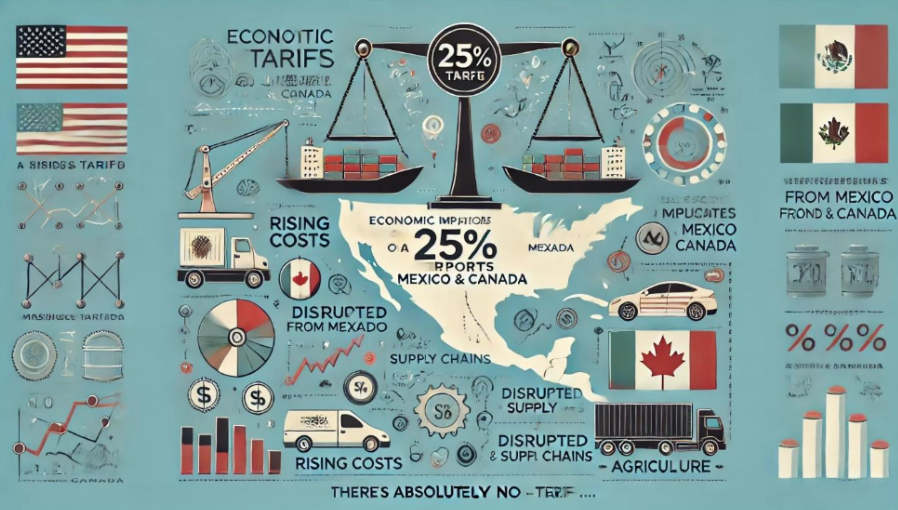

The potential reintroduction of a 25% tariff on imports from Mexico and Canada following the inauguration of President Trump on January 20, 2025, poses significant implications for the U.S. economy and the value of the U.S. dollar. Historically, tariffs are tools for protecting domestic industries, but they can also trigger consequences that ripple through the economy, public sentiment, and international relations. This article will delve into the short and long-term impacts on the dollar, considerations for the U.S.-Mexico-Canada Agreement (USMCA), and the potential ramifications for various sectors within the U.S. economy.

What is a Tariff

A tariff is a government-imposed tax or duty on imported or exported goods. Tariffs are typically used to regulate foreign trade and can serve several purposes.

Tariffs can provide a source of income for the government, especially in countries with fewer other means of generating revenue. One of the primary purposes of tariffs is to protect domestic industries from foreign competition. By imposing taxes on imports, domestic products can be sold at more competitive prices, encouraging consumers to buy domestically produced goods instead of foreign products. Tariffs can help manage the flow of goods and services into a country to address issues such as trade imbalances or to shield a nascent industry from international competition.

Tariffs can also leverage trade negotiations between countries. By raising barriers against imports, a government may compel its trading partners to make concessions or negotiate better trade deals.

Governments may use tariffs as part of broader economic policies to support specific industries or sectors viewed as strategic or vital to national interests. Generally, tariffs can be categorized into two main types.

Ad Valorem Tariffs are levied as a percentage of the value of the imported goods. For example, a 10% tariff on a product worth $100 would result in a tariff fee of $10.

Specific Tariffs are fixed fees applied per unit of imported goods, regardless of their value. For instance, a particular tariff might charge $5 for every imported pair of shoes.

Tariffs can significantly affect international trade dynamics, impacting prices, trade volumes, and economic relationships between countries.

Short-Term Impacts on the Dollar

The immediate market reaction in forex trading to the announcement of a 25% tariff has led to a volatile response from financial markets. Investors may quickly reassess their positions on the U.S. dollar in anticipation of inflationary pressures on imported goods from Canada and Mexico. The initial reaction has been a whipsaw response as uncertainty engulfs market sentiments. Moreover, currency traders often respond to potential policy shifts, leading to speculative movements that can heighten volatility.

Inflation and Consumer Prices With a 25% tariff imposition, prices for goods imported from Mexico and Canada—automotive parts, consumer electronics, or agricultural products—are expected to rise. This increase in consumer prices could lead to inflationary pressures, particularly affecting consumers who rely heavily on imported goods. Higher consumer prices could lead to reduced discretionary spending and varying impacts on gross domestic product (GDP). Inflation typically leads central banks to react by adjusting interest rates, which can, in turn, impact the dollar’s strength.

Trade deficit and growth, given their interdependence, in the U.S. could experience a widening trade deficit with its North American neighbors in the immediate aftermath of tariff imposition. Many goods pass through an integrated supply chain, and sudden tariffs complicate these processes. If businesses face higher input costs, their competitiveness could diminish, reducing economic growth. As a result, investor confidence in the U.S. economy might weaken, further impacting the dollar’s value.

