New Features Introduced In PAN Cards To Enhance Security, Know About Them

16 Jan 2017 9:49 AM GMT

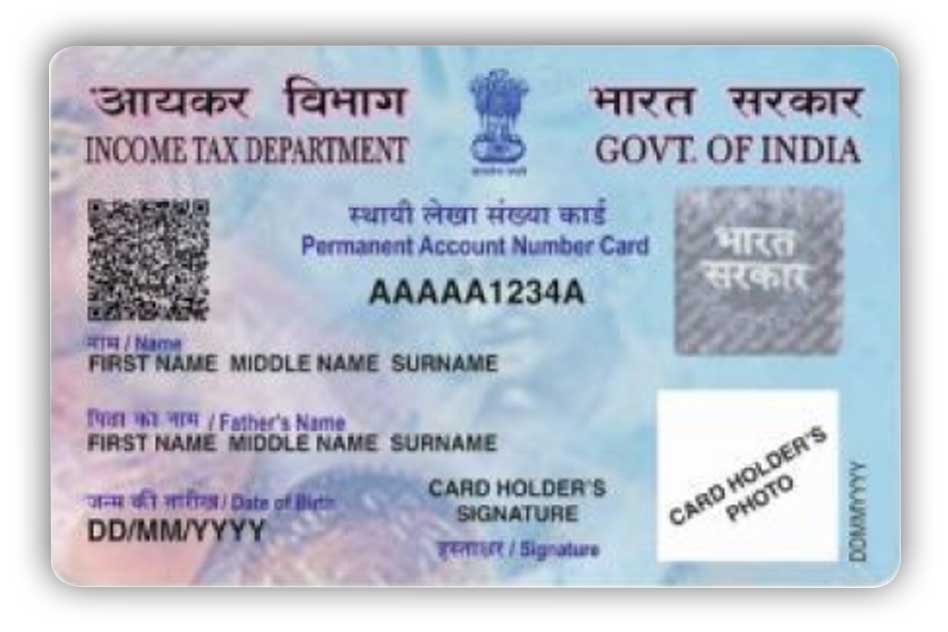

To check fraudulent practices in taxation and banking systems, the Income Tax Department has directed all the Pan Card Centres and TIN (Tax Information Network) facilitations to print Pan Cards with security features to make them tamper-proof and with bilingual contents in Hindi and English, as reported by The Economic Times.

According to Pragativadi , as per the guidelines, the new features in PAN card will be:

- A Quick Response (QR) code which will have details of the PAN applicant, enabling verification of the PAN card.

- The particulars like Name, Father’s name and date of birth fields will be elaborated.

- The signature and position of PAN have been changed.

The new PAN cards are being printed by NSDL (National Securities Depository Ltd) and UTI ITSL (UTI Infrastructure Technology and Services Ltd). It started on January 1, 2017.

“The distribution of new PAN cards started on 1 January. However, these are only for the fresh lot of PAN card applicants,” the official told PTI in Mumbai.

“We have automated the data and made the PAN cards error-free,” says the official and he further stated that the existing cardholders could also apply for a fresh PAN card and they will be issued the newly designed cards. This move is not to replace existing cards.

On 10 January 2017, NSDL also issued a circular informing the Tax Information Network – Facility Centres (TIN-FCs) about the changes in existing PAN cards.

It is mandatory to hold the PAN cards for any transactions above Rs 2 lakhs. It is also used to open a bank account and as an identity proof.

Permanent Account Number or PAN is a means of identifying taxpayers in the country. PAN is a unique identification number assigned to every Indian, mostly who pay tax. Through this method, all tax related information for a person is recorded against a single number which acts as the primary key for storage of information. This is then shared across the country, and hence no two people or tax paying entities can have the same PAN.

All section

All section