Image Credit: Indian Express

Fact Check: Viral Posts Falsely Claim State Govts Benefit More Than Central Govt From Rising Fuel Prices

Writer: Yusha Rahman

Yusha, an engineer turned journalist with a core interest in sensible journalism. Since the time she worked in an MNC, she saw how fake news was rife to malign images of communities, leaders, etc. This encouraged her to give up her career in MNC and passionately work towards curbing fake news and propaganda.

India, 19 Feb 2021 12:13 PM GMT | Updated 19 Feb 2021 12:20 PM GMT

Editor : Bharat Nayak |

As the founding editor, Bharat had been heading the newsroom during the formation years of the organization and worked towards editorial policies, conceptualizing and designing campaign strategies and collaborations. He believes that through the use of digital media, one could engage the millennial's in rational conversations about pertinent social issues, provoking them to think and bring a behavioral change accordingly.

Creatives : Abhishek M

" An engineer by profession, Abhishek is the creative producer of the team, graphic designing is his passion and travelling his get away. In more ways than one, he makes the content visually appealing."

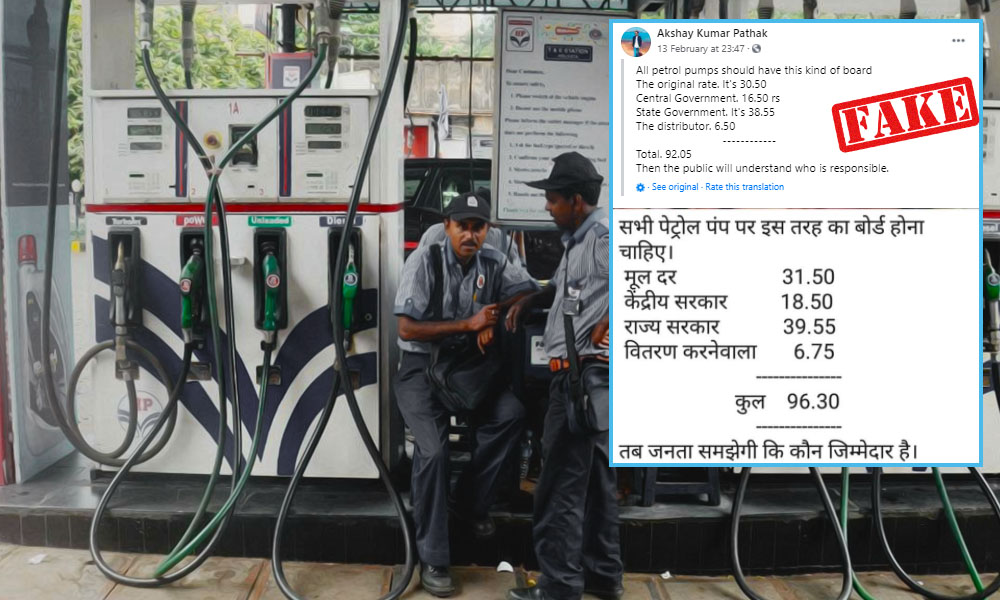

Social media users are sharing posts claiming that the hike in petrol prices benefits the state governments much more than the Central government. The Logical Indian Fact-Check team debunked the claim.

Many social media users are sharing posts to claim that the hike in petrol prices benefits a State government more than the Central government. The posts show the purported breakup of petrol price and include the basic rate, the money that Central government takes, the money that state governments take, and the amount that dealers make from one litre of petrol. The post says, "All petrol pump should have this kind of board. Basic rate (of Petrol) 30.91 (Rs), Central government 16.50, State Government 38.55, Dealers 6.50. Total 92.05, then the citizens will know who is responsible".

The basic rate, the amount taxed by the Central government, application of Value-Added Tax (VAT) by State governments and the gain made by dealers and overall prices of petrol are varying from post to post; but all posts portray just one information that VAT taken by the state government is much higher than the tax that the Central government takes on petrol.

पेट्रोल पंपों पर जब ऐसे बोर्ड लगेंगे, तब जनता स्वयं समझ जाएगी कि पेट्रोलियम पदार्थों की मूल्य-वृद्धि के लिए केंद्र सरकार जिम्मेवार है या उससे अढ़ाई गुणा अधिक टैक्स लगाने वाली राज्य सरकारें।

Posted by DrRamniwas Manav on Monday, 15 February 2021

The post is rife in the background to the recent price hike in petrol due to which the price of petrol in Rajasthan and Madhya Pradesh have breached Rs 100 mark. Petrol in Rajasthan and Madhya Pradesh are now being sold at over Rs 100 per litre after the petrol/diesel prices have increased for 11 days in a row.

These posts are being widely shared on Facebook.

The post is also viral on Twitter.

Claim:

For every litre of petrol sold, the Central government takes a very meagre amount in the form of excise duty compared to VAT that the State government takes.

Fact Check:

On searching with the keyword, "petrol price hike explained", we found an article by Indian Express written on February 19, 2021. The article explained the petrol price hikes in India. According to the article, though theoretically, the prices of petrol in the Indian market are decontrolled, which means that if the price of petrol rises in the international market, it rises in India and vice versa. But this does not happen practically, which was evident during the coronavirus pandemic. During the early phase of the coronavirus pandemic last year, when crude oil prices crashed in the global market, the state-owned oil retailers stopped price revisions for a record 82 days. Seeing the reduction in petrol prices, the Central government hiked the central excise duty on petrol to Rs 32.98 per litre during the course of last year from Rs 19.98 per litre at the beginning of 2020, citing the reason to boost revenues as economic activity fell due to the pandemic. At the same time, many state governments also increased the VAT on petrol to increase their revenue. For example, Delhi increased sales tax from 27% to 30%. Hence, we can say that the price hike is benefitting both the state and central government.

On further Google search, we found a PDF on the website of Bharat Petroleum, which described the price build-up of petrol at Delhi at BPCL retail pump outlets on February 16, 2021. According to this detail, the price charged to dealers excluding Excise Duty and Vat is Rs 32 per litre, Excise Duty (the tax levied by Central government) is Rs 32.90 per litre, the commission of dealer is Rs 3.67 per litre, Value Added Tax (the tax levied by State government) which included the VAT on dealer's commission is at 30 per cent which amounts to Rs 20.61 per litre. Hence, the retail selling price in Delhi is Rs 89.29 per litre. Here we can clearly see that the excise duty is much higher than VAT.

The same information is also visible on the website of Indian Oil Corporation Limited (IOCL).

There is a clear difference between the price breakup available on the sites and the viral images.

The imposition of VAT varies in India from state to state and Union Territories to Union Territories, i.e., all states and Union Territories have their own rate of VAT applied on per litre petrol which differs from 6% to 36%. According to data given by Petroleum Planning and Analysis Cell, Andaman and Nicobar Island levy 6% VAT on petrol while states like Manipur and Rajasthan levy over 36% VAT. Many states also add cess on these tax.

If you have any news that you believe needs to be fact-checked, please email us at factcheck@thelogicalindian.com or WhatsApp at 6364000343.

Also Read: Fact Check: No, Indian Oil Is Not Sold To Adani Group As Claimed By Social Media Posts

All section

All section