There have been more than 200 suicides by Bank Managers of Public Sector Banks in past 4 years, citing workload and pressure. It has not been talked about much, and I feel that there are certain ground realities which deserve to be acknowledged.

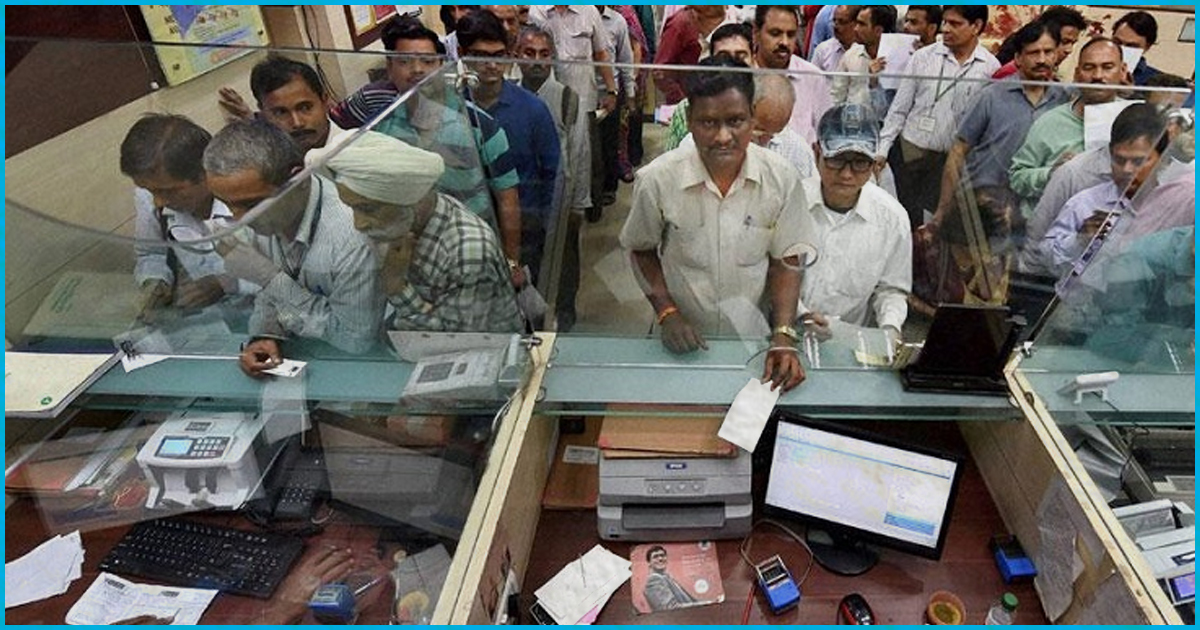

It is common knowledge that the Public Sector Banks(PSBs) in India are ailing. They usually don’t make it to headlines or editorials in mainstream news. When they do, it is either to report a massive scam or to discuss the viability of their merger and privatisation. Sometimes, it is a provocative piece on how the banks will remain closed on a Sunday followed by a Monday, or abrupt rule changes that “may” cause inconvenience to the public. Overall, there is no denying the fact that the experience of an average customer in a PSB is near to traumatic, and it is no surprise that the branch or regional level staff is a butt of jokes, irritation, and negative imagery among the public.

However, that is only the tip of the iceberg. The experience of bank officers and clerks at branch and regional levels is nothing short of harrowing, sandwiched between the expectations of general public and the pressure from senior level management that colludes with crony capitalists and Government officials to cater to vested interests. Banks have gone on strike in the recent past, and they are on strike again, 21st December and 26th December. Why? With my experience at two rural branches, one SME(small-to-medium enterprise) branch, one currency chest branch, two regional offices, one head office, one loan processing cell and one foreign exchange branch spanning 3 states in a period of 3.5 years, I have tried to structure this write-up to present a holistic picture.

