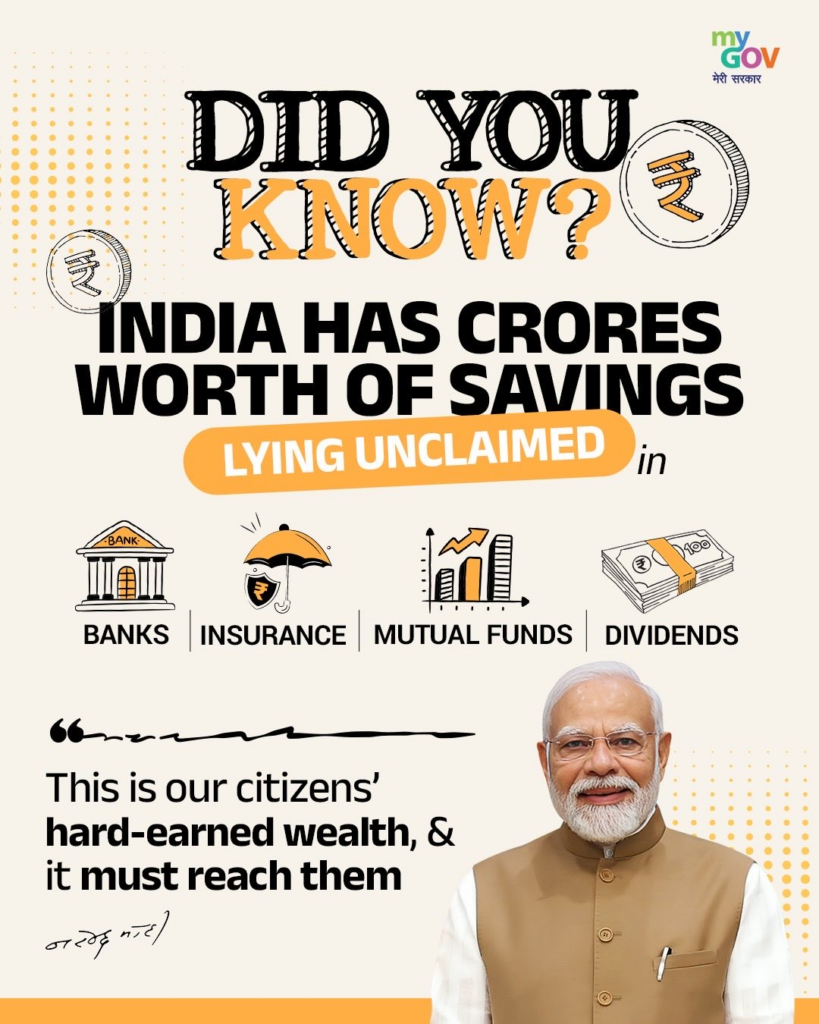

Prime Minister Narendra Modi’s “Your Money, Your Right” campaign seeks to reconnect millions of Indians with over ₹1 lakh crore in forgotten financial assets, combining digital tools, grassroots outreach and regulatory coordination to strengthen financial inclusion.

Across India’s vast financial system lies a staggering pool of unclaimed money-bank deposits left dormant, insurance payouts never collected, mutual fund investments forgotten, and dividends unpaid.

To address this silent accumulation, Prime Minister Narendra Modi has spearheaded a nationwide awareness and facilitation drive titled “Your Money, Your Right.”

Launched on October 4, 2025, the campaign aims to empower citizens, including NRIs and legal heirs, to trace and reclaim financial assets that belong to them but have slipped through the cracks of time, migration and paperwork.

According to official estimates, unclaimed assets in India now exceed ₹1 lakh crore, with nearly ₹78,000 crore lying in banks alone. Insurance companies hold around ₹14,000 crore, mutual funds about ₹3,000 crore, and unpaid dividends account for close to ₹9,000 crore.

The government says these figures represent the hard-earned savings of ordinary families-money that could support education, healthcare or small businesses if returned to rightful owners.

A Three-Pronged National Campaign

The initiative rests on a three-pillar framework-Awareness, Accessibility and Action. At the awareness level, the Prime Minister and the Ministry of Finance have repeatedly urged citizens to “check once” for forgotten assets, stressing that even small, inactive accounts can add up to significant sums over time.

