Image Credit: Pexels (Representational)

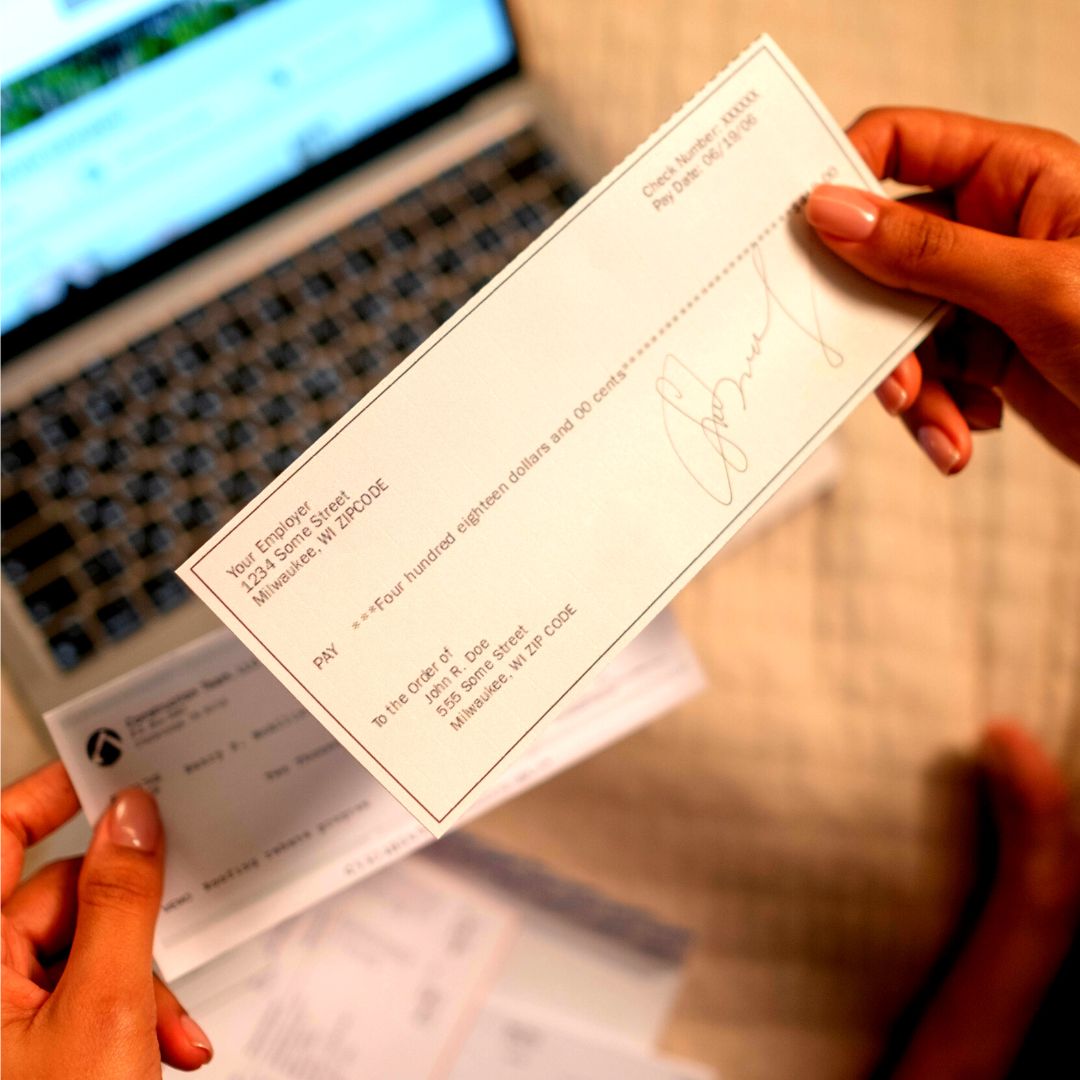

Know About All Important Guidelines For Cancelled Cheques

Writer: Vakilsearch

Vakilsearch.com is the pioneer online platform that provides legal services to startups, corporates and professionals in India.

