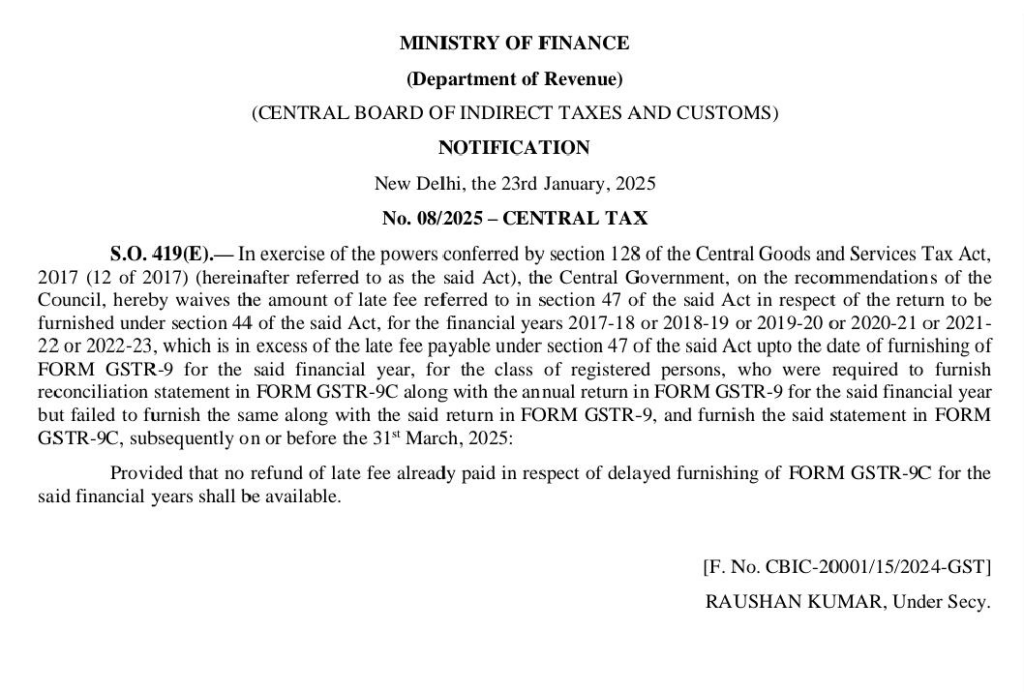

The Central Board of Indirect Taxes and Customs (CBIC) has announced a waiver of late fees for businesses that missed the deadline for filing Form GSTR-9C, applicable for financial years 2017-18 to 2022-23. This waiver is valid if the forms are submitted by March 31, 2025, following the 55th GST Council meeting. While this decision aims to ease compliance for late filers, it does not provide refunds for late fees already paid.

Waiver Announcement and Impact

On January 23, 2025, the CBIC issued a crucial notification that will significantly impact businesses across India. The waiver applies to late fees incurred under Section 47 of the Central Goods and Services Tax (CGST) Act due to the delayed filing of Form GSTR-9C, which serves as a reconciliation statement required alongside annual returns. This move is particularly relevant for registered taxpayers who failed to submit their forms by the original deadlines set for financial years spanning from 2017-18 to 2022-23.The new deadline of March 31, 2025, allows businesses an extended opportunity to comply without facing additional financial penalties.

Officials from the Ministry of Finance stated that this initiative is aimed at promoting compliance among businesses still grappling with previous filing requirements. “We understand that many businesses have faced challenges in adhering to the timelines due to various factors, including economic fluctuations and regulatory complexities,” said a senior CBIC official. However, it is important to note that this waiver does not extend to refunds for late fees already paid, a point that has raised concerns among those who have incurred these costs in the past.

Reasons Behind the Waiver

The decision to waive late fees was driven by several factors, including feedback from various industry stakeholders who expressed difficulties in meeting compliance deadlines. Many businesses were adversely affected by economic disruptions caused by the pandemic and subsequent market fluctuations. The GST Council’s recognition of these challenges reflects a growing understanding of the need for flexibility in tax compliance measures.

Moreover, this waiver aligns with broader government efforts to simplify tax procedures and encourage voluntary compliance among taxpayers. By reducing financial penalties, officials hope to foster a more cooperative relationship between businesses and tax authorities.

Background Context

The waiver stems from discussions during the recent GST Council meeting, where officials sought to address ongoing compliance challenges faced by businesses due to the complexities of GST regulations. Since its implementation in July 2017, the Goods and Services Tax has undergone numerous amendments and updates, often leaving businesses struggling to keep up with changing requirements. The reconciliation statement is a critical component of GST compliance, as it helps ensure that the tax paid by businesses aligns with their reported income.

By extending the deadline and waiving excess fees, the government aims to encourage timely submissions moving forward while alleviating some financial burdens on businesses that have struggled with compliance in the past. This initiative is part of a broader strategy to enhance taxpayer engagement and streamline processes within India’s tax framework.

Reactions from Business Associations

Business associations have welcomed this announcement as a positive step towards easing compliance burdens. Industry leaders have voiced their appreciation for the government’s understanding of their challenges. “This waiver will provide much-needed relief for many small and medium enterprises that have been struggling,” said an official from a prominent industry association. However, they also call for further measures that could address past penalties incurred by compliant businesses.

The Logical Indian’s Perspective

This decision by the CBIC represents a significant step towards fostering a more accommodating regulatory environment for businesses. By waiving late fees, the government acknowledges the challenges faced by many in navigating complex tax regulations. While this measure provides much-needed relief for those who have yet to file their GSTR-9C forms, it also highlights an important issue: how can we ensure fairness for those who have already paid penalties?

As we look towards a more equitable tax system, it is crucial that policymakers consider measures that support all stakeholders involved. This could include potential avenues for reimbursement or additional support mechanisms for those who have been financially impacted by previous regulations. How can we further support businesses in achieving compliance without imposing undue financial strain?

We invite our readers to share their thoughts and experiences in the comments below! Your insights could help shape a more inclusive dialogue around tax compliance and business support in India.