Image Courtesy: jagoinvestor | virtual-papyrus

Ever thought to settle your provident fund claims without your Employers consent?

Yes, you guess it right Employees provident fund a retirement benefit available to salaried employees, now can be claimed without employers signature after a new gazette by the statutory body of provident fund, EPFO ( Employees provident fund organisation ) issued.

At present, to settle claim one has to get his/her employers attestation before the filling the form for further process. However, The employee remains the owner of his provident fund account but the procedure leads to unwanted delays and sometimes harassment, as complained by employees to EPF.

As per the rules, Any company with over 20 employees has to register with EPFO for benefiting the salaried, Contributing 12% equally with Employee deducted from employee’s salary. The interest rate given on provident fund is nearly 8.5 % P.A.

In October 2014. the authority issues UAN ( Universal Account number) which is linked with bank account or adhaar card of employee to deposit provident fund. This way, it simplified the process of transferring the funds even, if the employee leaves the job numerous times. One UAN once activated, will become a permanent key to use for all your EPF account on EPFO portal

EPFOs new order issued on 1st Dec Says “Employees whose details like adhaar number and bank account numbers have been linked with UAN( Universal account number ) May submit claims in form 19, Form 10c and form 31 directly to the commissioner without attestation of their employers in such form and manner as may be specified by the central provident fund commissioner, for fast settlement of claims.

Now, let me take you to the steps of using new EPFO forms 19, form 10c and form 31.

First Activate UAN

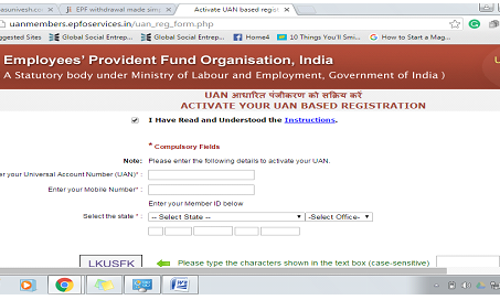

- Let me tell you about the procedures of activating UAN ( Univeral account number)

- Go to this address http://uanmembers.epfoservices.in/uan_reg_form.php

- Fill out the details with your mobile number.

- You will get an authorization pin on mobile.

- Enter authorization no in the box.

- Tick accepting terms and condition click submit.

- UAN account is activated which is also your username for EPFO account.

Fill these forms mentioned and send them along with the cancelled cheque to the nearest office, The Link: http://search.epfoservices.org:81/locate_office/office_location.php

for EPF office locations.

- Form 19 (UAN)

This form is used to withdraw EPF amount when you quit your job due to retirement, resignation, disablement, termination, marriage, or permanent settlement abroad. You can can only withdraw money only if you are unemployed for 2 or more months. If you change the job and join another one within 60 days then, you are not eligible to withdraw the money. However, you can transfer the deposits through EPF transfer using your UAN details. - Form10c

This form is used to apply for EPS i.e Employee pension scheme and shall be applied along with form 19 (UAN) However, You can only apply this form when your ore EPF account is not more than 10 year old. - Form 31

This form is used to withdrawal of amount partially against deposit in your PF account for the purpose of Marriage, home loans, Emergencies. There are certain

Conditions that have to be implied for filing out.

Click this for downloading forms: http://www.epfindia.com/site_docs/PDFs/Circulars/Y2015-2016/WSU_Changes_MAP_31406.pdf

Remember:

As forms 10c, form19 and form31 have been in use, even before. the only difference between old and new is new forms have UAN with the form no in brackets.

Your UAN must be activated and linked with Bank account or adhaar card to use the facility.

Your KYC ( Know your customer) of your bank account number must be verified.

We hope after the detailed view on the new policy implementation of EPF forms, it must have eased all your provident fund concerns. These procedure will soon come online making the whole process Hassle free.