Public messages, social media outreach and multilingual information campaigns have been rolled out to reach diverse communities.

Accessibility is being addressed through a network of dedicated digital portals created by financial regulators. The Reserve Bank of India’s UDGAM portal allows users to search for unclaimed bank deposits using basic identifiers such as name, PAN or Aadhaar.

Insurance claimants can approach IRDAI’s Bima Bharosa, mutual fund investors have SEBI’s MITRA platform, while unpaid dividends and shares can be traced via the Investor Education and Protection Fund Authority (IEPFA) under the Ministry of Corporate Affairs.

The third pillar-action-comes alive through on-ground facilitation camps. So far, camps have been organised in over 470 districts, with bank officials and regulators assisting citizens in filing claims, verifying documents and understanding next steps.

Government officials report that these combined efforts have already helped return around ₹2,000 crore to rightful owners within weeks of the campaign’s launch.

Human Stories Behind the Numbers

While the figures are striking, officials emphasise that the real impact lies in individual stories. Many unclaimed assets belong to elderly account holders who changed addresses, workers who migrated across states, or families unaware of investments made decades ago.

In several cases, legal heirs remained oblivious to insurance policies or fixed deposits held by deceased relatives.

At facilitation camps, bank officers recount instances of widows discovering long-forgotten savings accounts, or adult children tracing dividends linked to shares bought by parents in the 1980s and 1990s.

For rural households, even modest recoveries can make a meaningful difference, underscoring why the government is keen to take the process beyond digital platforms alone.

Coordination Across Regulators and States

One notable feature of “Your Money, Your Right” is the coordination across institutions that traditionally operate in silos. The RBI, SEBI, IRDAI, banks, insurance firms and state-level committees are working together under a unified message.

In some states and Union Territories, including Jammu & Kashmir, mega facilitation camps have been organised at district headquarters to reach remote populations.

Officials say standardised claim procedures and simplified documentation requirements are being promoted to reduce friction.

The emphasis, they note, is not merely on reclaiming money but also on restoring trust in the financial system, especially among citizens who may feel intimidated by formal processes.

Why Unclaimed Assets Keep Growing

Despite repeated efforts over the years, India’s pool of unclaimed financial assets has continued to expand. Experts point to several reasons: frequent changes in contact details, lack of nominee updates, low financial literacy, and limited awareness of claim mechanisms.

Digitalisation has improved record-keeping, but it has also widened gaps for those without easy access to technology.

The current campaign acknowledges these challenges by blending technology with human support. By encouraging families to update nominations, maintain records and periodically review investments, the government hopes to prevent today’s active accounts from becoming tomorrow’s unclaimed assets.

A Step Towards Deeper Financial Inclusion

Beyond immediate recovery, the initiative aligns with India’s broader push for financial inclusion and consumer empowerment.

Officials argue that returning dormant funds to citizens not only boosts household resilience but also reinforces the idea that financial institutions are custodians, not owners, of public money.

The campaign has also sparked conversations about proactive disclosure by banks and companies, and the need for clearer communication with customers over the long term.

Some policy observers suggest that periodic reminders, easier nominee management and community-level financial education could reduce the scale of unclaimed assets in future.

The Logical Indian’s Perspective

The “Your Money, Your Right” campaign is a timely reminder that economic justice often begins with awareness. Helping citizens reclaim what is rightfully theirs is not just a financial exercise; it is an act of dignity, empathy and inclusion.

Yet, the sheer volume of unclaimed assets also reflects systemic gaps in financial literacy and accessibility, particularly for the elderly, migrants and digitally excluded communities.

At The Logical Indian, we believe that such initiatives must be sustained beyond campaigns-through continuous education, simplified systems and compassionate outreach-so that no one is left behind in navigating their financial rights.

Today, in the country's banks, Rs 78,000 crore of our citizens own money is lying unclaimed. We don't know who this money belongs to, it is just lying there.

— Nirmala Sitharaman Office (@nsitharamanoffc) December 6, 2025

Insurance companies have Rs14,000 crore, Mutual Funds have Rs 3000 crore. And all this money is lying unclaimed.

This… pic.twitter.com/x83BSxB2lB