Major Issues

1.Losses and wage revision: PSBs are reporting heavy losses: PNB 12,282 crores, IDBI 8237 crores, SBI 6547 crores, BoI 6043 crores, OBC 5871 crores, UBOI 5247 crore. Overall PSBs losses amount to 80,000 crores in face of pending wage revision of bankers. Every 5 years, wages are revised through the Bipartite Settlement. Last time it was revised in 2012, and it has been pending since November 2017. Every time there is a hike of 12-15% in salaries, but this time only 2% has been proposed. After much protest, it has gone upto 8% only. Reason being, cost-cutting due to losses. Bankers are now asking to be included within the Central Pay Commission of the Central Govt since a lot of NPA and losses happen because all kinds of Govt schemes and bad loans are thrust on them. Despite every other sector like Railways, Electricity, Power, Income Tax etc making losses receive a proper wage revision, banks not only carry out obsolete schemes at the cost of core banking operations but also suffer losses in form of rightful salary increment.

2. A picture of NPAs(Non-Performing Assets): Any loan on which interest is not being serviced becomes a bad loan. If it continues for a certain period of time, it starts becoming an NPA. For every NPA, the bank has to set aside that amount for provisioning. When neither the Principal nor Interest is received, it has to be written-off, that is, taken off the balance sheet of the bank. NPAs have been plaguing the PSBs. NPAs do not happen overnight. 2006-08 was a period of fast economic growth, during which there was an overenthusiastic prediction of growth figures of companies and loans were advanced based on project reports by the promoters itself. During Raghuram Rajan’s tenure as the RBI Governor, he had sniffed the growing bad loans and sent a list of high profile possible frauds amounting to a total of Rs. 17,500 crores to the PMO. What action was taken on it, is still a mystery. On 6th April 2018, Minister of State for Finance Shiv Pratap Shukla had presented the rapidly growing NPA figures in Parliament, “Till 31.03.2015 NPA of PSBs was 2.67 lakh crores and by 30.06.2017 NPA had grown upto 6.89 lakh crores.” 11 of 21 PSBs are now under RBI scrutiny who have more than 15% NPA.

Acc to May 2018 report of India Spend, Indian Persons and Companies have a total of 4 lakhs crores NPA. This includes Personal Loan, Car Loan, Housing Loan and Corporate Loan. If all of this comes back, loans of farmers of 8 states can be waived off. Even after that, 32% of the money would be left. Acc to RBI’s Financial Stability Report of March 2018, PSBs are reporting NPAs of 15.66% which can go upto 17.3% in March 2019. These figures show that something is fundamentally wrong in the way these loans are being assessed, processed, sanctioned and advanced. These decisions are taken at the policy level and then thrust in the form of insane pressure and targets on branch and regional levels.

3.Cross-Selling: To make up for all these losses and bad loans, cross-selling is the new menace that has been sucking the life out of bankers and branches. Cross-Selling is the selling of third-party products on bank counters. Ideally, if a customer walks in to open a saving bank account and you also sell them the benefits of a PPF(Public Provident Fund) or an RD account, that is cross-selling. That works, because the PPF and RD genuinely result in the benefit of both the customer and the bank. However, they do not fetch any commission to bank officials at any hierarchy. The income goes solely towards the profit of the bank. Hence, General Insurance, Life Insurance, Mutual Funds, Credit Cards are all being given as “targets” to be shoved down customers’ throats. This fetches commission more than the salaries for officials above the ranks of DGM along with complementary foreign tours. Many times, customers accounts are debited without their consent or knowledge of the same. A rationale given to us in training centres is that for SBI, profit by Govt Business was 18%, but profit through cross-selling was 24%, so it should be justified. However, it takes common sense to see through this. For a govt account like PPF, Sukanya Samriddhi Yojana etc, every digital transaction fetches Rs 12/- and every physical receipt fetches Rs 50/- income to the bank. If only staff members opened their PPF accounts and put a Standing Instruction from their savings to PPF, it would fetch income in crores. Staff is pressurized to qualify exams such as CIF, AMFI etc for selling these third-party products.

What does the rule say? On 31st October 2014, RBI instructed through an office order that under Banking Regulation Act 1949, Section 10 (1) B (11) cross-selling through banks is strictly prohibited as no commission to Bank employees can be given on sale of any third party products. However, every PSB at the regional level has a “Manager Cross-Selling” whose job is to build pressure on branch managers for cross-selling insurance, mutual funds, credit cards etc. Those who cannot do that are transferred as a punishment. Core banking operations take a serious hit and customers’ obvious flak is received by the frontline staff as a result. Point to note here is that the gains by staff actually sourcing these mediocre policies are few as compared to mammoth monetary gains made by the senior management.

