India’s Union Budget 2026-27, presented by Finance Minister Nirmala Sitharaman on Sunday, blends growth-oriented spending with reforms across infrastructure, technology, agriculture, health and social welfare.

The Budget earmarks ₹12.2 lakh crore for capital expenditure, proposes seven high-speed rail corridors, new rare earth mineral corridors, a Biopharma Shakti programme, and incentives for manufacturing and bonds markets.

It also maintains a firm fiscal strategy while proposing policy measures aimed at boosting jobs, investment, and productivity. Government officials emphasised the ‘Viksit Bharat’ vision and inclusive growth, while opposition leaders questioned allocations for social sectors and job creation.

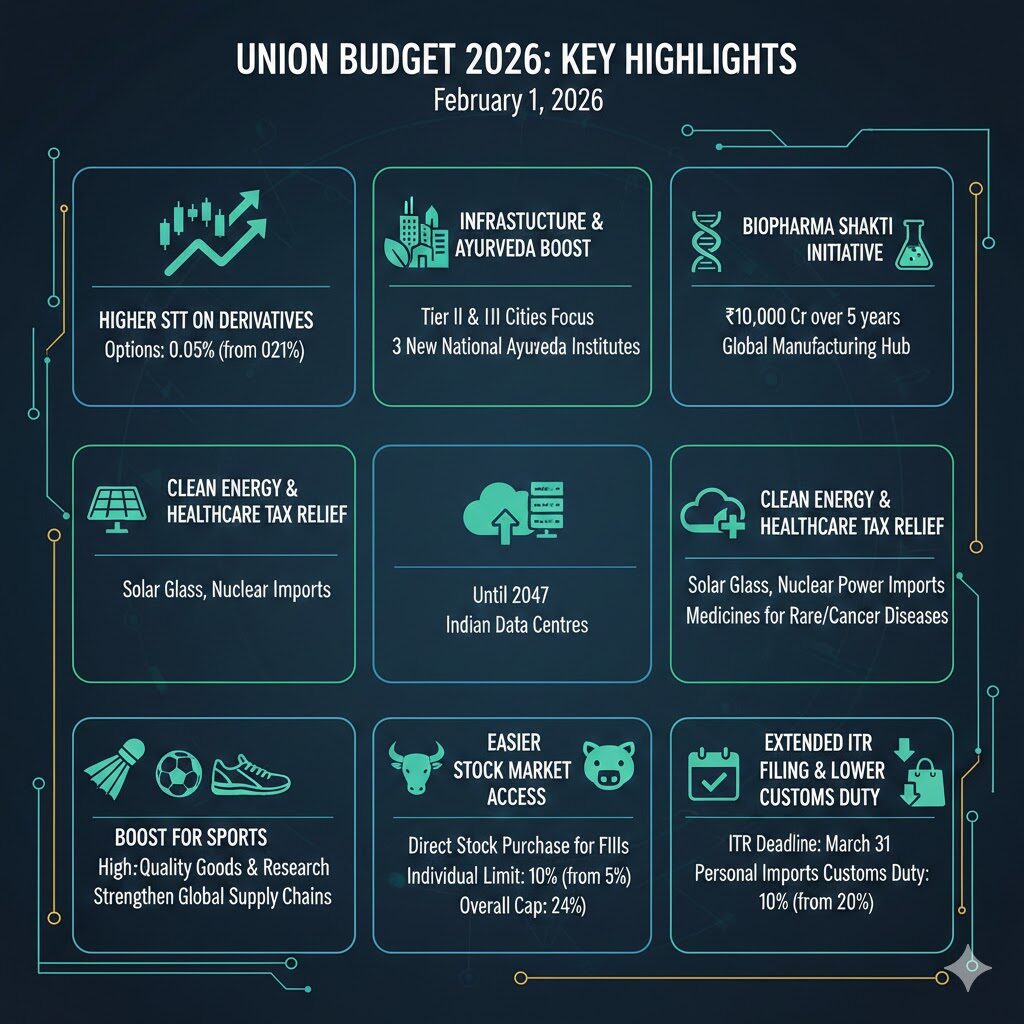

Key Highlights of Union Budget 2026

- Tax Relief for Clean Energy and Healthcare Imports: Tax exemptions have been introduced for solar glass raw materials, imports meant for nuclear power projects, microwave ovens, certain personal-use imports, and medicines used to treat rare and cancer-related diseases.

