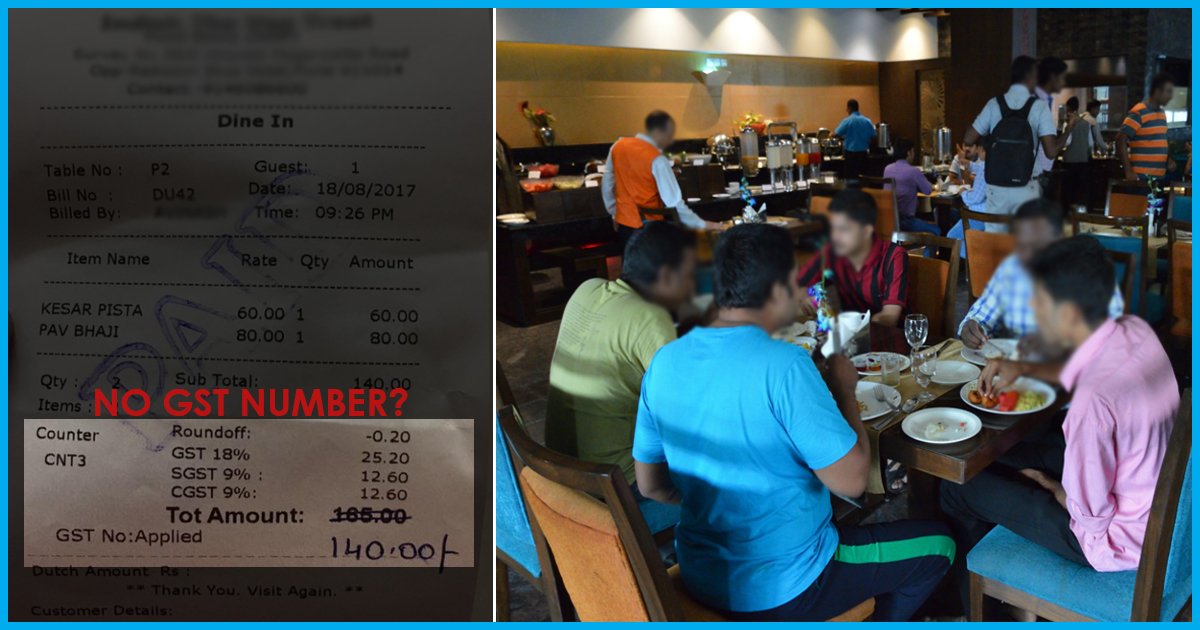

Non-Registered Restaurants Duping Customers By Charging Them GST; Here’s How You Can Verify Your Bill

21 Aug 2017 12:50 PM GMT

Editor : Sudhanva Shetty Shetty

Writer, coffee-addict, likes folk music & long walks in the rain. Firmly believes that there's nothing more important in a democracy than a well-informed electorate.

Businesses that are not registered under GST should not collect GST on sales or claim GST credits on the goods that have been purchased. Since you have not registered for GST, your business should only issue normal invoices. Unlike invoices issued by GST registered businesses, normal invoices do not include tax invoice. It does not also indicate that the invoiced amount includes GST.

There are reports of non-GST-registered restaurants charging customers GST on their bills, robbing them of their money in broad daylight.

This is illegal and can be verified easily.

1. Verify if the dealer is registered or not under GST

For this, it is mandatory for the dealer to print the GST number on the bill.

2. Verify the GST number

You can verify GST number in this link: https://services.gst.gov.in/services/searchtp

3. GST rates for restaurants

GST, which was rolled out on July 1, provides for two taxation rates from restaurants – 12% and 18%, depending on whether if it is an AC restaurant or a non-AC restaurant, and whether the restaurant has the license to serve alcohol or not.

The 12% and 18% GST rates include both CGST (Central GST) and SGST (State GST).

- For the GST tax rate of 12%, 6% is CGST and the remaining 6% is SGST.

- For the GST tax rate of 18%, 9% is CGST and the remaining 9% is SGST.

The 12% GST rate is for

- non-AC restaurants

- roadside eateries that don’t serve alcohol,

- local delivery restaurants.

The 18% GST rate is for

- the restaurants with full air-conditioning (both with or without alcohol),

- non-AC eateries that serve alcohol.

Now, the CBEC has clarified that GST rate of 18% will be levied by restaurant-cum-bars even when only the first floor area is air-conditioned and used for serving food and liquor while the ground floor only serves food and is non-AC.

4. In case of GST-related fraud, where can you file a complaint?

Email : [email protected].gov.in

Phone: 0120-4888999, 011-23370115

Twitter: @askGST_Goi, @FinMinIndia

All section

All section