Union Budget 2026–27 may have skipped real estate-specific incentives, but its strong focus on infrastructure, City Economic Regions and tier-II and tier-III cities is expected to reshape property markets beyond India’s crowded metros.

Presented by Finance Minister Nirmala Sitharaman on February 1, the Union Budget 2026–27 did not announce any direct tax relief or policy incentives for the real estate sector – a move that initially left developers and homebuyers underwhelmed.

However, a closer reading of the Budget reveals a strong underlying push for planned urbanisation, infrastructure expansion and decentralised growth, which experts believe could indirectly unlock significant opportunities for real estate across India’s smaller cities.

Instead of focusing on short-term stimulus, the government has doubled down on its long-term development strategy, emphasising connectivity, industrial growth, tourism infrastructure and urban planning – all of which play a critical role in shaping real estate demand.

Industry observers say this signals a shift away from metro-centric development towards a more balanced, regionally inclusive growth model.

City Economic Regions: A Game Changer for Smaller Cities

One of the most closely watched announcements in Budget 2026 is the proposal to develop City Economic Regions (CERs) across tier-II and tier-III cities. With an allocation of ₹5,000 crore per region over five years, CERs aim to create integrated urban clusters with modern infrastructure, efficient mobility and improved civic services.

According to experts, these regions could become new growth engines for residential, commercial, industrial and logistics real estate, particularly in cities that have traditionally remained outside mainstream investment radar.

Temple towns and cultural centres are also expected to benefit, with increased focus on tourism infrastructure, hospitality projects and mixed-use developments.

In her Budget speech, Sitharaman reiterated the government’s intent to promote balanced urbanisation, stating that economic growth must extend beyond large metropolitan centres to create sustainable livelihoods across the country.

Infrastructure-Led Growth And Its Real Estate Impact

The Budget’s continued emphasis on capital expenditure, transport corridors, freight connectivity and urban infrastructure has been welcomed by the real estate and construction industries. Improved highways, rail networks and last-mile connectivity are seen as critical enablers for property development, especially in emerging markets.

Industry leaders argue that infrastructure investment reduces development risk, improves land viability and enhances long-term demand confidence. Logistics parks, industrial hubs and warehousing facilities are expected to see increased traction, particularly along new economic corridors and near CERs.

Additionally, the Budget’s announcement of infrastructure risk-sharing mechanisms is expected to crowd in private investment, making large-scale urban and industrial projects more feasible in non-metro regions.

REITs And New Investment Avenues

Another significant development for the real estate ecosystem is the government’s plan to establish dedicated Real Estate Investment Trusts (REITs) for recycling assets owned by Central Public Sector Enterprises (CPSEs).

This move is aimed at unlocking value from underutilised assets and channelising long-term institutional capital into infrastructure and real estate.

Market analysts believe that such measures could deepen India’s real estate investment landscape, improve transparency and offer stable returns to investors, while freeing up public resources for new development projects.

Affordable Housing: A Missed Opportunity?

Despite the optimism around infrastructure and regional development, several industry bodies and housing advocates have expressed disappointment over the absence of targeted support for affordable housing. Groups such as CREDAI have pointed out that rising construction costs and high interest rates continue to strain both developers and homebuyers.

Experts argue that measures such as tax incentives, revised affordable housing definitions and interest subventions could have provided immediate relief to middle- and lower-income households. Without such interventions, they warn, housing affordability may remain a challenge even as new cities and regions develop.

Why Tier-II And Tier-III Cities Matter Now

Over the past few years, soaring land prices, congestion and saturation in major metros have prompted developers and buyers to look beyond traditional urban centres. Smaller cities offer lower costs, expanding job markets and improving quality of life, making them increasingly attractive for both end-users and investors.

Budget 2026 builds on this momentum by strengthening the economic and infrastructural ecosystem around these cities. Analysts believe that sustained policy support, coupled with private sector participation, could transform many tier-II and tier-III cities into self-sustaining urban hubs.

