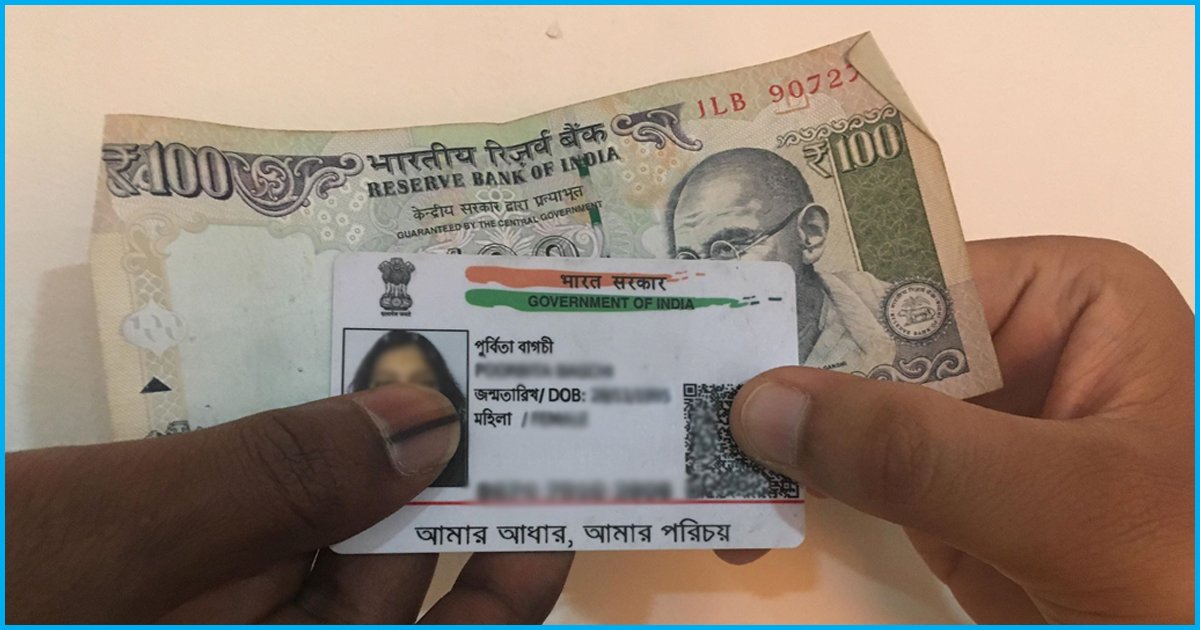

UIDAI To Impose 18% GST For Updating Aadhaar

Updating Aadhaar will be costlier from now since Unique Identification Authority of India (UIDAI) announced that it would impose 18% GST for updating Aadhaar information. The UIDAI tweeted the new charges saying that the subscribers will have to pay 18% GST in addition to Rs 25.

Aadhaar Enrolment is FREE. Updation charges – Rs 25 + 18% GST, as applicable. If the center charges you more, DO NOT pay. Report to us by calling 1947 or writing to [email protected] We have zero tolerance for corruption or process violation. pic.twitter.com/60k5iMgaSJ

— Aadhaar (@UIDAI) February 1, 2018

Currently, UIDAI charges Rs 25 for updating any pieces of information in aadhaar like address, date of birth, gender, mobile number, and email. It charges the same amount for biometric updates too. If the new changes are implemented, the subscribers have to pay 4.5% extra.

UIDAI also tweeted the list of supporting documents for updating aadhaar. “To update details in your Aadhaar, you need to present the supporting documents,” UIDAI tweeted. The supporting documents include:

1. Passport 2. PAN Card 3. Ration/ PDS Photo Card 4. Voter ID 5. Driving License 6. Government Photo ID Cards/ service photo identity card issued by PSU 7. NREGS Job Card 8. Photo ID issued by Recognized Educational Institution 9. Arms License 10. Photo Bank ATM Card 11. Photo Credit Card 12. Pensioner Photo Card 13. Freedom Fighter Photo Card 14. Kissan Photo Passbook 15. CGHS / ECHS Photo Card 16. Address Card having Name and Photo issued by Department of Posts 17. Certificate of Identify having photo issued by Gazetted Officer or Tehsildar on letterhead 18. Disability ID Card/handicapped medical certificate issued by the respective State/UT Governments/Administrations.

To update details in your Aadhaar, you need to present the supporting documents (not applicable for mobile number, email or biometric updates). See the list of acceptable documents here – https://t.co/BeqUA0pkqL pic.twitter.com/dfbUbNYw43

— Aadhaar (@UIDAI) February 4, 2018

UIDAI has launched a toll-free helpline number for the aadhaar card holders. They can report to UIDAI if the aadhaar enrollment centre demands higher money than the prescribed fee. The subscribers can report the problem by dialling 1947 or writing to [email protected] You have to visit the nearest aadhaar centre to check whether the updations were done or not.

UIDAI also informed in its Twitter handle that parents can apply for aadhaar card for children if their kids do not have any other ID proof.

You can apply for Aadhaar of a child even when you do not have any address proof for the child.

Get address and location of your nearest centre from: https://t.co/oCJ66DD0fK

See the list of acceptable documents here – https://t.co/BeqUA07J2b. pic.twitter.com/TGSrFCagOn— Aadhaar (@UIDAI) February 6, 2018

The government had made it mandatory to link the 12-digit aadhaar number with welfare schemes and official documents. The last date for linking aadhaar with bank accounts, PAN card and mobile number is March 31, 2018.

All section

All section