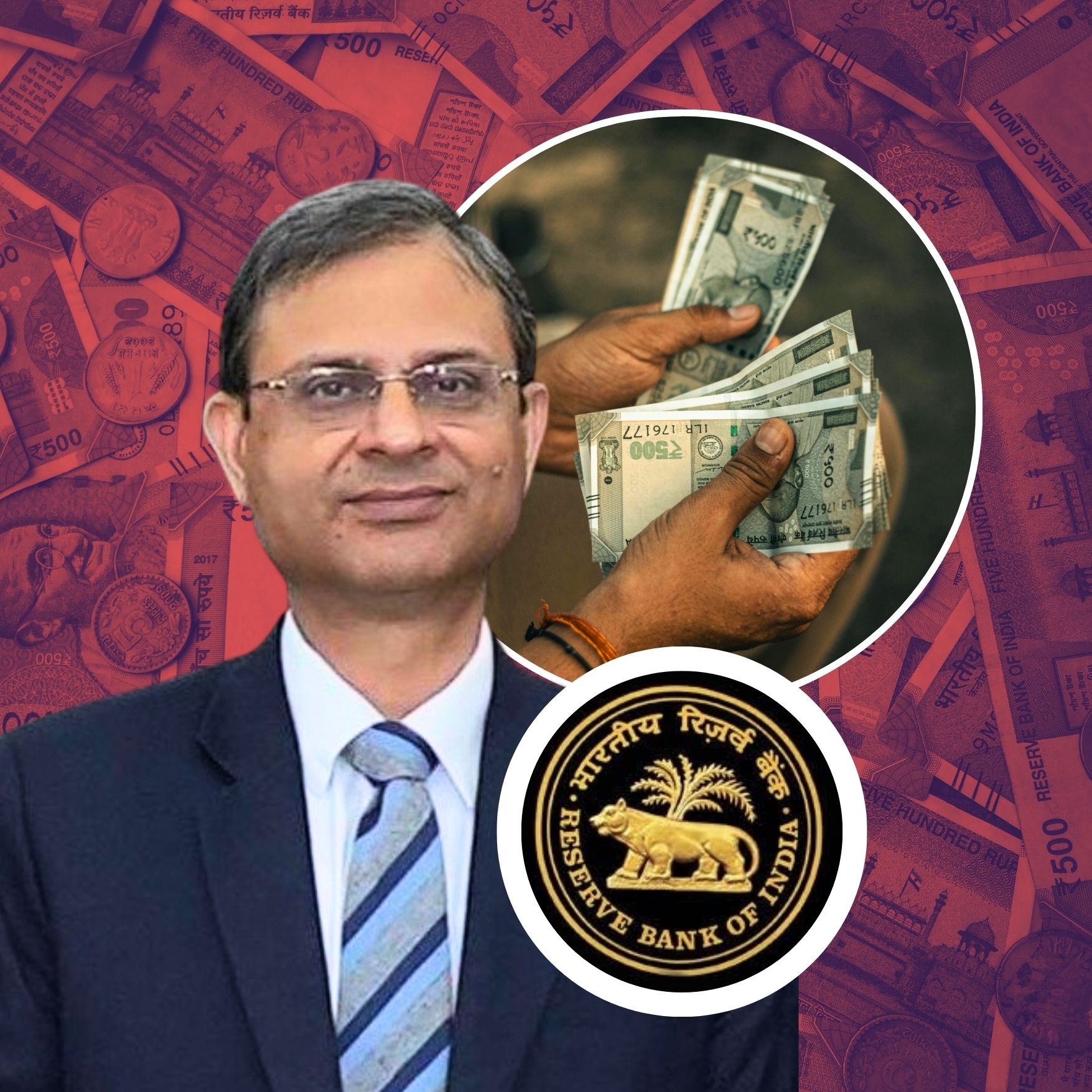

The Reserve Bank of India cut the repo rate by 25 basis points to 5.25 per cent on December 5, 2025, after a unanimous Monetary Policy Committee decision announced by Governor Sanjay Malhotra in Mumbai following a three-day meeting from December 3 to 5.

This sixth consecutive cut since February responds to record-low inflation at 0.25 per cent in October and robust 8.2 per cent GDP growth in Q2 FY26, aiming to support expansion while maintaining a neutral stance.

Economists and businesses welcome cheaper loans, though some caution on price risks; RBI projects 6.8 per cent FY26 growth and 2.6 per cent inflation.

Rate Cuts Gain Momentum

India’s central bank began easing rates from 6.5 per cent in February 2025 with three prior 25 basis point reductions totalling 100 points by October, pausing briefly amid strong recovery signals.

