In a significant move towards bolstering financial inclusion in Kenya, Syntellect, a global fintech startup based in India, has entered into a strategic partnership with Kenya Women Microfinance Bank PLC (KWFT), a prominent microfinance lender in East Africa. This collaboration aims to address the housing infrastructure and lending challenges faced by the underbanked populations in Kenya.

Syntellect’s innovative tool, RightProfile™, is at the forefront of reshaping customer profiling and loan underwriting. This technology provides lenders worldwide with crucial insights into the creditworthiness of underserved, unbanked, and low-income customer segments. As Syntellect ventures into the Kenyan market, its focus lies in comprehending the essential housing infrastructure issues and the unique challenges lenders encounter when serving the underbanked.

The global instant loans market, valued at $11.71 billion in 2020, is projected to witness a remarkable annual growth rate of 24.8% from 2021 to 2028, according to Grand View Research. East Africa, particularly Kenya, has become a hotspot for instant lending due to a significant unbanked population. The World Bank reports that in Kenya, only 27.6% of adults have formal financial accounts, reflecting a common situation in other African countries.

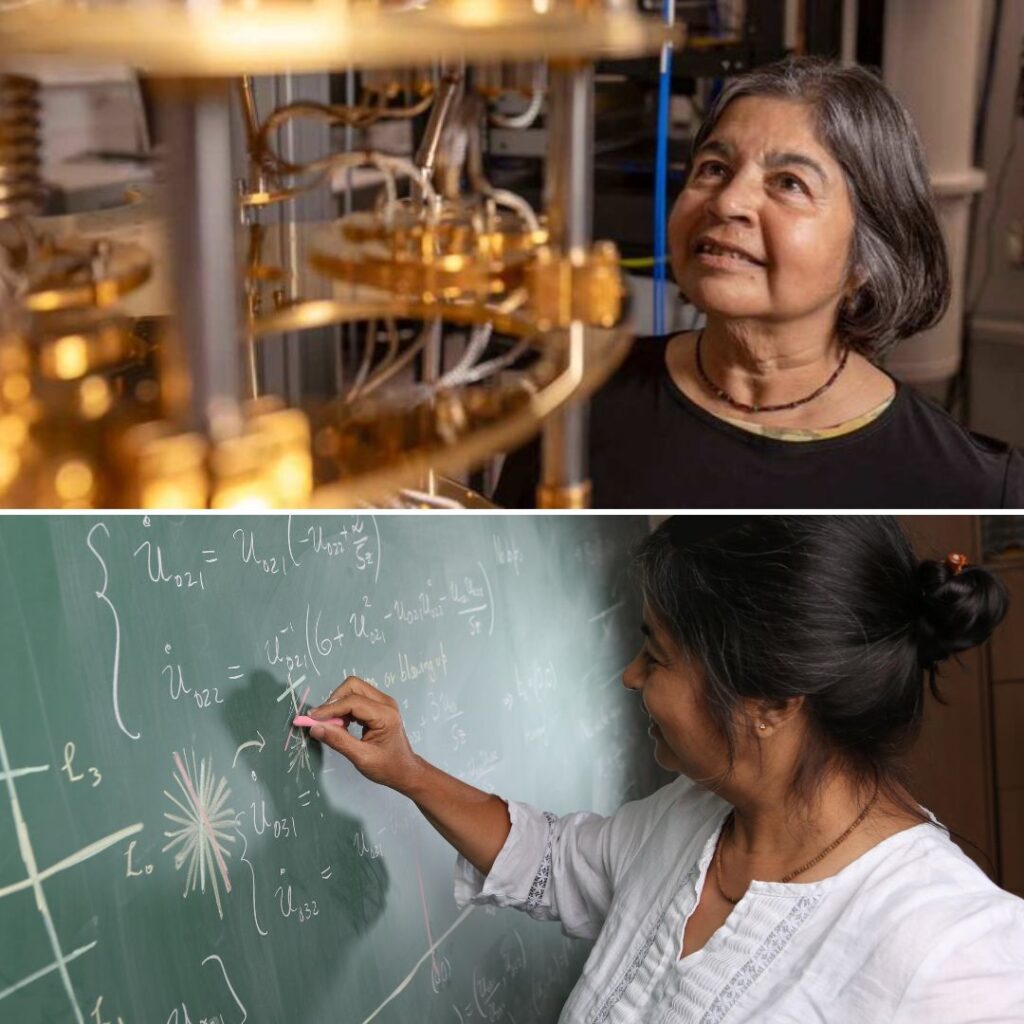

Sumedha Salunkhe Naik, CEO of Syntellect, expressed enthusiasm about the partnership’s potential impact on KWFT’s customer base of 800,000 individuals, especially those in rural areas where 80% of their clients are located. Naik emphasized that through RightProfile™, the goal is to promote financial inclusion and empower individuals to shape a brighter future for themselves and their families.

“At Syntellect, our approach towards partnerships is deeply rooted in engaging with our clients beyond standardized solutions. We strive to understand their business models, challenges, and group dynamics. This personalized approach, combined with our advanced technology, empowers us to create intelligent underwriting solutions tailored to the unique needs of our clients,” said Naik.

Mr. Kibet Kipkemoi, Director of ICT and Bank Operations at KWFT, expressed excitement about the collaboration, stating, “We are thrilled to partner with Syntellect to further our mission of shaping a brighter future for underbanked communities here in Kenya.” He added that the partnership aligns with KWFT’s vision of financial empowerment and improving the well-being of those they serve, emphasizing that it’s not just a collaboration but a shared commitment to creating a better tomorrow for the people of Kenya.

Syntellect, founded by banking veteran Sumedha Salunkhe Naik, focuses on expanding access for the unbanked and has garnered recognition from multilateral organizations. Funded by UK-based Reall, an impact organization in affordable housing, Syntellect envisions transforming the affordable housing lending landscape in India, Africa, and South America to create financial inclusivity.

Also Read: Al For Resilient Future”: Al Holds Potential To Create 100 Million Jobs