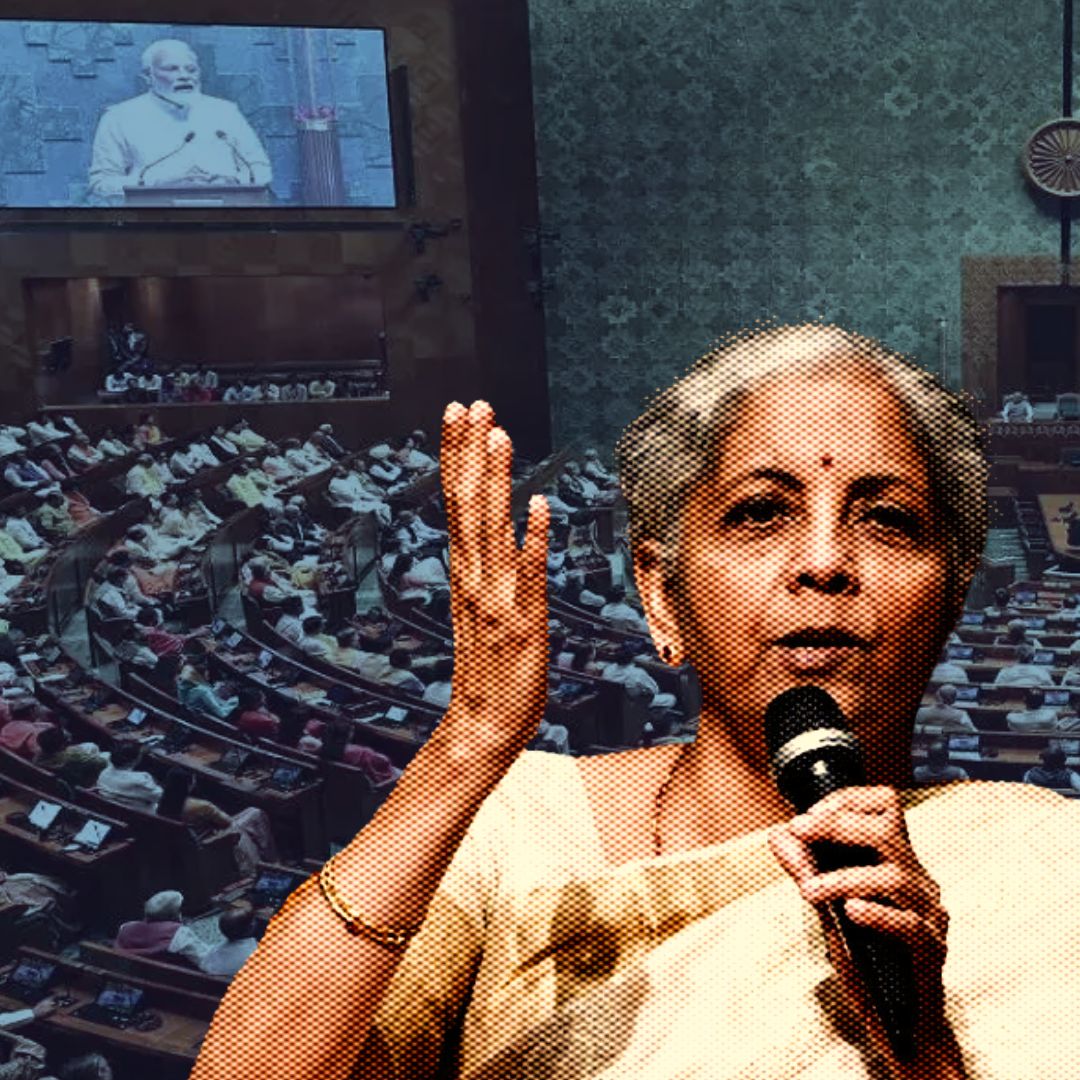

On December 3, 2024, the Lok Sabha passed the Banking Laws (Amendment) Bill, which allows bank account holders to nominate up to four individuals for their accounts. This significant legislation aims to enhance governance and customer convenience. Finance Minister Nirmala Sitharaman stated that the amendments will improve protections for depositors and investors. However, opposition members raised concerns about potential privatization and cybersecurity risks.