Long-Term Implications for the Dollar

If the tariffs are maintained over an extended period, inflation could stabilize at higher rates as consumers adapt to more expensive goods. If inflation steadily rises, the Federal Reserve might be compelled to intervene by raising interest rates. An increase in interest rates could eventually strengthen the dollar as higher yields attract foreign investment. However, if inflation outpaces wage growth, consumption may falter, leading to economic stagnation and weakening confidence in the dollar.

Businesses may seek to restructure their supply chains to mitigate the impact of tariffs. This scenario could lead to a movement of manufacturing out of North America, potentially favoring countries with lower labor costs. A diminished role of the U.S. in North American manufacturing could lead to reduced exports and a shift in economic power dynamics, which would have repercussions for the dollar’s value on global currency markets.

The long-term enforcement of tariffs may lead to strained diplomatic relations between the U.S., Canada, and Mexico. Retaliatory tariffs could emerge, further compounding economic losses. Experiencing trade friction with close neighbors can deter global investors and trade partners, who may seek to engage more cautiously with the U.S. economy. Prolonged tensions may render the dollar less favorable as an international reserve currency, impacting its strength and stability.

Impacts on the USMCA Agreement

The U.S.-Mexico-Canada Agreement (USMCA), designed to facilitate trade and strengthen economic ties between these three nations, could strain significantly under a 25% tariff scenario.

The USMCA aimed to create a more balanced trading environment and incorporate new technologies and labor standards. The introduction of high tariffs starkly contradicts the collaborative nature intended by this agreement, threatening the foundation of mutual benefit that was a hallmark of USMCA negotiations.

Disruption to Trade Flows Tariffs disrupt the established trade flows encouraged by the USMCA. These trade facilitation provisions were designed to reduce costs and simplify the customs process and trade negotiations. An abrupt imposition of tariffs could lead to inefficiencies, increased costs, and uncertainty among businesses operating under this framework, potentially driving some firms to reconsider their investment strategies.

The friction introduced by tariffs could spark discussions among Mexico and Canada regarding their adherence to the USMCA. If trade relations deteriorate, both countries may weigh their options for revising or even withdrawing from the agreement altogether, leading to a cascading effect where other nations might reconsider their relationships with the U.S. Using the agreement as leverage, Mexico and Canada could pursue more favorable trade agreements with other countries, thus undermining U.S. influence in the region.

Sector-Specific Implications

The automotive sector is particularly vulnerable to tariffs due to its heavy reliance on the integrated North American supply chain. A 25% tariff could raise vehicle prices for consumers, block sales volume, and potentially lead to layoffs within the industry. Many automakers may relocate production facilities outside North America to avoid the tariff impacts, thus undercutting jobs and manufacturing capabilities.

Agriculture Agriculture would bear another significant brunt of increased tariffs as Canada and Mexico are major export markets for U.S. agricultural products. With an added tariff, U.S. farmers may face retaliatory measures, like tariffs on U.S. corn or soybeans, consequently diminishing U.S. competitiveness in these markets. This situation could lead to decreased prices for domestic farmers and increased domestic consumer prices.

The increased cost of imported goods could affect the retail and consumer goods sectors, which are often price-sensitive. Big-box stores and small retailers might pass these costs on to consumers, leading to decreased sales and increased pushback against seemingly inflated product prices. A prolonged period of tariff-induced pricing could shift consumer behavior and preferences toward cheaper domestic alternatives.

The technology sector, which relies heavily on components sourced from Canada and Mexico, could see significant disruptions. A decrease in production efficiency could hinder product availability and innovation cycles, putting U.S. firms at a global disadvantage against companies based in countries with lower tariffs. The long-term effect could be detrimental to the competitiveness of the U.S. technology landscape.

Conclusion

The potential imposition of a 25% tariff on imports from Mexico and Canada under a newly inaugurated President Trump in 2025 has profound short- and long-term implications for the U.S. dollar and bilateral trade relationships. Market volatility and inflationary pressures will likely lead to a weakened dollar and decreased consumer confidence in the short term. Over the long term, the sustained tariffs could facilitate economic restructuring, impact the dollar’s standing as a global reserve currency, and threaten the integrity of established trade agreements like the USMCA.

Various sectors—such as automotive, agriculture, retail, and technology—could face unique challenges as they navigate these changes, potentially leading to more significant economic ramifications for the U.S. economy. As such, policymakers must tread carefully, balancing protecting domestic industries with the overarching need for global trade cooperation and stability in international relationships. The future of U.S. trade policy and its implications on currency and economic relations hinge on the decisions made in the upcoming years, highlighting the critical interplay between domestic political actions and broader economic landscapes.