Finance Minister Nirmala Sitharaman made history today by presenting her ninth consecutive Union Budget for 2026–27, the first ever to be delivered on a Sunday.

Key highlights include a major transition toward the New Income Tax Act 2025, which makes income up to ₹12 lakh completely tax-free under the new regime via an enhanced Section 87A rebate.

“Our government’s sankalp is to focus on our poor, underprivileged and the disadvantaged. To deliver on this sankalp and given that this is the first budget prepared in Kartavya Bhavan, we are inspired by three Kartavya,” said FM Nirmala Sitharaman.

“Our government has decisively and consistently chosen action over ambivalence, and we have pursued far-reaching structural reforms, fiscal prudence and monetary stability, while maintaining a strong thrust on public investment” said Sitharaman.

What the Common Man Gains

- Higher farm incomes and rural jobs through expanded focus on fisheries, animal husbandry, and digital agriculture, aimed at strengthening the rural economy and allied sectors.

- Education and skill development get a boost with new institutes, university townships, and hostels, improving access to learning and student infrastructure.

- MSMEs gain easier credit and targeted support, helping small businesses expand, generate jobs, and improve financial resilience.

- Healthcare access strengthened via more medical professionals, hospitals, and mental health services, addressing both physical and psychological well-being.

- Urban mobility and growth to accelerate with new high-speed rail corridors, enabling faster travel and better city connectivity.

Budget 2026 LIVE UPDATES: Key Reforms

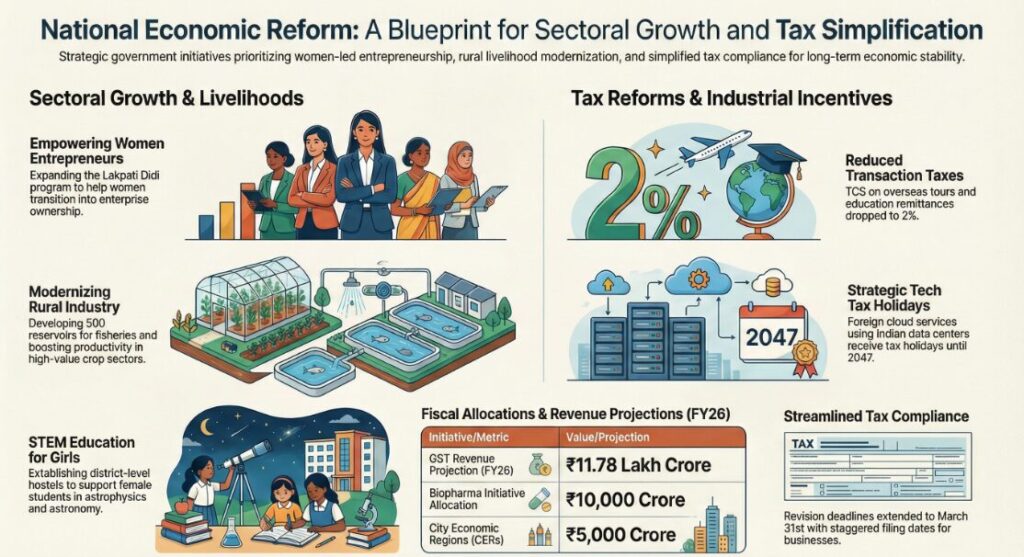

- The government is expanding the Lakpati Didi program to boost women entrepreneurship. Women will be supported to move from credit-linked livelihoods to owning their own enterprises. Community-run self-help entrepreneur marts will be set up with enhanced financing to strengthen women-led businesses.

- Fisheries initiatives will develop reservoirs and market linkages involving startups, women’s groups, and fish producer organizations. Animal husbandry and high-value crops like coconut and sandalwood will get support to modernize enterprises, increase productivity, and create rural employment.

- Support for high-value crops like coconut, cashew, walnuts, and pinenuts to boost productivity and farmer incomes. The government will enhance livelihoods, provide training and assistive devices, focus on vulnerable groups, and strengthen fisheries with 500 reservoirs, market linkages, and women- and startup-led initiatives.

- To support girls’ education in STEM, the government will establish one girls’ hostel per district, providing safe accommodation and promoting astrophysics and astronomy through immersive study and laboratory experiences for female students.

- The government cuts TCS on overseas tour packages from 5–20% to 2% with no minimum limit. LRS remittances for education and medical expenses also drop to 2%, while TDS on manpower services is clarified at 1–2%, easing tax compliance.

