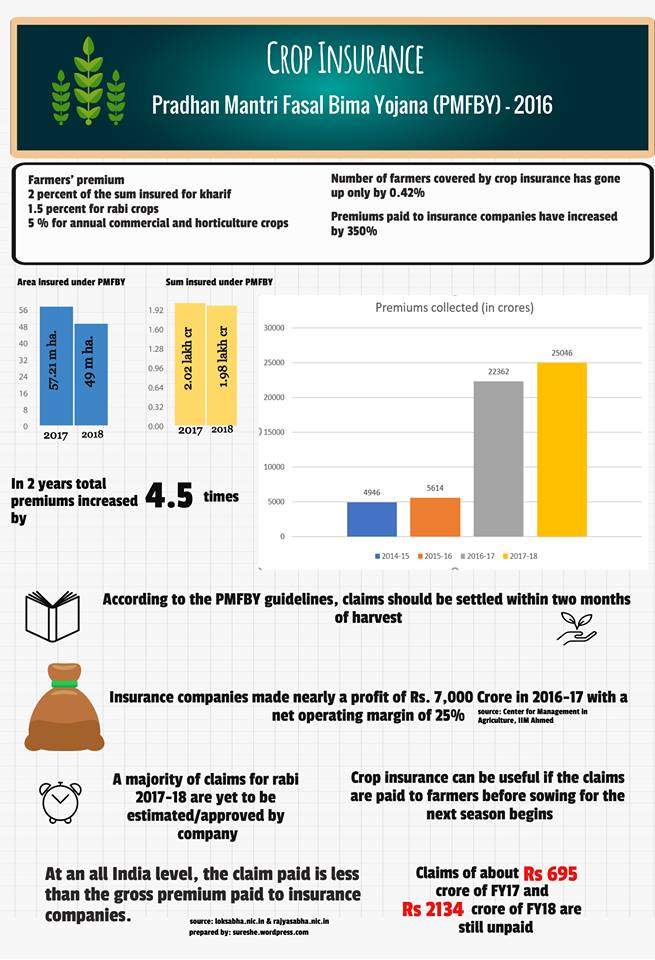

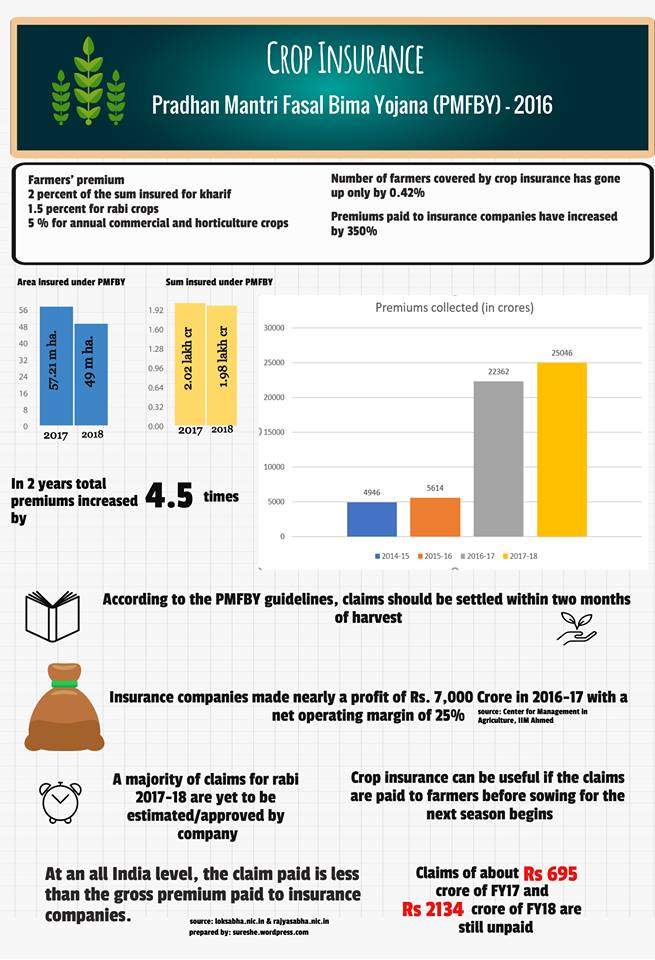

P Sainath, the founding editor of People’s Archive Of Rural India and former Rural Affairs Editor of The Hindu, has alleged that PM Narendra Modi led NDA much-touted crop Insurance scheme Pradhan Mantri Fasal Bima Yojana(PMFBY) is going to be a bigger scam than Rafale.