Recent drivers include sharp disinflation from GST cuts, low food prices, and steady global oil, contrasting resilient GDP at 7.8 per cent in Q1 and 8.2 per cent in Q2 FY26. The rupee above 90 to the dollar and US tariff concerns shaped discussions, with MPC shifting to neutral from accommodative to balance growth and stability.

Economic Projections and Voices

RBI forecasts 6.8 per cent GDP growth for FY26, up from prior estimates, with quarterly breakdowns at 6.5 per cent Q1, 6.7 per cent Q2, 6.6 per cent Q3, and 6.3 per cent Q4. Inflation outlook drops to 2.6 per cent amid core easing below 4 per cent target midpoint.

Governor Malhotra called it a “rare goldilocks” phase of strong growth and swift disinflation, stating, “Since October, the economy has seen significant disinflation.” To boost liquidity, RBI launched Rs 1 lakh crore open market operations and $5 billion forex swaps, aiding quicker loan rate pass-through for homebuyers and businesses.

RBI’s Monetary Policy Committee

The Monetary Policy Committee (MPC) comprises six members, chaired by RBI Governor Sanjay Malhotra, tasked with deciding the repo rate every two months to balance inflation and economic growth.

Established under the Finance Act 2016, it includes three RBI officials and three independent experts who vote transparently, with minutes published for accountability.

This shift from Governor-led decisions ensures diverse views on data like CPI inflation and GDP trends. In December 2025, the MPC has unanimously cut rates 25 basis points to 5.25 per cent amid low inflation at 0.25 per cent. The neutral stance signals flexibility for future adjustments, fostering public trust in policy-making.

What is Repo Rate?

The repo rate is the interest rate at which the Reserve Bank of India lends short-term funds to commercial banks against government securities as collateral, under a repurchase agreement. Banks borrow when facing liquidity shortages, agreeing to buy back securities later at a fixed price.

RBI uses this tool in bi-monthly policy reviews to regulate money supply. A lower repo rate, now at 5.25 per cent after December 2025 cut, injects liquidity; higher rates curb excess funds. It influences overall lending costs, serving as a benchmark for economic control since its formal use in 2001.

How Repo Rate Impacts Economy

Lower repo rates reduce banks’ borrowing costs, prompting cheaper loans for homes, cars, and businesses, spurring spending, investment, and GDP growth like the projected 7.3 per cent for FY26. It eases EMIs for millions, boosts housing and consumption, and supports jobs in manufacturing and services.

Conversely, hikes combat inflation by raising loan rates, curbing demand and stabilising prices. In December 2025, the 25 basis point cut amid 0.25 per cent inflation aids recovery, enhances rupee stability above 90 to dollar, and counters global risks like US tariffs through RBI’s liquidity measures.

Impact on Loans

The Reserve Bank of India (RBI) cut the repo rate by 25 basis points to 5.25% on December 5, 2025, encouraging banks to reduce lending rates and lower EMIs for various loans by approximately 0.15-0.25%.

RBI announced Rs 1 lakh crore in open market operations (OMOs) via bond purchases and a $5 billion three-year USD/INR forex swap to inject liquidity and accelerate rate pass-through to borrowers.

For a Rs 50 lakh home loan at 8.5% over 20 years, the original EMI is Rs 43,391; assuming a 0.25% rate drop to 8.25%, the new EMI becomes Rs 42,603, a monthly reduction of Rs 788 and annual savings of Rs 9,455.

This benefits millions of middle-class families and small businesses, easing festive-season pressures and potentially boosting consumption and housing demand.

GDP Growth Outlook

RBI upgraded FY26 GDP growth projection to 7.3 per cent from prior forecasts, reflecting Q2’s stellar 8.2 per cent expansion driven by 9.1 per cent manufacturing and 10.2 per cent financial services growth. Secondary sector at 8.1 per cent and tertiary at 9.2 per cent underline resilience despite global headwinds like US tariffs.

Nominal GDP rose 8.7 per cent, supported by fiscal discipline and GST tweaks. Quarterly breakdowns show 6.5 per cent in Q1, 6.7 per cent Q2, 6.6 per cent Q3, and 6.3 per cent Q4, painting a steady recovery path for jobs and investments.

The Logical Indian’s Perspective

This measured cut promotes economic harmony by easing credit for families and entrepreneurs, embodying empathy for everyday struggles and fostering inclusive prosperity. Pairing it with inflation vigilance ensures sustainable coexistence for all.