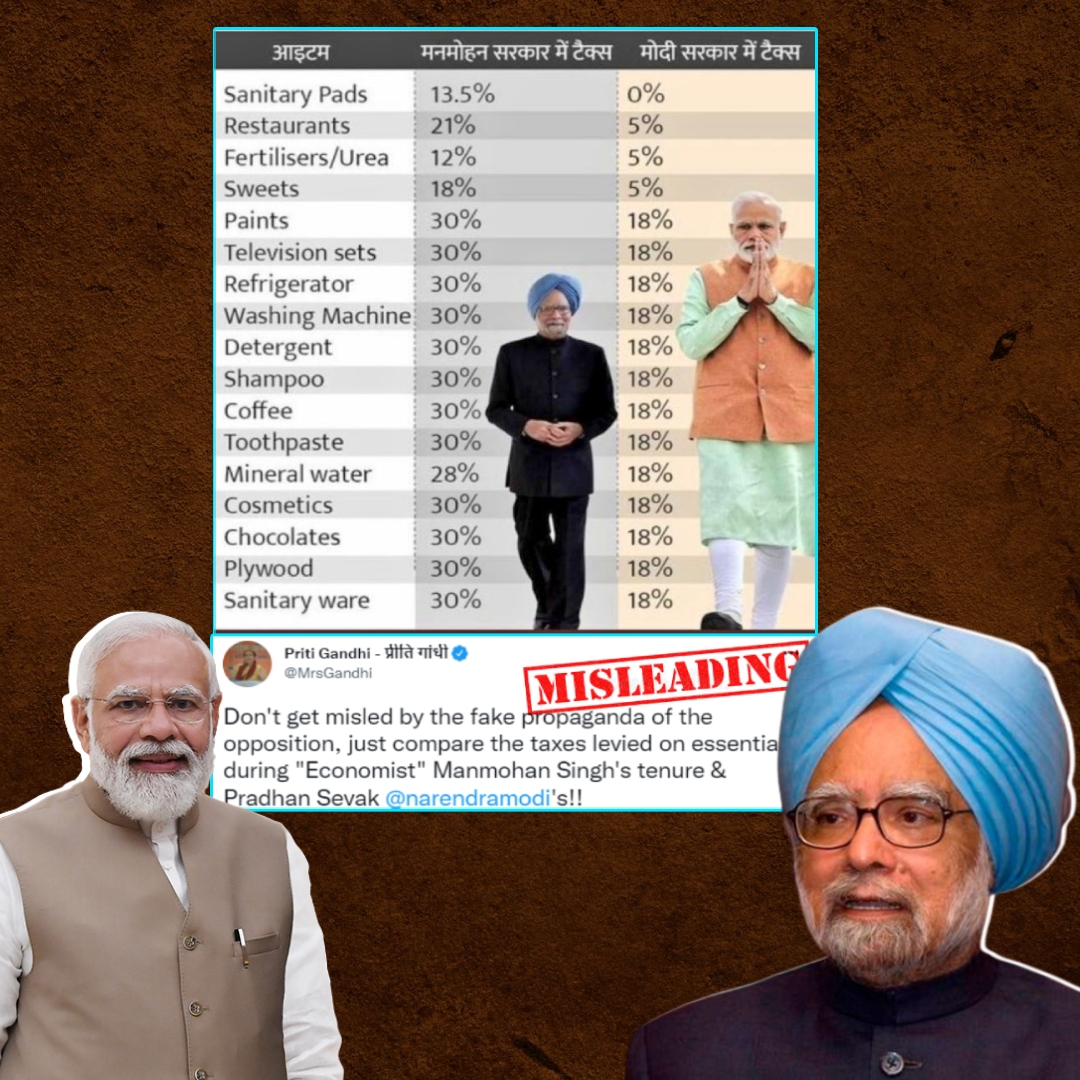

BJP Mahila Morcha social media in-charge Priti Gandhi shared this image and wrote, "Don't get misled by the fake propaganda of the opposition, just compare the taxes levied on essentials during "Economist" Manmohan Singh's tenure & Pradhan Sevak @narendramodi's" The Logical Indian fact check team verified the viral claim.

