Ex-PM Manmohan Singh Also Gave Rs 52,000 Crore Loan Waiver To Farmers, But Did It Work?

14 April 2017 8:45 AM GMT

The UP government recently announced a huge loan waiver package for the farmers.

This is not the first time a government has announced such a package nor will it be the last time. Before we judge whether the package would really benefit the farmers or not, let’s look at some factual information about how the packages were implemented in the past and also dig into some history of loan waivers. The idea of the article is not to denounce the initiatives of the government over the years but to give our community members an overall perspective of it.

You can read our earlier coverage on the issue: Does The Banking System Really Want To Help Farmers?

What happened in 2008 with the biggest loan waiver?

Rs 52,000 crores were released by the Indian government as part of the Agricultural Debt Waiver and Debt Relief Scheme (ADWDRS), launched in May 2008, in order to address the financial indebtedness of the farmers right before the 2009 general election. Farmers and their issues have always been a part of election campaigns, but that’s where they always remained and loan waivers became an easy way out to brush farmer’s issues under the carpet. The money was to clear part of the dues of farmers against specific parameters based on small/marginal/other farmers and the period of disbursal of the loan – it’s overdue and unpaid/position.

The CAG audit revealed lapses and errors raising which included inaccuracy of claims to an inclusion of ineligible beneficiaries to the accuracy of claims to reimbursement of the lending institution, all ranging serious concerns about the implementation of the scheme.

- The farmers entitled to receive the benefits were not included in the list of beneficiaries by the lending institutions.

- Farmers who had taken loans for non-agricultural purposes were given benefits under the scheme.

- Loans amounting to hundreds of crores not meant be waived under this scheme were also waived off.

- No record of loan application receipts or acknowledgments from farmers confirming the receipt of the loan waivers.

- Lending institutions were responsible for implementing the scheme and also monitoring of their own work – a clear conflict of interest. The monitoring was to be done by nodal agencies, which was never in place.

- Tampering, overwriting and alternation were found with the claim records, thus creating serious doubts over the documentation.

- Commercial banks received reimbursement for loans, amounting to Rs 164.4 crores; this was extended to micro financial institutions.

- Debt waiver/relief certificates were not issued in many cases for eligible beneficiaries.

History of loans & rural indebtedness

It was in 1904 the cooperative societies/banks were created to provide cost-effective financial services to the farmers. The State Bank of India was created in 1955 with an objective to extend banking services to rural and urban areas. This was followed by the nationalization of commercial banks in 1969 to further enable the govt. to extend credit to agriculture proactively. Regional Rural Banks in 1975 and the establishment of NABARD in 1982, were all efforts to make credit easily accessible to the farmers and in general to the agriculture sector.

The State Bank of India was created in 1955 with an objective to extend banking services to rural and urban areas. This was followed by the nationaliSation of commercial banks in 1969 to further enable the government to extend credit to agriculture proactively. Regional Rural Banks in 1975 and the establishment of NABARD in 1982, were all efforts to make credit easily accessible to the farmers and in general to the agriculture sector.

Aside from creating the lending institutions, the Government also introduced various lending schemes such as Kisan Credit Card Scheme.

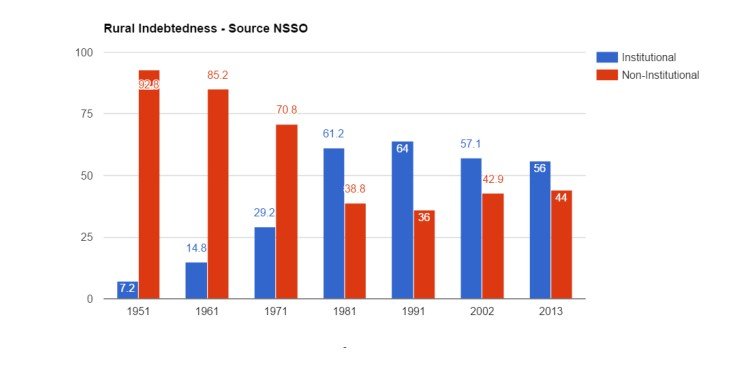

Despite the various efforts to establish, enable, and empower institutional lending to the agriculture sector starting all the way from 1905 till date, the non-institutional lending contributes to a whopping 46% of lending, as per the 2013 NSSO data, with the private money lenders contributing 33%.

What kind of credits do the farmers typically need?

Credit, in general, is divided into 3 categories:

- short-term,

- long-term &

- indirect

Short-term agricultural credit or crop loans enable cultivators to procure inputs such as fertiliser and seeds needed for seasonal agricultural operations

Long-term credit is for investment in fixed assets, such as irrigation pumps, tractors, agricultural machinery, plantations and those related to dairying, fishing and poultry.

Indirect finance of agriculture includes loans to input dealers, loans for setting up agri-clinics and agribusiness centres, loans to microfinance institutions, loans to dealers in agricultural machinery and drip and sprinkler irrigation systems, loans for construction and running of cold storage units, irrespective of their location, loans to food and agro-processing units, and diverse other activities related to agriculture.

The AIDIS data reveals a sharp rise in the share of short-term credit in the proportion of input costs points towards diversion of subsidised credit for non-agricultural purposes.

A farmer who receives loans at a concessional rate of 4% can easily deposit in a financial institution and receive an interest rate of approximately 7.5-8% in a fixed deposit scheme for six months.

Indirect credit has risen even more impressively, due mainly to more and more categories being brought within the ambit of agricultural credit.

There is enough data to prove that not all the credit is what it seems and better transparency and monitoring systems need to be first put in place to avoid the misuse and exploitation by both the banks and the beneficiaries.

So why is it that despite the blockbuster loan waivers & the institutional lending farming continues to suffer?

First, the simple answer – lack of accountability and lack of proper monitoring reduces the effectiveness of the loan waivers. This coupled with the fact that not all the debt is formal, reduces their effectiveness even more.

Now to the more elaborate answer. When a farmer’s loan is waived off by the bank, the chances of them getting subsequent loans from the same banks is at great risk because the farmer is now a risky borrower. Given how the farmer’s income is at the mercy of so many factors starting from the weather to the water (but most importantly the minimum support price offered by the govt. for the produce), the income is never enough to cover for the expenditure. This pushes the farmer into further debt and this time since the banks won’t offer the loans, their only option is the private money lenders.

So unless the real issues that push the farmers into debt are addressed, no matter how many loan waivers are announced they are never going to make farming and farmers sustainable.

What is the way forward?

- Not more lending institutions but better lending institutions with transparency and accountability.

- While we seem to be in a rush to go digital and go cashless, there is a greater need to bring technology closer to the farmers

- It’s time we make smart villages so they became self-reliant. In other words, the farmers should be empowered to store, process and package their produce so they can maximise their profits.

- We keep hearing how software engineers quit their jobs and turn to farming. They are able to do this because they have better access to information, technology, market and various other resources. There is no reason why the same can’t be made available to the farmers.

- More than 50% of the Indian population still depends on agriculture. This is where the real potential of “Make in India” lies.

- Land continues to be a major reason which makes or breaks the farmers. The 2013 Land Acquisition must be enforced rather than diluted.

- Obviously involving farmers in these kinds of discussions and debates will help not just formulate these policies, but also allow for a better implementation.

Farmers are not a liability, they are our assets – and they should be treated as such.

The article was originally published on: sureshe.wordpress

Also Read: Farm Loans Worth Rs. 36,359 Crore Waived Off: UP Govt’s Big Relief To Farmers

All section

All section