He said, “It is a gigantic scam and if it continues for a few more years without change and in the present system, it is going to be a bigger scam than Rafale deal. It is more an insurance scheme for the banks and insurance company. It is completely public money that is getting spent without the private corporations spending any money of their own.”

He further added that the farmers cannot get a loan from the bank without signing the insurance scheme and premium will be deducted from the farmer’s account. If there is a crop disaster and there is an insurance payout, the first claim on the insurance will be that of the bank who gave the loan not the farmers.

Benefits the corporate and has turned each state into an estate of Private companies

“The scheme’s design ensures the syphoning off of over giant sums of public money to private corporations and to a couple of public insurers (in line for privatisation). In the past three years over Rs. 66,000 crores of state govt. money and central govt money (i.e. public money) have been poured into the PMFBY’s operations. (Apart from the premiums paid up by farmers).

‘Compensation’ payouts for devastated crop have been a joke. Most of that has come out of the paid premiums, is a fraction of the losses incurred, and leaves over huge sums of public money in the hands of private corporations,” said P Sainath.

Private insurance companies make profits of crop destruction

In a Kishan Sammelan held in Ahmedabad on November 3, P Sainath gave an example from Maharashtra of how insurance companies like Reliance & Essar are making money without spending a single pie.

“Some 2.80 lakh farmers sowed soya in their farms. In a district, the farmers paid a premium of Rs 19.2 crore, the state government and the central governments paid Rs 77 crore each, amounting to a total of Rs 173 crore, which was paid to Reliance insurance.

“The entire crop failed and the insurance company paid out the claims. Reliance paid Rs 30 crore in one district, giving it a total net profit of Rs 143 crore without investing a single rupee. Now multiply this amount to each of the districts it has been entrusted,” he said as reported by IANS.

Insurance firm earned a whopping margin of Rs 15,975 crore in the last two years of Bima scheme

An RTI filed by Haryana based journalist PP Kapoor reveals that gross margin(premium minus compensation paid) of Rs 15,975 crore was made by insurance companies in the fiscal years of 2016-17 & 2017-2018 under Pradhan Mantri Fasal Bima Yojana across the country.

While the farmer’s income is stagnant and farmers suicide is not decreasing, the profit of Private insurance companies is increasing. The RTI revealed that the earning of by insurance companies rose by 44% to Rs 9,335.62 Crore in 2017-18 from Rs 6,459.64 Crore in 2016-17. In 2016-17, government-owned Agriculture Insurance Company Of India(AIC) earned a premium of Rs 7984.56 crore and paid a compensation of Rs 5373.96 crore but in the next year, it walked out of crop insurance business leaving 10 private insurance companies to share the crop insurance market.

The Pradhan Mantri Fasal Bima Yojana

The PMFBY, which replaced the previous National Agricultural Insurance Scheme, was launched by the union government in January 2016.

- Under this scheme, the premium rates to be paid by the farmers have been brought down substantially so as to enable more farmers to avail insurance cover.

- Under the scheme, farmers will pay 2 per cent of premium fixed by insurance firms for Kharif crops and 1.5 per cent for rabi crops.

- For annual commercial and horticultural crops, farmers will have to pay a premium of 5 per cent.

Infographic Source:

Suresh Ediga

To know more about the PMFBY, read here: Crop Insurance Companies Made Rs 10,000 Crore Profit From Govt’s Crop Insurance Scheme: Report