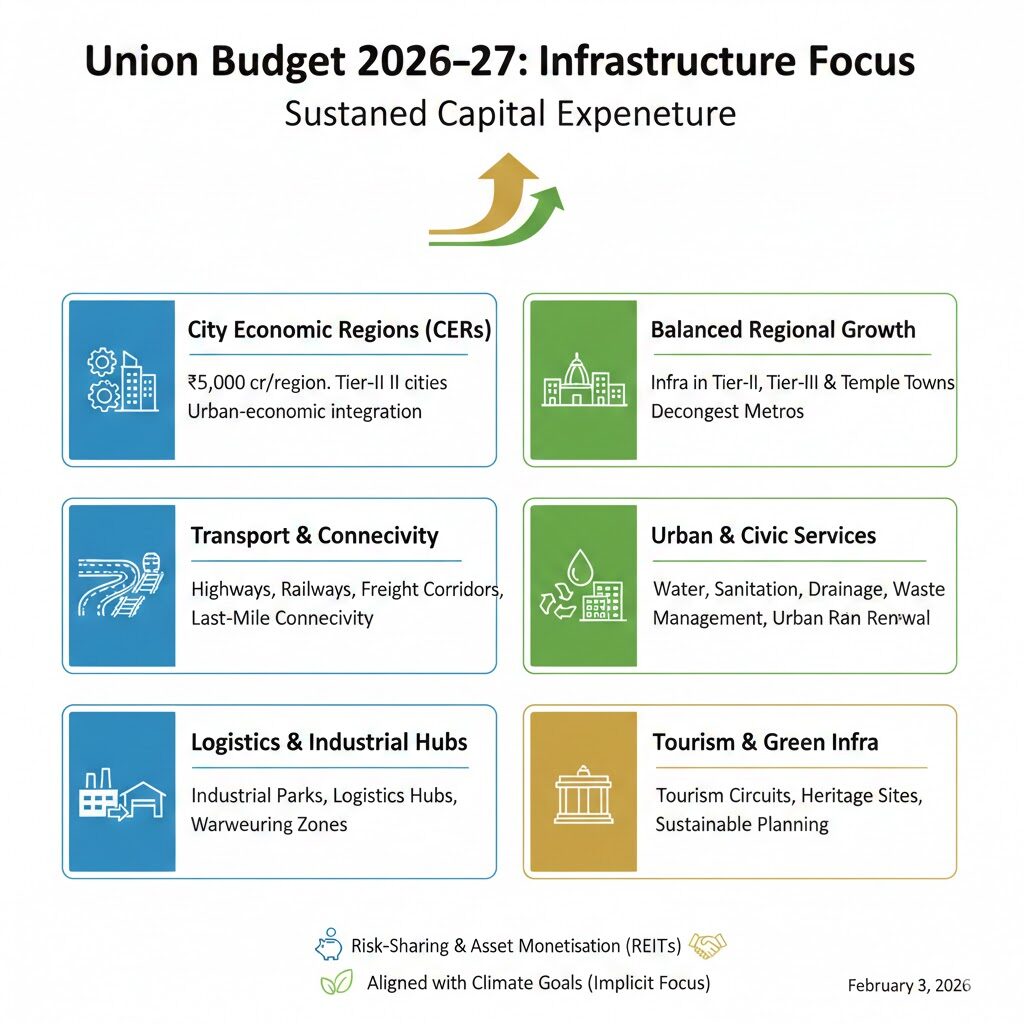

Union Budget 2026–27: Key Infrastructure Highlights

- Sustained Push on Capital Expenditure:

The government continued its high public capital expenditure strategy, reinforcing infrastructure as the backbone of long-term economic growth. - City Economic Regions (CERs):

Introduction of planned City Economic Regions in tier-II and tier-III cities, with an allocation of ₹5,000 crore per region over five years, to drive integrated urban and economic development. - Focus on Tier-II, Tier-III Cities and Temple Towns:

Infrastructure development in smaller cities and culturally significant towns to ease pressure on metros and promote balanced regional growth. - Transport and Connectivity Expansion:

Continued investments in highways, railways, freight corridors and last-mile connectivity to improve mobility and logistics efficiency. - Urban Infrastructure and Civic Services:

Enhanced focus on water supply, sanitation, drainage, waste management and urban renewal to support sustainable city growth. - Logistics and Industrial Infrastructure:

Boost to industrial parks, logistics hubs and warehousing zones, especially along economic corridors and near CERs. - Tourism and Cultural Infrastructure:

Development of tourism circuits, temple towns and heritage destinations, supporting hospitality, retail and mixed-use infrastructure. - Infrastructure Risk-Sharing Mechanism:

Introduction of measures to de-risk large infrastructure projects, aimed at attracting greater private sector and institutional investment. - Asset Monetisation and REITs:

Proposal to use dedicated REITs for CPSE assets to recycle capital and fund new infrastructure projects. - Green and Sustainable Infrastructure (Implicit Focus):

Continued emphasis on energy efficiency, sustainable urban planning and resilient infrastructure, aligned with climate goals.

The Logical Indian’s Perspective

Budget 2026 reflects a conscious shift towards long-term, decentralised development, prioritising infrastructure and regional balance over sector-specific concessions.

While this approach may not offer immediate relief to all real estate stakeholders, it carries the potential to create more inclusive growth, reduce migration pressures on metros and revitalise smaller cities.

However, development must go hand in hand with affordability, transparency and community participation. As India builds new urban centres and reimagines old ones, policymakers must ensure that growth does not come at the cost of social equity or cultural heritage