- Boost for Sports Manufacturing: Dedicated initiatives will be launched to support high-quality sports goods manufacturing and research, strengthening India’s presence in global sports supply chains.

- Easier Stock Market Access for Foreign Investors: Foreign investors can now directly purchase Indian stocks, with the individual ownership limit raised from 5% to 10% and the overall cap increased to 24%.

- Extended ITR Filing Deadline: The deadline for filing Income Tax Returns (ITR) has been extended from 31 December to 31 March of the assessment year (for example, AY 2026–27 returns can now be filed till March 31, 2027).

- Lower Customs Duty on Personal Imports: Customs duty on dutiable goods imported for personal use has been reduced to 10%, down from the earlier 20%.

- Higher STT on Derivatives: Securities Transaction Tax (STT) on derivatives has been increased. Futures trading STT now stands at 0.05%, up from 0.02%, while options transactions will attract 0.15%, compared to 0.01% earlier.

- Infrastructure Push to Tier II & III Cities: The government will prioritise infrastructure development in Tier II and Tier III cities, alongside expanding Ayurveda’s footprint through three new premier national institutes.

- Biopharma SHAKTI Initiative: To position India as a global biopharma manufacturing hub, the Finance Minister announced the Biopharma SHAKTI initiative, with an allocation of ₹10,000 crore over the next five years.

- Tax Holiday for Foreign Cloud Firms: Foreign cloud service providers operating through Indian data centres will be offered a tax holiday until 2047, aimed at strengthening India’s digital infrastructure ecosystem.

Growth, Jobs and Reforms: Key Budget Priorities

The Budget increases capital expenditure to ₹12.2 lakh crore for FY27 from ₹11.2 lakh crore in the current year, underscoring infrastructure-led growth. It proposes seven high-speed rail corridors linking key cities including Mumbai–Pune, Pune–Hyderabad and Delhi–Varanasi, aimed at enhancing connectivity and economic integration.

Alongside this, the government announced plans to set up ‘rare earth corridors’ in Odisha, Kerala, Andhra Pradesh and Tamil Nadu to boost critical mineral extraction and processing.

A Biopharma Shakti programme with an initial outlay of ₹10,000 crore over five years seeks to position India as a global biopharma manufacturing hub. Sitharaman said these measures will create jobs and strengthen national competitiveness.

Fiscal Strategy and Sectoral Support

The Budget maintains a focus on fiscal consolidation and macro-economic stability, with projected government expenditure set against commitments to infrastructure, health and social welfare. Sitharaman highlighted the continuity of reforms for ‘Viksit Bharat’ 2047 vision, including a high-level banking reform committee, incentives for corporate and municipal bonds, and enhanced foreign investment limits for NRIs.

Initiatives such as India Semiconductor Mission 2.0 and expanded support for emerging technologies and AI underline the government’s drive for future-ready industries. Critics, however, have raised questions around whether allocations for health, education.

The Logical Indian’s Perspective

The Union Budget 2026 reflects a broad, ambitious agenda that seeks to balance long-term economic transformation with immediate needs for infrastructure and investment.

While forward-looking initiatives in technology, manufacturing and transportation are welcome, The Logical Indian believes that genuine, inclusive development must equally prioritise strengthened public services, climate-resilient livelihoods, and equitable access to opportunities for marginalised communities.

Budgets should not just be about macro targets and headline figures, but about dignity, safety and well-being across society.