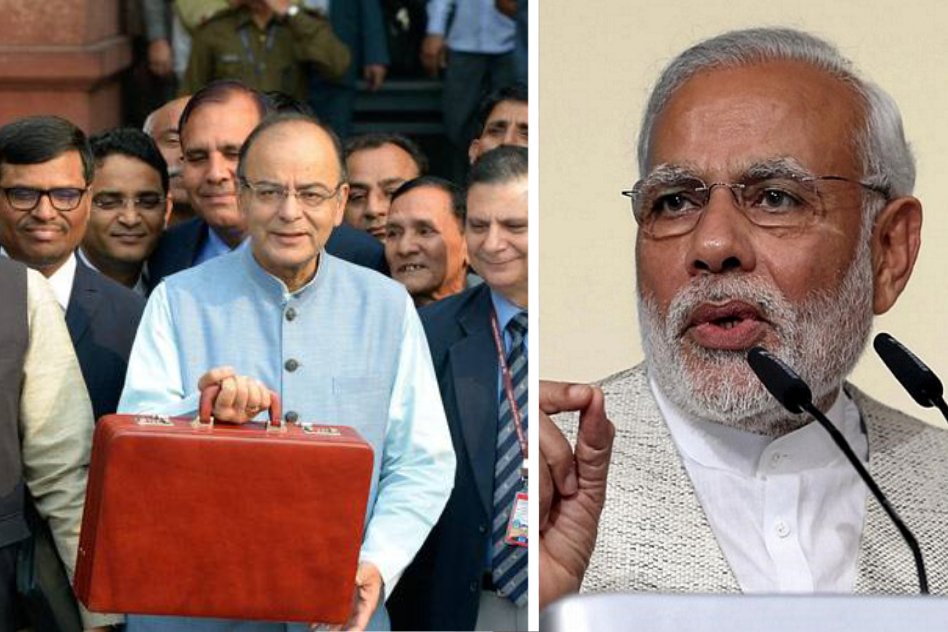

India's Debt Trap - 25% Of The Budget Is Spent On Paying Of Debts

19 Aug 2016 10:34 AM GMT

Early Years

During India’s freedom struggle, one of the landmark reform measures that took the country one step closer to being independent was the Morley-Minto reforms. The Morley-Minto reforms were the early reform measures which guaranteed more powers to the provincial legislatures among others, it allowed representatives for the first time to pass resolutions, the members of the Legislative Councils were permitted to discuss budgets and suggest amendments. Even as part of the reform measures, they were not allowed to discuss or debate the debt of the governments. Ostensibly, discussing on the debt situation of India under British rule would have got mass awareness of people on how the British were siphoning off India’s wealth to the advantage of the British empire. Today, India is at the crossroads and on the brink of an irreversible debt trap.

The Present scenario

Let us look at the numbers behind the debt

1. The Centre’s total debt is now a staggering Rs 4,700,000 crore. Include the states’ debt and India’s total government debt is Rs 6,500,000 crore, approximately 65% of its GDP. (US at 75% of GDP). 6% of the budget of the US goes towards interest payments, while 25% of India’s budget goes towards interest payments. The US reportedly borrows at a low 1-3 % while India borrows at 7-9%. Yes, the interest rates change based on different scenarios. The fiscal deficit which our budget talks of is basically how India spends more than it earns. It is not surprising that the principal political parties never take pot shots at each other on this issue. Jehangir Pocha reports that India’s debt is in such a bad scenario that we have to borrow money to pay the interest rates on old loans.

2. 25% of India’s budget occupy the interest payments. Food, fuel, fertilizer subsidies and defense spending occupy 30% of the budget, India has a measly 40% left to spend on other social expenditures.

The Outcome

The consequences of high-interest rate payments are too big to quantify, the more the money spent for paying loans, India will have to find new ways to tax businesses and citizens to generate more money given the fact that global economy still remains dull and thereby affecting India’s export earnings. It is high time India’s debt numbers become a matter of public debate and discussion, higher debts and interest payments will consequentially affect the citizens by different means, it could bring inflation, lack of social spending and government investment. India’s debt belongs to every citizen; the media and the Parliament should take up the debt trap which India has struck itself into and find way and means of clawing back out of it.

All section

All section