- I propose to extend time available for revising returns from 31st December to up to 31st March with the payment of a nominal fee. I also propose to stagger the timeline for filing of tax returns – individuals with ITR 1 and ITR 2 will continue to file till 31st July and non-audit business cases or trust are proposed to be allowed time till 31st August: FM

- Immunity from prosecution for individuals failing to disclose non-immovable foreign assets valued under ₹20 lakh, effective retrospectively from October 1, 2024, easing compliance for small-value foreign asset holders.

- Fast-track Advanced Pricing Agreements (APA) for companies to two years with a six-month extension and allow modified returns for associated entities. Foreign firms providing cloud services via Indian data centres get a tax holiday until 2047.

- Tariff on dutiable goods imported for personal use reduced from 20% to 10%.

- Basic customs duty exempted on components and parts for manufacturing civilian training and other aircraft; raw materials for MRO aircraft parts used by defence units also exempt.

- Basic customs duty exemption extended to capital goods for lithium-ion cell manufacturing, now covering battery energy storage systems; sodium antimonate imports for solar glass also exempt.

- ₹5,000 crore allocated for CITY Economic Regions (CERs) over five years.

- Markets slide post-Budget as Sensex falls 2,300 points and Nifty slips below 25,000.

- Tax holiday till 2047 proposed for foreign cloud service companies using Indian data centres, with a condition to serve Indian customers via Indian reseller entities.

- GST revenue projected at ₹11.78 lakh crore in FY26, marking an 11% year-on-year increase; FY27 estimates crucial amid post-September 2025 rate tweaks aimed at boosting consumption and compliance.

- ₹10,000 crore biopharma initiative launched; Ayurveda institutions to expand to meet rising global demand for traditional medicine.

Budget Speech Length Ranking

- 2019: 137 minutes

- 2020: 162 minutes

- 2021: 110 minutes

- 2022: 92 minutes

- 2023: 87 minutes

- 2024 (Feb Interim): 56 minutes

- 2024 (July): 85 minutes

- 2025: 77 minutes

- 2026: 85 minutes

Reform Express

Finance Minister Nirmala Sitharaman on Sunday said the government would continue to pursue its reform agenda. “Our government has undertaken comprehensive reforms towards creating employment, boosting productivity and accelerating growth.”

“After the Prime Minister’s announcement on Independence Day in 2025 over 350 reforms have been rolled out. This includes GST simplification, notification of labor codes and registration of mandatory quality control orders. High level committees have been formed. And in parallel, the central government is working with the State governments on deregulation and reducing compliance requirements,” she noted.

Rare Earth Corridor

Finance Minister Nirmala Sitharaman announced a strategic initiative in the Union Budget to establish dedicated rare earth corridors across Odisha, Tamil Nadu, Kerala and Andhra Pradesh to strengthen India’s critical mineral supply chain and reduce dependence on China.

“We now propose to support the mineral rich states of Odisha, Kerala, Andhra Pradesh and Tamil Nadu to establish dedicated rare earth corridors to promote mining, processing, research and manufacturing,” she noted.

Direct Tax Relief

In her address, Sitharaman stated that since assuming office 12 years ago, the country’s trajectory has been defined by stability and moderate inflation. To provide middle-class relief, she announced new tax slabs: income between ₹4 lakh and ₹8 lakh will be taxed at 5%, while the ₹8 lakh to ₹12 lakh bracket sits at 10%.

Railway & Banking Reforms

The central government has proposed the development of seven high-speed rail corridors to encourage cleaner and more efficient intercity travel.

The planned routes will link Mumbai–Pune, Pune–Hyderabad, Hyderabad–Bengaluru, Hyderabad–Chennai, Chennai–Bengaluru, Delhi–Varanasi, and Varanasi–Siliguri, significantly improving connectivity between major economic hubs.

On the financial front, citing robust bank balance sheets, record profitability and asset coverage of over 98%, the government announced the formation of a high-level banking committee.

The Logical Indian’s Perspective

While the 2026–27 Budget offers significant tax breathing room for the middle class and ambitious goals for AI and green energy, we must ask if the “Viksit Bharat” vision is reaching those at the very margins. Economic stability is a commendable achievement, yet the true test of any fiscal policy lies in its ability to resolve persistent rural distress and the widening wealth gap.

We believe that development must be measured not just by capital expenditure figures but by the empathy shown toward gig workers, small-scale farmers, and the unemployed youth. Progress is only meaningful when it is inclusive, fostering a society where every citizen feels the warmth of the country’s growth.

#WATCH: FM @nsitharaman presents the Union Budget 2026-27 in the #LokSabha

— DD News (@DDNewslive) February 1, 2026

LIVE: https://t.co/og5kOntUZc@FinMinIndia @nsitharamanoffc #Budget2026 #Budget #ViksitBharatBudget #Budget2026onDD pic.twitter.com/IVvx5b5OV0