India, 11 Aug 2022 6:38 AM GMT | Updated 11 Aug 2022 6:46 AM GMT

Creatives : Snehadri Sarkar |

While he is a massive sports fanatic, his interest also lies in mainstream news and nitpicking trending and less talked about everyday issues.

Guest Author : Vakilsearch

Vakilsearch.com is the pioneer online platform that provides legal services to startups, corporates and professionals in India.

A cancelled cheque is a cheque that has already been paid for in another situation. A cheque is marked as cancelled by the bank and the instant cash is drawn against it. The cheque cannot be used again to authorise the withdrawal of more money from the payer's bank account once it has been cancelled.

The internet has ruled the world and transformed how things used to operate. The way the financial industry operates has also been modernised. For services like money transfers, cash withdrawals, and other things, internet banking offers capabilities that remove the need for users to visit the bank locations. Cheque books, deposit slips, and some other paper forms that have been previously an integral component of banking services have been used far less as a result of this. You should be aware of the meaning of a cancelled cheque and the circumstances in which it may be useful.

Cancelled Cheques: Explained

When a cheque has two parallel lines drawn across the layout, it is said to be cancelled. In between these lines, you must additionally write the word 'cancelled'. On the voided cheque, your signature is not required.

The information from the cancelled cheque, including the account number, name of the account holder, MICR code, bank name and branch name, and IFSC, will be collected.

Listed below are the top 5 areas where a cancelled cheque might be required!

Electronic Clearance Service

To establish an ECS (Electronic Clearance Service) from your account, you must present a voided cheque as confirmation that you have an active account in good standing with the aforementioned bank.

Employer's Provident Fund

Your employer's account department will want a cancelled cheque when you withdraw money from your EPF (Employer's Provident Fund) in order to verify the information and make sure the cash is spent on an account when you own it.

Monthly Equated Installment

You can be required to provide a cancelled cheque for paying off EMIs while applying for a variety of loans, including a personal loan, home loan, or loan for consumer goods

Insurance Policy

You must give a cancelled cheque to the insurance company when you buy a new insurance policy, extend an existing one, or file an insurance claim.

Mutual Fund Investments

You must provide a cancelled cheque as part of your KYC whether you have linked a bank account to participate in mutual funds on a regular basis (Know Your Customer).

A cancelled cheque is a cheque that has already been paid for in another situation. A cheque is marked as cancelled by the bank and the instant cash is drawn against it. The cheque cannot be used again to authorise the withdrawal of more money from the payer's bank account once it has been cancelled.

Since cancelled cheques reveal your name, bank account number, and other information in addition to other facts, they are frequently used to demonstrate your ownership of a specific account number.

Did you know, In Thane, Maharashtra, a man was robbed of ₹40,000 a few years ago by criminals posing as bank agents? After submitting an application for a personal loan with a bank, the victim received calls from a fraudster pretending to be a bank representative asking for the victim's cancelled cheques, which were then utilised fraudulently.

The victim discovered the fraud after he received a message alert on his phone informing him that such a transaction had been performed from his account.

It's crucial to cancel a cheque properly to prevent it from being used fraudulently. Draw two parallel lines across the cheque leaf, then type 'cancelled' in them beyond the lines. Since a cancelled cheque is just used to verify your account information and not conduct a transaction, you do not need to sign it. The term 'cancelled' in writing is required. Try to use ink that is waterproof and dark.

Additionally, double-cheque the recipient's identity before giving them the voided cheque. To lessen the likelihood of someone impersonating you and using voided cheques fraudulently, go directly to the bank or other relevant institution if you have the time to do so. Alert the bank right away to recall or trace any transactions you believe were made from your account without your permission.

Also Read: Good To Know: Here's A List Of Different Types Of Companies Registered In India

All section

All section