Key Provisions of the Bill

The Banking Laws (Amendment) Bill introduces several important changes to the Indian banking framework, including:

1. Nomination Flexibility: Account holders can now nominate up to four individuals, either simultaneously or successively, streamlining inheritance processes.

2. Directorship Changes: The definition of “substantial interest” for directorships is revised, increasing the threshold from ₹5 lakh to ₹2 crore.

3. Tenure Extension: The tenure of directors in cooperative banks is extended from eight years to ten years.

4. Regulatory Reporting: Compliance reporting dates will shift from the second and fourth Fridays of each month to the 15th and last day of every month.

5. Auditor Remuneration: Banks will have greater discretion in determining remuneration for statutory auditors.

These changes aim to improve governance standards while ensuring better protection for depositors.

Legislative Context

The bill was introduced in the Lok Sabha on August 9, 2024, amid discussions about improving banking regulations in light of evolving financial landscapes. With unclaimed deposits in Indian banks estimated at around ₹78,000 crore as of March 2024, this legislation seeks to enhance transparency and address issues related to unclaimed assets. Sitharaman highlighted that Indian banks remain robust compared to global counterparts facing instability, asserting that these reforms are crucial for maintaining a stable banking environment.

Diverse Reactions from Stakeholders

While the government presents this bill as a progressive step towards modernising banking operations, it has faced criticism from opposition parties. TMC MP Kalyan Banerjee described the legislation as a “donkey passage towards privatisation,” warning that it could reduce government stakes in public sector banks. Concerns were also raised about increasing cybersecurity threats associated with these changes. Congress MP Karti Chidambaram emphasised the need for simplifying current Know Your Customer (KYC) processes to avoid unnecessary burdens on customers.

Implications for Customers and Banks

The implications of this legislation extend beyond regulatory compliance; they also affect everyday banking experiences for millions of Indians. By allowing multiple nominations, the bill aims to ease the burden on families dealing with bereavement and financial transitions. However, stakeholders must remain vigilant about how these changes are implemented and whether they genuinely serve customer interests without compromising security or accessibility.

News in Q&A

1. What is the Banking Laws (Amendment) Bill, and what are its main features?

The Banking Laws (Amendment) Bill, passed by the Lok Sabha on December 3, 2024, allows bank account holders to nominate up to four individuals for their accounts. Key features include extending the tenure of directors in cooperative banks from eight to ten years and revising the definition of “substantial interest” for directorships, raising the threshold from ₹5 lakh to ₹2 crore.

2. Why was this bill introduced, and what issues does it aim to address?

The bill was introduced to modernise banking regulations in India and address issues such as unclaimed deposits, which were estimated at around ₹78,000 crore as of March 2024. By enhancing nomination processes and improving governance standards, the legislation aims to facilitate smoother asset transfers for families during bereavement.

3. How has the government justified the need for these amendments?

Finance Minister Nirmala Sitharaman stated that these amendments are crucial for strengthening governance in the banking sector and enhancing protections for depositors and investors. She emphasised that Indian banks remain stable compared to global counterparts, making these reforms necessary for a robust banking environment.

4. What concerns have been raised by opposition parties regarding this bill?

Opposition members have expressed concerns that the bill may lead to increased privatisation of public sector banks. TMC MP Kalyan Banerjee referred to it as a “donkey passage towards privatisation,” while Congress MP Karti Chidambaram highlighted potential cybersecurity risks and called for improved Know Your Customer (KYC) processes.

5. What are the potential implications of this legislation for customers and banks?

The legislation aims to ease the burden on families dealing with financial transitions after a bereavement by allowing multiple nominations. However, successful implementation will depend on ensuring that these changes do not compromise security or accessibility for customers, thereby maintaining public trust in the banking system.

The Logical Indian’s Perspective

The passage of the Banking Laws (Amendment) Bill reflects a critical juncture in India’s banking evolution, balancing modernisation with customer rights. While enhancing governance and convenience is commendable, it is vital to ensure that these changes do not compromise security or lead to unintended consequences such as privatisation. As we move forward, how can we ensure that reforms serve the interests of all stakeholders without sacrificing public trust? We invite our readers to share their thoughts on this pivotal legislation and its implications for India’s financial future.