A graphic showing the difference between Goods and Services Tax and Value Added Tax is going viral across social media. The graphic aims to offer a contrast in taxation rates between the United Progressive Alliance and the incumbent National Democratic Alliance.

Claim:

The graphic compares taxes during the Manmohan Singh government and the Modi government. It shows the taxation rates of several products such as sanitary napkins, television sets, fertilisers, restaurants, etc. At a glance, the Modi government's taxation rates seem lower than the Manmohan Singh government. It is being shared with the claim that GST has considerably reduced the taxation rates on goods and services compared to VAT during the UPA era.

The claim is viral across social media with the following declaration: "Those who call GST as Gabbar Singh Tax will not tell the difference. They will only mislead the public."

BJP Delhi spokesperson Anuja Kapur also tweeted the graphic with the same claim.

BJP Mahila Morcha social media in-charge Priti Gandhi shared this image and wrote, "Don't get misled by the fake propaganda of the opposition, just compare the taxes levied on essentials during "Economist" Manmohan Singh's tenure & Pradhan Sevak @narendramodi's"

The Logical Indian received several messages on our WhatsApp fact check no. +91-6364000343 requesting to fact check the claim.

Screengrabs of a request received on the TLI WhatsApp fact check number

The claim is viral across Twitter and Facebook.

Fact Check:

The Logical Indian fact-check team verified the viral claim and found it misleading.

Value-added tax (VAT) was introduced on April 1, 2005. VAT is an indirect tax levied on goods and services for value added at every point of production or distribution cycle, per this article on Business Standard.

The article mentions that every state has its VAT laws for proper implementation, and different states apply different VAT rates according to their implied laws.

Along with VAT, the Central Sales Tax was also in effect during the UPA years. Central Sales tax refers to the tax levied on generated sales occurring in inter-state trade in a country. CST was applicable to goods sold over state borders.

As per information on the Department of Revenue website, the entire revenue generated through CST is collected and kept by the state where the sale originates.

Goods and Services Tax (GST) came into effect in 2017. As per information on the GST Council website, GST is based on destination-based consumption taxation as against the origin-based taxation practised in VAT and CST. GST is determined by the Centre and the States simultaneously levying tax on a common base. Central GST is levied by the Centre, whereas the States levy State GST.

Under GST, a uniform tax rate would be levied on particular goods or services across the country. The information on GST Council also mentions that GST subsumes a majority of the indirect taxes in India, such as Value Added Tax (VAT), Central Sales Tax, etc. GST was introduced as a unified and centralised tax on

goods and services to eliminate the cascading effect of taxes

in VAT and CST.

Comparison Between GST and VAT:

We conducted a keyword search to identify the changes that have taken place after the introduction of GST. We came across this document which documents the change in taxation rates on goods and services, pre and post-GST.

As per the document of Cbic.gov.in, the GST levied on curd and lassi has been reduced from 4% from pre-GST to 0%. Similarly, the GST rates for rice (previously taxed 2.75%), wheat (previously taxed 2.5%), flour (previously taxed 3.5%), and honey (previously taxed 6%) have been reduced to 0% under GST.

We came across an NDTV article published on July 18, 2022, which reported that rice, wheat, flour, lassi, curd, and paneer would attract a GST of 5%.

Some items mentioned in the viral graphic show reduced taxation rates on washing machines, detergents and shampoos, having reduced GST rates at 18%.

However, the services sector was diversely impacted by the implementation of GST. An Economic Times article published on August 4, 2016, documents the effect of hiked taxation rates on the service industry. Prices of many services have increased as they were charged 15% service tax in the pre-GST period, whereas they are charged 18% GST now.

Conclusion:

We found that VAT was implemented differently across states under the UPA regime and GST was an effort to implement a unified and centralised tax on

goods and services and to eliminate the cascading effect of taxes

in VAT and CST.

Under GST, while the taxation rates of some products have reduced, rates of some products have kept fluctuating. Meanwhile, the services industry has been affected by a hiked rate of GST. Thus, we can conclude that comparing GST and VAT on different goods and services is illogical. Hence, the viral claim is misleading.

If you have any news that you believe needs to be fact-checked, please email us at factcheck@thelogicalindian.com or WhatsApp at 6364000343.

All section

All section