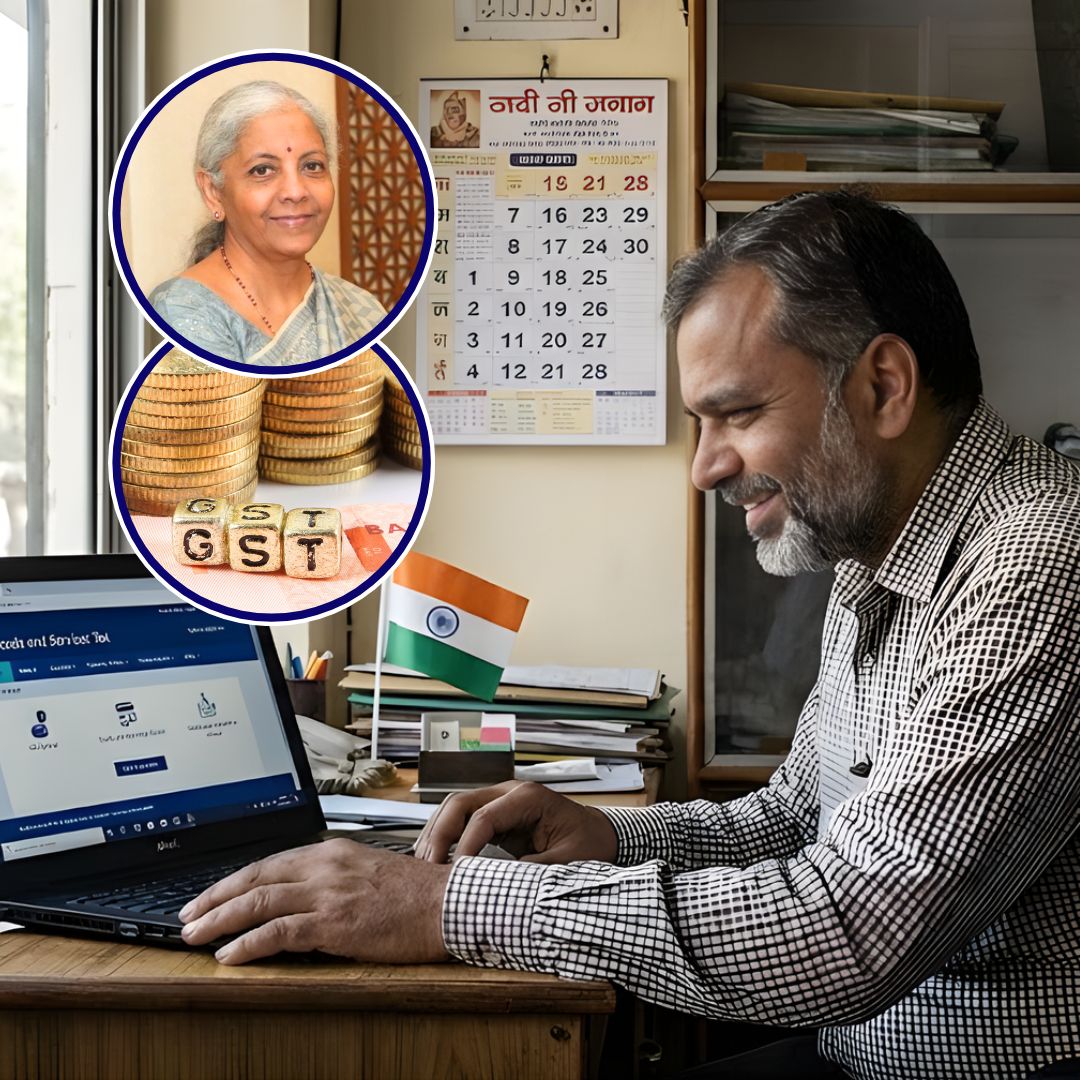

The Central Goods and Services Tax (CGST) Rules were amended effective November 1, 2025, to introduce Rule 14A, a simplified and technology-driven GST registration process for small taxpayers.

This scheme targets businesses whose monthly output tax liability on supplies made to registered persons does not exceed ₹2.5 lakh. The objective is to enable quicker, transparent, and risk-based registration that reduces compliance burden while improving tax governance for micro and small enterprises.

Under the new Rule 14A scheme, eligible taxpayers can receive automatic GST registration approval electronically within three working days of submitting their application, provided Aadhaar authentication and risk checks are completed successfully.

Eligibility and Application Procedure

To qualify, taxpayers must confirm that their monthly B2B output tax liability (including CGST, SGST/UTGST, IGST, and Compensation Cess) does not exceed ₹2.5 lakh, and that they do not hold more than one GST registration per PAN per State or Union Territory.

Applications are filed online through the GST portal at gst.gov.in by submitting FORM GST REG-01, where applicants select the “Rule 14A (Simplified Registration)” option. Aadhaar-based authentication via OTP or biometric verification is mandatory for the primary authorised signatory and at least one partner or promoter to enhance trustworthiness and prevent misuse.

Fast-track Electronic Approval and Compliance Measures

Once the Aadhaar authentication is successful and the application passes automated risk parameters, registration is approved automatically within three working days, with the GST Identification Number (GSTIN) issued electronically. This digital process eliminates lengthy manual interventions, making it easier for small businesses to start their taxable operations swiftly.

However, taxpayers must exit the scheme by filing FORM REG-32 (withdrawal) and REG-33 (final return) if their monthly tax liability exceeds ₹2.5 lakh, or if cancellation proceedings are initiated. Failure to comply with exit requirements may lead to GST registration cancellation, affecting input tax credit claims and risking penalties.

According to a report, 142,000 applications were cleared in just 15 days, with 66% of the new GST registrations under the system being processed within 24 hours. The fastest approval took only 21 minutes, reflecting substantial gains in efficiency and transparency.

Background and Regulatory Context

Rule 14A is part of the GST Network (GSTN) and Central Board of Indirect Taxes and Customs (CBIC) initiatives to digitize tax processes and implement risk-based governance. Alongside Rule 9A, which facilitates electronic risk-based registration for normal taxpayers, Rule 14A specifically caters to “low-risk” smaller entities by blending technological efficiency with regulatory oversight.

This move aligns with broader government efforts to improve ease of doing business, combat tax evasion, and promote voluntary compliance.

Overview of GST 2.0 Reforms

India’s GST 2.0 initiative, implemented from September 22, 2025, marked the most significant overhaul to the Goods and Services Tax system since its introduction in 2017. The core of this reform was a rationalisation of tax slabs into a simpler three-tier structure: a 5% slab primarily for essential goods and services; an 18% standard slab covering most goods and services; and a 40% rate for luxury and sin goods such as pan masala, tobacco products, high-end cars, and private aircraft.

This replaced the earlier multi-slab system that included 12% and 28% rates, reducing confusion, disputes, and compliance complexities. The aim was to create a more transparent, equitable, and efficient tax system that would stimulate consumption, boost economic activity, and make compliance easier for businesses and consumers alike.

The Logical Indian’s Perspective

The Logical Indian recognises Rule 14A as a progressive step that balances the need for regulatory control with the convenience of small taxpayers. By simplifying registration and incorporating biometric authentication, the scheme fosters a trustworthy and transparent tax environment.

Yet, the strict withdrawal requirements and compliance checkpoints call for adequate taxpayer awareness and government support to prevent unintentional lapses. Encouraging continuous dialogue between taxpayers and authorities can ensure these reforms translate into real-world benefits.

Simple GST Registration#NextGenGST pic.twitter.com/57sASS8alP

— CBIC (@cbic_india) September 3, 2025