4.Goverment Schemes: The statistics show that every Govt scheme implemented through banks is a success viz, Jan Dhan, Aadhaar Linking, Digital India, Atal Pension Yojana, Demonetisation, LPG linking, and the greatest ticking time bomb: MUDRA Yojana. The truth is anything, but.

(A) Demonetisation: It is well known that the megalomaniac decision imposed on the country had caught even the RBI Governor and Chief Economic Advisor off-guard, so there was no question of banks having any strategic or logistical preparedness for the same. The data that show the truth of success or failure of the same has already been out in news. What it meant for bank employees, however, has not been given enough coverage. Already running on staff shortage and bad infrastructure, the employees worked for upto 12 hours. In absence of note-counting and note-sorting machines, bank personnel have suffered the losses personally in case of counterfeit notes or counting mistakes. From 45,000 to upto 2.2 lakhs, bankers have paid from their own pockets. Some have even taken personal loans to make good this amount as it was more than their monthly salary. For overtime and working on public holidays, none of the employees was compensated. In few states, when the officers were given 40,000/- as compensation after the merger of SBI with associates, this amount was recovered from them with interest. All of this resulted in extreme humiliation and harassment which led to depression and suicidal tendencies and ultimately in a dozen suicides during that time.

(B) Digital India: A pressure in the form of “targets” are imposed on branches to meet the numbers required by the Govt to make this scheme a success, failing which humiliation and punishment transfers are used as deterrents. As a result, faulty and useless apps have to be forcibly downloaded on customers mobile phones without their knowledge or consent many times. BHIM Aadhaar, for example, is a merchant product. Using the biometric device, the app recognises the Aadhaar linked account and makes a payment to shopkeeper’s account. To make it a success, we have formed teams whose job is to simply download this app anyhow on as many phones as possible. As a result, individual customers, instead of shopkeepers have been given biometric devices with a stamp paper agreement. All of this means nothing and is a huge drain on resources, time and potential of the bank. The same story goes for most of Digital India scheme implemented through banks.

(C) Jan Dhan: Targets of hundreds of such accounts were thrust upon PSBs. To make the accounts operational and live, many bankers credited one rupee from their own pockets. Then targets were given to shut these accounts. These accounts were misused a lot during Demonetisation to exchange unaccounted money. Amit Shah’s cooperative bank in Ahmedabad reportedly received 750 crores of currency within 5 days. It is impossible, even with machines, to count that amount of currency in 5 days. Further, these accounts are now being converted to normal accounts as they have transaction restrictions and customers want proper accounts. It has been a redundant, time and energy wasting exercise on already overburdened PSBs.

(D) MUDRA Yojana: The Govt facing criticism over failure to create jobs, came up with this. Most of them are bad loans and are a potential crisis for the banking industry, as also pointed out by Raghuram Rajan. The MSME loans have been renamed as MUDRA yojana and are being blindly lent in the name of creating job givers and entrepreneurs. These loans are upto 10 lakhs and are unsecured, without any collateral or mortgage. Between 2015-18, 12.27 crore people have been given 5.54 lakh crores of Mudra Loans. 60% of these have been given to women. Now, while microfinance institutions until 2015 registered a growth of 53%, after MUDRA they registered only 23%. This figure defies logic. Reason is simple. Due to insane pressure and targets of ANYHOW sanctioning these loans, PSBs have resorted to desperate measures. 25 customers have been given Over Draft (OD) of Rs 1000 each and a MUDRA loan has been reported of Rs. 25000/-. Neither the customers know that they have an OD, nor that they are a statistic in MUDRA loan. Further, the loans actually being given are also bereft of systems and procedures. Many times we have no financial data, no balance sheets, no tax returns and no estimates. We simply take the loan amount to be given, enter it in the loan processing software and play with the figures like net worth, stock, sales, operating profit, etc until the system calculator equates loan amount with loan recommendation. Many firms do not produce a stock statement timely and we simply delay their accounts slipping into NPA category by entering random figures and asking them to submit the same figures on bank forms. MUDRA loans are an active volcano the entire banking industry is sitting on.

(E) LPG Linking: This, along with many other tasks that do not come under banking operations have built up to the never ending workload of banking personnels. The customers are perpetually unsatisfied and the staff shortage further affects customer services. It is rather unfair to expect the staff with all this burden to be present at every counter with a smile.

