State-run banks disbursed over ₹2.5 trillion worth of loans in October, a finance ministry statement said on Thursday.

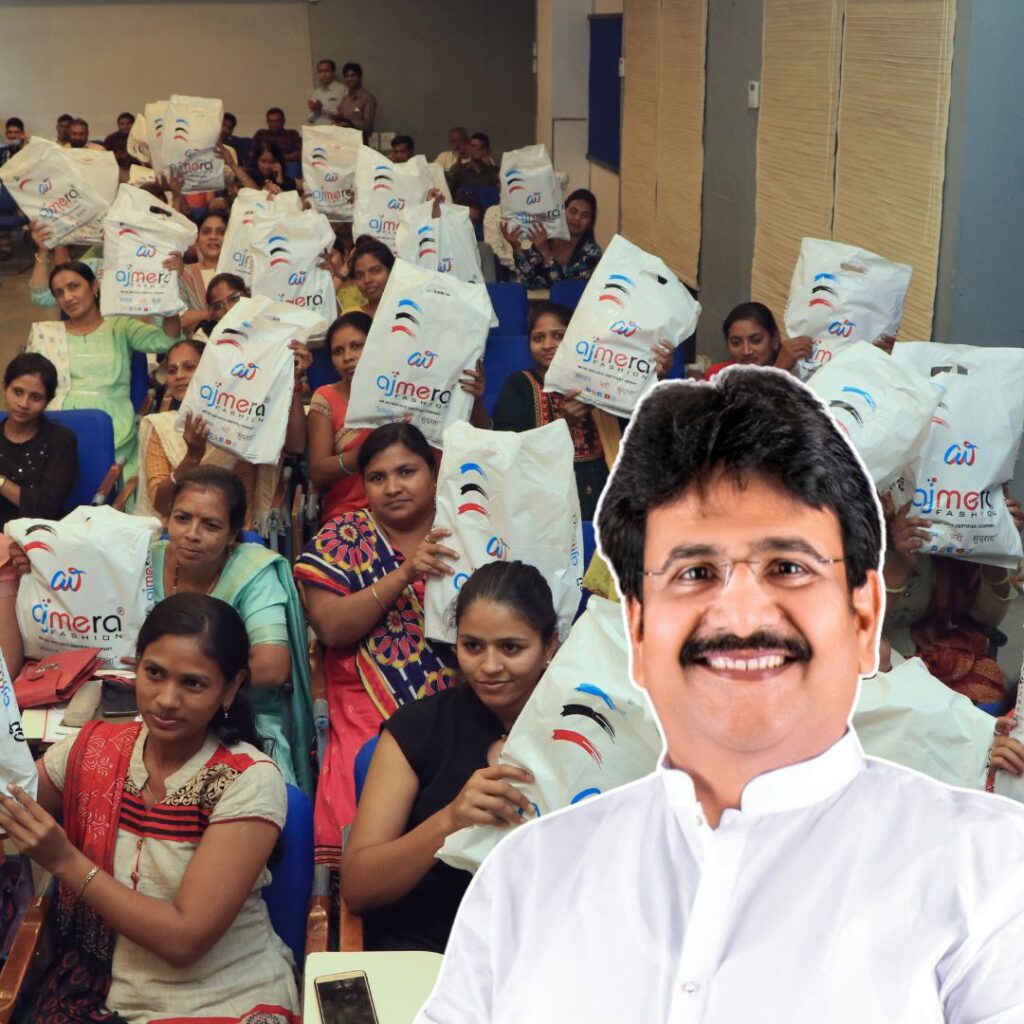

An official statement from the ministry said that the banks held camps and outreach initiatives in 374 districts in October. Out of the total ₹2.5 trillion lent by state-owned banks, ₹1 trillion was given as new term loans while ₹46,800 crores were given as new working capital loans, the ministry said in the statement.

Finance Minister Nirmala Sitharaman in September had said that banks would conduct customer outreach initiatives. The government’s move was aimed at boosting liquidity and investment as the Indian economy is witnessing a slowdown.

However, almost half of the loans accounting to around ₹1.23 trillion went to corporate entities, and only ₹37,210 crores worth of loans went to micro, small and medium enterprises. Agriculture loans were a little better at ₹40,504 crores, while home loans stood at ₹12,166 crores.

For the July-September quarter, analysts expect GDP growth rate to be closer to 4 per cent than 5 per cent. For October, non-banking financial companies (NBFCs) received credit support of Rs 19,627.26 crore from banks, the statement said.

“PSBs (public sector banks) actively reached out to their customers in these camps and made concerted efforts towards activities such as sanctioning of loans in line with prudential norms, opening of accounts along with Aadhaar and mobile seeding of accounts and popularising BHIM app. The drive also simultaneously galvanised similar outreach efforts in individual branches of PSBs,” the statement read.

Also Read: Four-Yr-Old Bandhan Bank Made More Profit Alone Than 17 PSU Banks Together