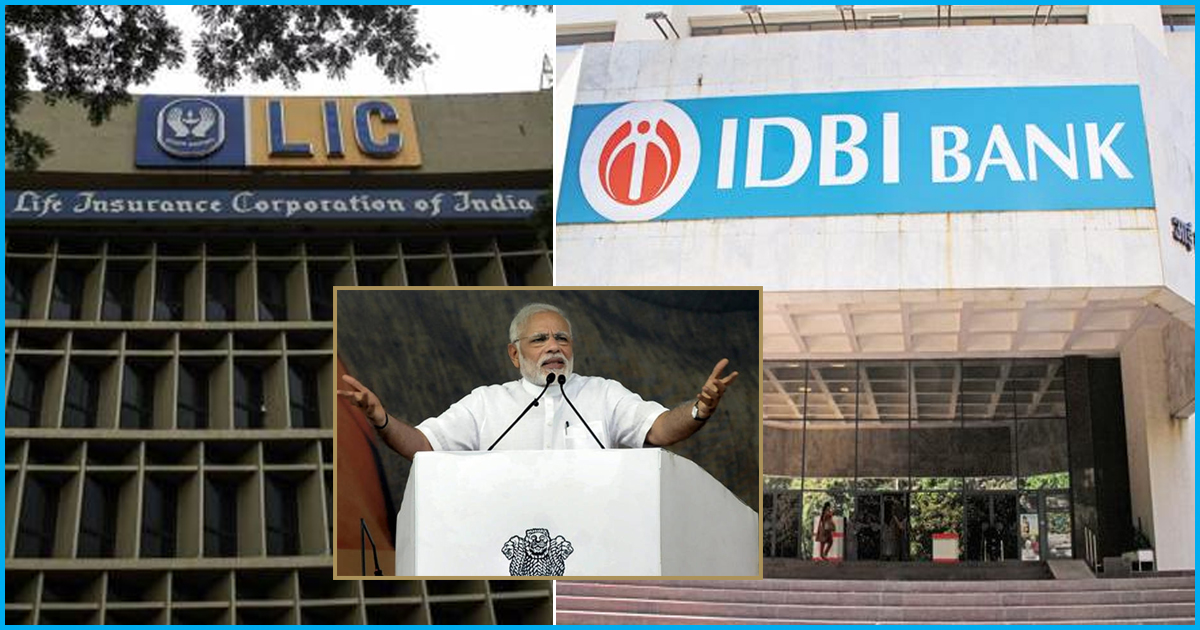

Should Your Hard-Earned Insurance Premiums Be Risked For A Failing Bank? LIC To Buy Stake In IDBI

27 Jun 2018 11:42 AM GMT

Life Insurance Corporation of India (LIC) is the medium of choice for millions of Indians when it comes to securing their future financial well-being. The Indian government is considering asking LIC to bail-out IDBI bank, the worst performing public sector bank, with tax-payer money. The problem staring us right in the face is that if the bank continues to sink down the drain, then what about LIC’s fiduciary responsibility to policyholders.

What does the government want?

LIC has often been the government’s lackey when it comes to buying unwanted things. For the past two years, the centre has failed to find any buyers for the struggling IDBI bank. IDBI’s gross non-performing assets are over $8 billion, a staggering 28 percent of the total. If all of IDBI’s distressed loans are marked down, then NPAs would become 36% of the total. Simply put, for every 100 Rs loaned by the bank, 36 Rs become Non-Performing Asset.

The government infused more than Rs 10,000 crore in the fiscal year 2017-2018. Then in May 2018, Rs 7,881 crore was again infused in IDBI, taking the government’s shareholding to almost 86% in the bank. As per reports, IDBI still needs more than Rs 10,000 crore capital infusion.

So, the government is considering that LIC, which already has more than 10% share in IDBI from some previous rescue attempts, should either infuse around Rs 21,000 crore to acquire a 51% stake or it infuses at least Rs 13,000 crore making its stake in the bank around 40%.

Usually, a majority stakeholder has controlling rights in a company. However, according to a report in BloombergQuint, LIC will not have a say in the bank’s management.

The government wants to bypass the risk-prevention measures

This plan, if it goes through, exposes LIC and millions of Indian citizens to a contagion risk. In layman terms, it means that if LIC puts policyholders’ money into IDBI, then an economic downturn or a collapse of IDBI will spread the problem to millions of citizens for no fault of their own. This is like taking an infection from a small contained part and letting it loose in the whole body.

Insurers do not buy stakes in banks or non-insurer agencies. This is a standard practice followed across the world.

In India, the Life Insurance Corporation, Act 1956 and the Insurance Laws (Amendment) Act, 2015 prohibit LIC (and other insurers) to acquire more than 15% stake in any company. Also, section 35 of the Insurance act prevents LIC from acquiring or controlling a non-insurance company.

For this proposal to go through, the Insurance Regulatory and Development Authority of India (IRDA) will have to clear it, and reports suggest that a meeting is already scheduled for this month-end. Say, the IRDA approves this, then the Securities and Exchange Board of India (SEBI) will have to grant special consideration to LIC.

Now, even if the government can reduce its stake in IDBI without the need of an approval from the Parliament, IDBI will still have to amend its Articles of Association by a special resolution passed by its shareholders.

Why risk the hard-earned money of the Indian citizens for a failing bank?

There have been previous cases when a profitable state-owned entity, such as LIC or ONGC, has been used to bail out debt-ridden companies. This reflects the government’s inability to find buyers, and the government’s response, in turn, will further decrease the prospect of lucrative privatisation in the future.

Economist-author Vivek Kaul took to Twitter and explained the problems in a series of tweets.

The government is ready to sell IDBI Bank to LIC. This is wrong at multiple levels. Let's try and understand the points one by one.

— Vivek (@kaul_vivek) June 23, 2018

This move exposes LIC and Indian citizens to unnecessary and avoidable risk. So, the question becomes why to do this in the first place.

If the government wriggles out from the failing IDBI bank, it won’t have to infuse any capital in the short-term. Moreover, the government can also claim that they are on track with the disinvestment targets.

But what about the common people?

All section

All section