In 2024, cryptocurrency exchange WazirX faced a significant setback when it was targeted by a cyberattack attributed to North Korean hackers. This attack, which was confirmed by the USA, Japan and South Korea in a joint statement, resulted in a substantial asset deficit, impacting the platform’s ability to meet its financial obligations.

To address this challenge, WazirX initiated a restructuring process under the legal oversight of the High Court of Singapore via its Singapore-based entity Zettai. The platform aims to restore balance between its assets and liabilities through a Scheme of Arrangement.

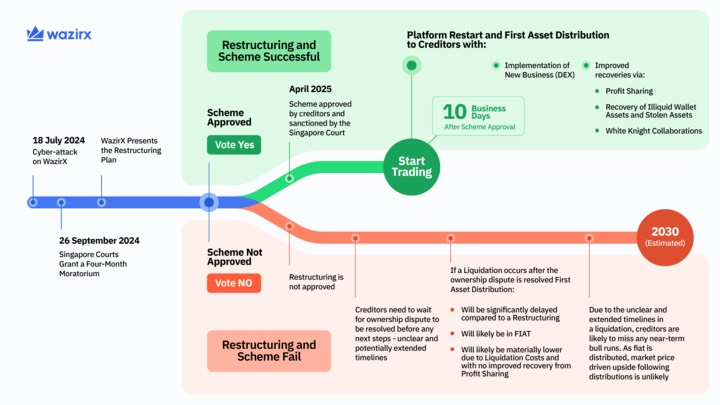

Users are set to vote on this scheme from March 19 to 28, 2025. Users need to vote ‘yes,’ for the scheme to become effective, which will enable distribution of 85% of funds within 10 business days. If the scheme fails, users risk facing extended delays and reduced returns through liquidation with no definite timelines.

Navigating the Restructuring Process

Zettai’s strategic approach to restructuring involves engaging seasoned financial advisors to optimize recovery for users. The process includes realigning holdings through secure trades, ensuring that asset distribution accurately reflects obligations to creditors.

A key component of this plan is the introduction of Recovery Tokens, which will be used to manage subsequent distributions of assets over the next three years. This mechanism allows users to benefit from ongoing market movements, as they will receive crypto rather than fiat currency.

The company plans to buy back these tokens quarterly, providing continued transparency and security for users. This proactive strategy contrasts sharply with other high-profile crypto setbacks, such as those experienced by Mt. Gox and FTX, where recovery efforts have been prolonged and uncertain.

Background and Industry Implications

The cyberattack on WazirX highlights the vulnerabilities faced by cryptocurrency exchanges and the need for robust security measures. Unlike traditional financial institutions, crypto platforms operate in a highly volatile environment where asset values can fluctuate rapidly.

This volatility, combined with the risk of cyberattacks, underscores the importance of having effective recovery strategies in place. The incident also emphasizes the need for regulatory frameworks that protect both companies and investors in the digital asset space. As India continues to grow as a hub for crypto activities, it has an opportunity to establish itself as a leader in defining security standards for the industry. This could involve timely audits of security protocols and the development of laws that address force majeure events like cyberattacks.