(5) Infrastructural Constraints: As a result of cost-cutting, there is severe staff shortage with a lack of basic facilities for customers and staff, both. For every 100 persons retiring every month, there isn’t enough new recruitment to fulfill the manpower requirement. Most branches work with 50% of sanctioned capacities. While staff strength is half, the amount of work is triple. Most of the work that is not core banking is not incentivised or allocated a budget for the same. Rural branches have a connection speed of as less as 64kbps, with no proper drinking water, chairs or washroom facilities. The staff works upto 10-11 hours every day and spends most public holidays in clearing pendency. Since media covers urban centres, automatic machines like SWAYAM, CDM, In-Touch branches etc are installed and function well there, but the semi-urban and rural areas grapple with heavy crowds and no infra support. Arbitrary transfers and improper role assignments without proper training, guidance and skill set further puts the banks, the customers and the staffs at a severe risk. Personnel handling a seat or portfolio don’t have enough knowledge or experience for the same and when things go wrong it is easy to scapegoat them. The banks cannot afford proper armed guards for ATMs, branches and cash remittances also, and the consequences have been seen in recent vandalizing, burglaries and murders in various PSBs across the country. Female employees especially if menstruating, pregnant or lactating, face extreme mental and physical harassment under such working conditions.

(6) Scams/Lack of Vigilance: In the recent PNB scam of Nirav Modi, the Deputy Manager and Chief Manager were made scapegoats. The Central Vigilance Commission had awarded the Vigilance Award to senior level functionaries of PNB thrice, during the same time period when a total of 293 Letter of undertakings(LoUs) were issued to Nirav Modi. It takes common sense to see that such high amounts cannot be sanctioned or advanced at lower level management capabilities. Since PSBs have invited a lot of ire for callous working, mindless vigilance and risk management tactics have been imposed which only confirm compliance at the personal risk and stress of lower and middle level management. We are supposed to report our day’s progress on whatsapp, on our bank’s dash board and further in P-review meetings. Unofficial orders to comply to certain data feeding, reports etc are issued over whatsapp, including a call to work on public holidays.

All of the above create a rather depressing and stressful work scenario for the staffs and leaves the customers unsatisfied and angry. The solution touted in the media is that of Privatisation, when clearly the problem is more complex than that.

Possible Solutions

- Reduction of uncompensated Government mandates is the first requirement. If any schemes are to be implemented through the banks that do not have to do with core banking operations, they should be incentivized with budgetary allocations and proper resources including infrastructure and personnel must be ensured. It must not be imposed and demanded from the PSBs in their current state to “make the schemes” a success.

- Mandates such as PSBs must invest in Govt bonds through Statutory Liquidity Ratio should be reduced. Instead, Basel standards of Net Stable Funding Ratios should be implemented.

- Stressed Assets(Loans likely to be NPAs) can be handled outside bankruptcy code, but they need a proper restructuring process. The loans cannot and must not be advanced out of pressure without assessing repaying capabilities. NPA recovery should not be the headache of branch level functionaries, rather the legal and penal system must be strengthened to make it as much a responsibility for borrowers as of lenders.

- Board of Directors of banks should keep away industrialists and politicians.

- MUDRA and KCC loans are a potential risk for the banking industry on the whole and it needs to be addressed urgently. Credit Guarantee Fund Trust for Micro and Small Enterprises(CGTMSE) run by Small Industries Development Bank of India(SIDBI) is a growing contingent liability and PSBs cannot afford any more of these in their current status of political interference and pressure tactics.

- Senior management of the banks must be brought under strict answerability and accountability regarding HR policy norms and financial advancements, instead of vigilance and due-diligence being restricted to lower and middle level management.

- Recruitments, wage revisions and transfers need to have a humane approach and free of “performance” as long as the PSBs are buckling under Govt schemes.

- Recapitalization of PSBs by the Centre should not be used as political tools. Instead of creating money to be lent to corporates who fund political parties, recapitalization if at all done, should be to strengthen the weakening PSBs, specially those who are struggling to come out of PCA(Prompt Corrective Action).

The PSBs need deep cleansing at the bureaucratic, strategic and structural level. More than that, it is time that the knowledge gap between public and frontline staff are reduced to facilitate cooperation from both sides.

About the author: The author is currently working in a public sector bank and wants to be anonymous. This article is opinion of the author and is intended to create debate among citizens to better the condition of public sector banks and their employees.