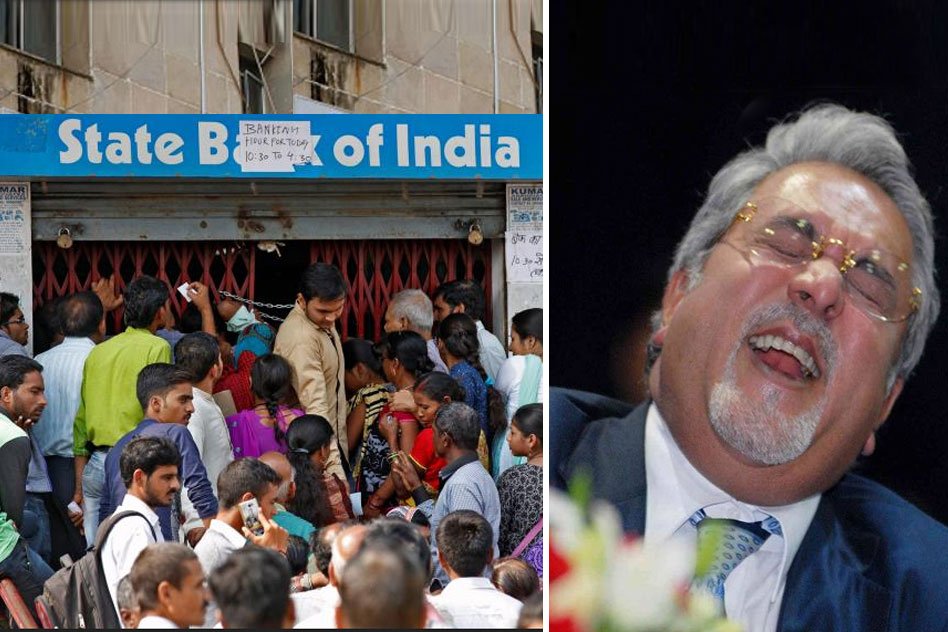

State Bank Of India Writes Off Loans Of 63 Wilful Defaulters, Rs 1201 Crore Of Vijay Mallya Also Written Off

16 Nov 2016 8:21 AM GMT

SBI Writes Off Loans Of 63 Wilful Defaulters

Write off by SBI

The State Bank of India (SBI) seems to have started a clean-up of its balance sheets by writing off loans worth Rs 7,016 crore owed to it by 63 accounts. As on June 30, 2016, SBI has already written off Rs 48,000 crore worth bad loans. Writing off a loan means that collecting the money back from the defaulters is up to the bank. But if the bank is unable to collect the amount, the burden is borne by the public exchequer.

What do the documents reveal?

63 accounts have been fully written off, 31 partially written off and six have been shown as NPAs. SBI has adjusted its balance sheets by moving the Rs 7,016 crore to an Advance Under Collection Account (AUCA) .

The top five defaulters

AS reported by DNA, following are the top five defaulters:

- Kingfisher Airlines owes a total of Rs 6,963 crore to 17 banks, of which SBI’s loan is Rs 1,201 crore. Recently, an e-auction of Mallya’s Kingfisher Villa in Goa failed to find any buyer. Sources said that SBICAP Trustee did not get earnest money deposit (EMD) from even a single bidder.

- KS Oil, once a leading edible oil player under the brand names Kalash and Double Sher in the mustard oil segment, turned defaulter. KS Oil has allegedly indulged in the diversion of funds from its core business. The company invested huge amounts on plantations in Indonesia and Malaysia but failed to get the expected returns. Though the loan account has been restructured, the company has been unable to revive itself. Lenders have also withdrawn the company from CDR (corporate debt restructure). KS Oil was declared NPA in 2013 with effect from September 30, 2011. As with Kingfisher, the recovery effort was futile as e-auction of five units failed due to lack of bidders.

- The third in the list of write-off accounts, Surya Pharmaceutical, was named a wilful defaulter in 2013. The company allegedly indulged in fraud, diversion of funds in retail and education sectors. SBI has symbolic possession of eight properties and is struggling for another in Jammu and Kashmir. A forensic audit from E&Y tagged this a fraud account.

- Ajay Kumar Vishnoi’s promoted GET Power Ltd was declared wilful defaulter on August 23, 2016. The company’s mismanagement and the delay in projects led to trouble for the promoters.

- The fifth in the list, Sai Info, has dues of Rs 375 crore and was declared wilful defaulter on August 26, 2016. In June 2013, the company’s main promoter Sunil Kakkad absconded, but was brought back to India and arrested. Kakkad is now out on bail. The company has cancelled two high-value projects – from the Department of Posts and a Mumbai CCTV surveillance project – worth Rs 2,200 crore. This account has also been declared fraud. SBI could not get any recovery and could only get symbolic possession of some of the properties.

To know the name of other defaulters, please read the article here.

Other Aspect of Write-offs

The Supreme Court has called the write off ‘a big fraud’ and ordered the RBI to share with the names of the biggest defaulters. On Tuesday, the Parliamentary consultative committee constituted to study non-performing assets (NPAs) in the banking sector, has suggested that the government should name all the defaulters whose loans have been written off by state-owned banks. There is a need to bring more transparency in the system, and the list of all the defaulters whose loans have been written off be made public.

Process of Write-offs

Let’s assume that a person has taken a loan of Rs 1,00,000 from a bank. From bank’s point of view, the loan is an ‘asset’ and the interest that would have accrued from the person would have been ‘income’. In the bank’s balance sheet, the loan amount is shown as an asset so long as the account is considered normal. But if the person or entity stops repaying the monthly instalments, the bank will generate lower revenue due to lack of interest payment. But the loan remains as an asset as the bank still hopes that the person will pay back. But beyond a point, as per Reserve Bank of India (RBI) norms, if there is no income coming from an asset, the bank will have to first provide for the loss of the ‘asset’ and then eliminate it from its balance sheet. The loss incurred by the bank will be borne by the public exchequer. A major portion of it is done by the government which loses tax revenues as the losses are set-off against tax.

Write-offs

In a write-off, the bank includes bad debts as an uncollectible loss on its tax return. The write-off is also called a ‘charge-off’. The write-off reduces the bank’s earnings and thereby reduces its taxable income. This accounting procedure may reduce the bank’s overall tax liability, which is the goal of a write-off. The designation of the debt as uncollectible doesn’t mean the bank will never collect on it until that point.

You can read the full article here: www.dna.com

All section

All section