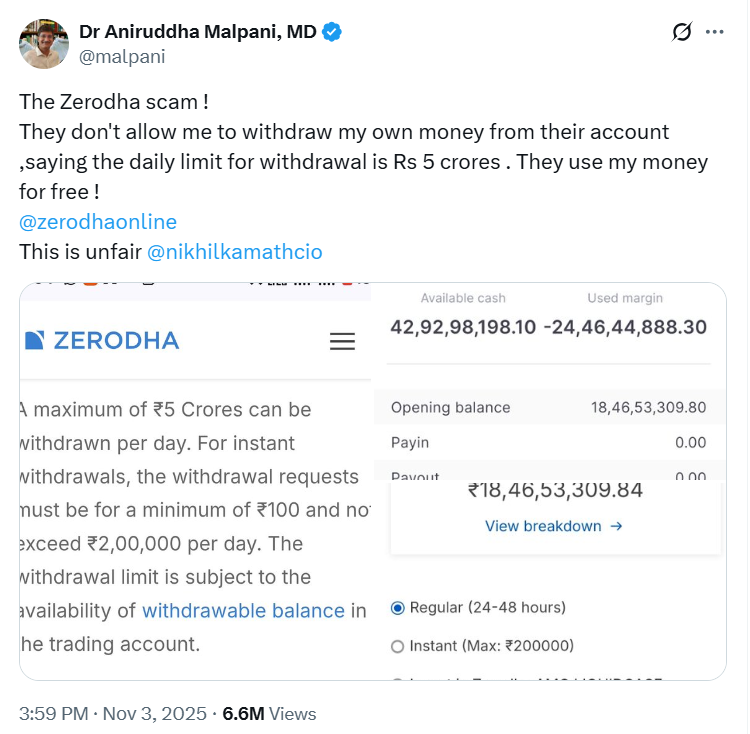

Zerodha, one of India’s leading stockbrokers, faced a viral social media allegation after Mumbai-based investor Dr Aniruddha Malpani claimed he was prevented from withdrawing over ₹42 crore from his account, citing a ₹5 crore daily withdrawal limit.

The post, made on social media platform X, sparked widespread debate, prompting immediate clarification from Zerodha’s CEO, Nithin Kamath, who assured the public that the withdrawal request had been processed and explained the policy’s purpose as a safety measure.

Background of the Controversy

The incident erupted when Dr Malpani, a respected investor and IVF specialist managing a portfolio exceeding ₹300 crore, shared screenshots showing an available balance of ₹42.9 crore. Despite this, he could not withdraw more than ₹5 crore in a single day. His social media post described the issue as a “scam.”

This sparked outrage among traders and investors, who questioned whether such limits were fair or restrictive. The controversy quickly went viral as users debated the transparency of broker policies, especially in the digital age where instant access to funds is expected by investors.

Zerodha’s Response and Clarification

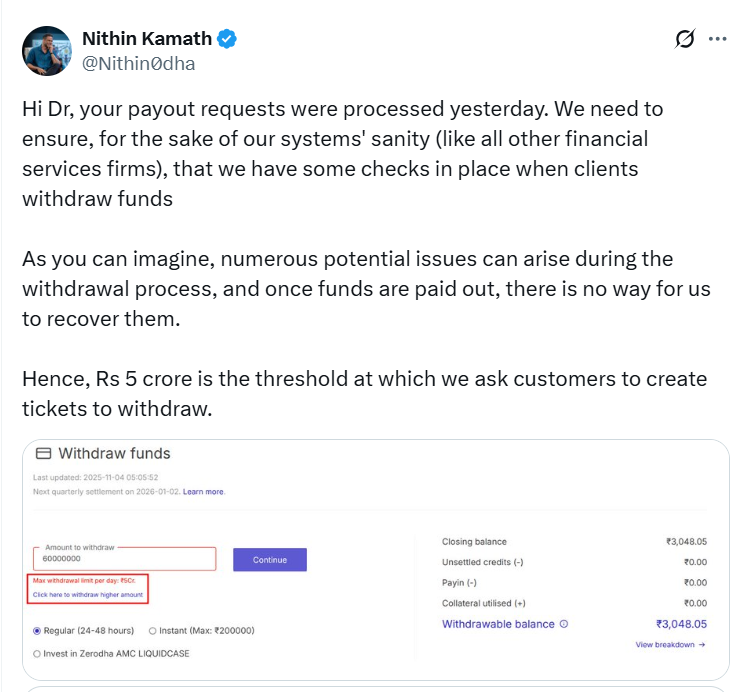

Nithin Kamath, Zerodha’s co-founder and CEO, responded promptly on Twitter (X), stating that the ₹5 crore daily limit is a standard security check rather than a restriction on funds. Kamath clarified that the payout requests he processed for Dr Malpani had already been approved.

He explained, “We need to ensure, for the safety of our systems and our clients, that there are checks for large withdrawals. Once funds are released, they cannot be reversed,” emphasizing that large transactions require creating a support ticket.

Kamath further reassured that such measures are common practice among financial institutions and are meant to prevent errors and fraud, not to withhold client money.

Broader Industry and Investor Implications

This incident shines a light on the balance between security and convenience in fintech and brokerage services. Many experts note that financial platforms worldwide enforce limits on high-value transactions to prevent fraud and systemic risks.

Nonetheless, transparency is crucial; clients should be clearly informed about policies and procedures. The incident has also provoked discussions about investor rights, platform transparency, and how fintech companies communicate safeguards to high-net-worth individuals.

Zerodha’s quick response and transparency in clarifying the policy help rebuild trust, but it also underscores the need for clear communication to prevent misunderstandings.

Hi Dr, your payout requests were processed yesterday. We need to ensure, for the sake of our systems' sanity (like all other financial services firms), that we have some checks in place when clients withdraw funds

— Nithin Kamath (@Nithin0dha) November 4, 2025

As you can imagine, numerous potential issues can arise during… https://t.co/dfrj56Hyxi pic.twitter.com/8hhCW0DRFO

The Logical Indian’s Perspective

This controversy highlights the importance of transparency, trust, and education in the evolving fintech landscape. While security measures are vital to prevent fraud and ensure system integrity, they must be communicated effectively to clients.

Investors should be aware of safeguarding protocols, and companies should balance security with ease of access to fund. Fostering open dialogue and setting clear expectations not only enhances trust but also helps prevent misconceptions.