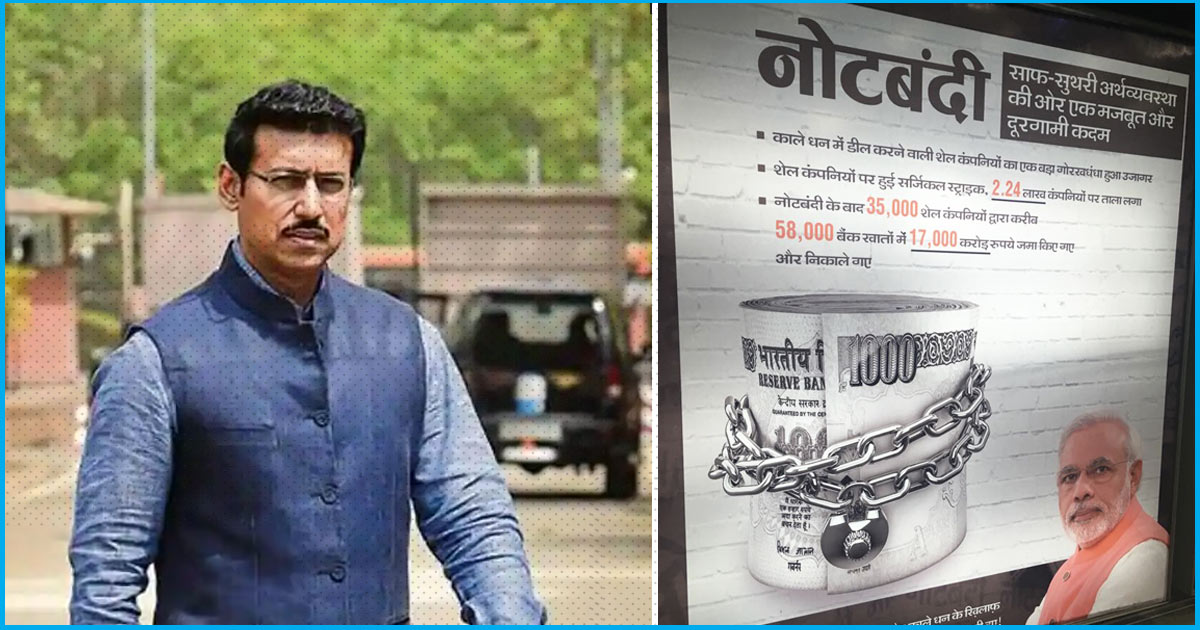

Airports, petrol pumps, movie halls and public roads, where ever you go, there is one thing you might find almost at all these places, our omnipresent Prime Minister Modi’s face whether on billboards or electric hoardings. These central government advertisements in public places also cost the taxpayers. On December 14, the Minister of State for Information and Broadcasting Rajyavardhan Singh Rathore informed the Lok Sabha in a reply that the central govt led by Bharatiya Janata Party has spent over Rs 5,200 crore in advertisements through electronic, print and other media since 2014-15, according to NDTV.

Money spent on Advertisements

The minister gave a break up of the amount of money spent by the BJP-led government. The written response said that a sum of Rs 979.78 crore was spent in the year 2014-15, which kept increasing in the following years. In the year 2015-16 the central government spent Rs 1,160.16 crore followed by Rs 1,264.26 crore spent in 2016-17 and lastly from 2017-18, the government paid Rs 1,313.57 crore money on the advertisement through all mediums. The minister further added that an amount of Rs 527.96 crore has been exhausted in the last quarter of the year 2018-19 till December 7. In all total, the Central government has spent a sum of Rs 5,245.73 crore in the last four-and-a-half years.

Rathore, a Member of Parliament (MP) from Jaipur Rural seat gave a break up of the money spent by the BJP government through the Bureau of Outreach and Communication (BOC) in the Lok Sabha. BOC is an entity that was created after merging the Directorate of Advertising and Visual Publicity, the Directorate of Field Publicity and Song and Drama Division last year, as reported by the NDTV.

He said while Rs 2,282 crore was spent on print advertisements, an expenditure of Rs 2,312.59 crore was used through audio-visual media, he said, adding that Rs 651.14 crore was spent on outdoor publicity.

Earlier RTI response

Earlier in October, an RTI response revealed that the Modi government had spent close to Rs 5,000 crore on outdoor and electronic media advertisement, in the last four years of its governance. This amount is almost equal to the expenditure by the UPA government during ten years of it being in power.

The RTI further revealed that Rs 2,211.11 crore was spent on electronic media advertisement. This was closely followed by print media advertisement at Rs 2,136.39 crore. And about Rs 649.11 crore was spent on outdoor advertisement.

Also Read: Modi Govt’s Expenditure On Publicity Is Already Almost Equal To 10 Yrs Of UPA Tenure: RTI Reply