Steps Taken By Govt To Prevent Any Future Nirav Modis & Vijay Mallyas

16 March 2018 12:55 PM GMT

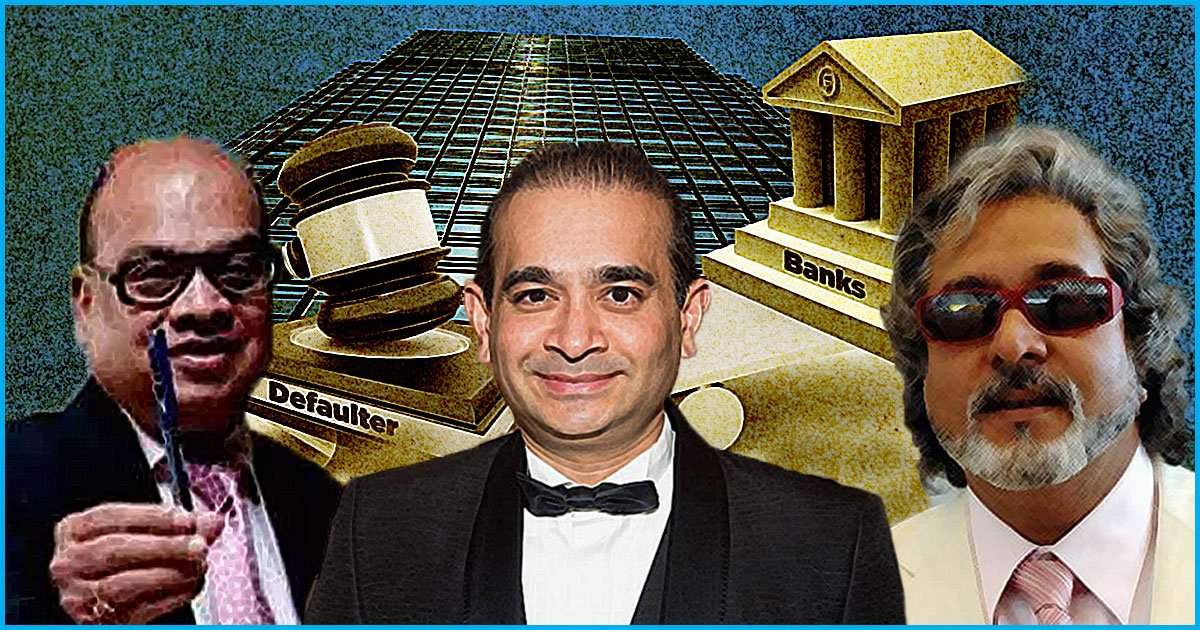

Recently, a lot of scams involving thousands of crores of loan default have come to the fore. The most notable being the Nirav Modi-PNB Scam, where the Punjab National Bank reported fraud of more than Rs 12,000 crore. This amount is equal to one-third of PNB’s total market capitalisation.

Following this, a case against Vikram Kothari, the owner of Rotomac, was filed by Bank of Baroda on behalf of a consortium of banks at the Central Bureau of Investigation (CBI), alleging default on loan to the tune of Rs 3,695 crore.

Vijay Mallya, businessman and former politician who reportedly owes Rs 9,000 crore to a group of banks had also fled the country to avoid extradition and has not returned since.

The Ministry of External Affairs said that 31 accused in fraud and economic offences have fled the country. As per Mint’s report, these people who are being pursued by Enforcement Directorate and CBI in 15 different cases, collectively owe Rs 40,000 crore to different banks and public institutions.

With cases like these coming to light, various steps are being taken.

Fugitive Economic Offenders Bill

A ‘Fugitive Economic Offenders Bill’ was approved by the Cabinet to extradite the fugitives who escape to other countries to avoid arrest. This bill empowers the government to confiscate the properties of such offenders in India.

Finance Minister, Arun Jaitley, said as quoted by The Indian Express, “Fugitive Offenders Economic Bill 2018 has been brought to confiscation of assets of a fugitive, including Benami assets. There will also be the provision to confiscate those assets outside India, but cooperation of that country will be needed. On the other hand, the jurisdiction of NFRA for investigation of Chartered Accountants & their firms under section 132 of the Act would extend to listed companies & large unlisted public companies, the threshold for which shall be provided in the Rules.”

A Fugitive Economic Offender is any person who has an arrest warrant issued against him and who leaves or has left India to avoid criminal prosecution, or refuses to return to India to face criminal prosecution.

National Financial Reporting Authority

The Cabinet gave its nod in setting up National Financial Reporting Authority, which would be acting as an independent regulator. The need of establishing a body like NFRA came in the wake of accounting scams. The government said that it is “to establish independent regulators for enforcement of auditing standards and ensuring the quality of audits to strengthen the independence of audit firms, quality of audits and, therefore, enhance investor and public confidence in financial disclosures of companies.”

Passport details mandatory for loans more than Rs 50 crore

After passing the Fugitive Economic Offenders Bill, the Union Cabinet made it mandatory to furnish passport details for loans of Rs 50 crore and more.

The passport details submitted by the loan borrowers will help the bank to do regular surveillance and inform the agencies to prevent the defaulters from fleeing the country.

Financial Services Secretary Rajiv Kumar tweeted, “Next step on clean and responsible banking. Passport details must apply for loans above Rs 50 crore. Step to ensure quick response in case of fraud.”

RBI announces new norms to tackle bad loans

The Reserve Bank (RBI) tightened the rules for bad loans or Non-Performing Assets (NPAs) and sought to push more large loan defaulters toward bankruptcy courts. It abolished half a dozen existing loan restructuring mechanisms. RBI said that the new set of rules were aimed at creating a “harmonized and simplified generic framework” for resolution of stressed assets in view of new bankruptcy regulations. The Central government had given more powers to RBI last year for dealing with non-performing assets (NPAs).

Insolvency and Bankruptcy Code (Amendment) Bill, 2017

The Lok Sabha amended the Insolvency and Bankruptcy Code in December 2017 to prevent wilful defaulters and existing promoters from participating in the insolvency proceedings of stressed assets of companies. They will be allowed only if they make their bad loans operational by paying up interests.

All section

All section