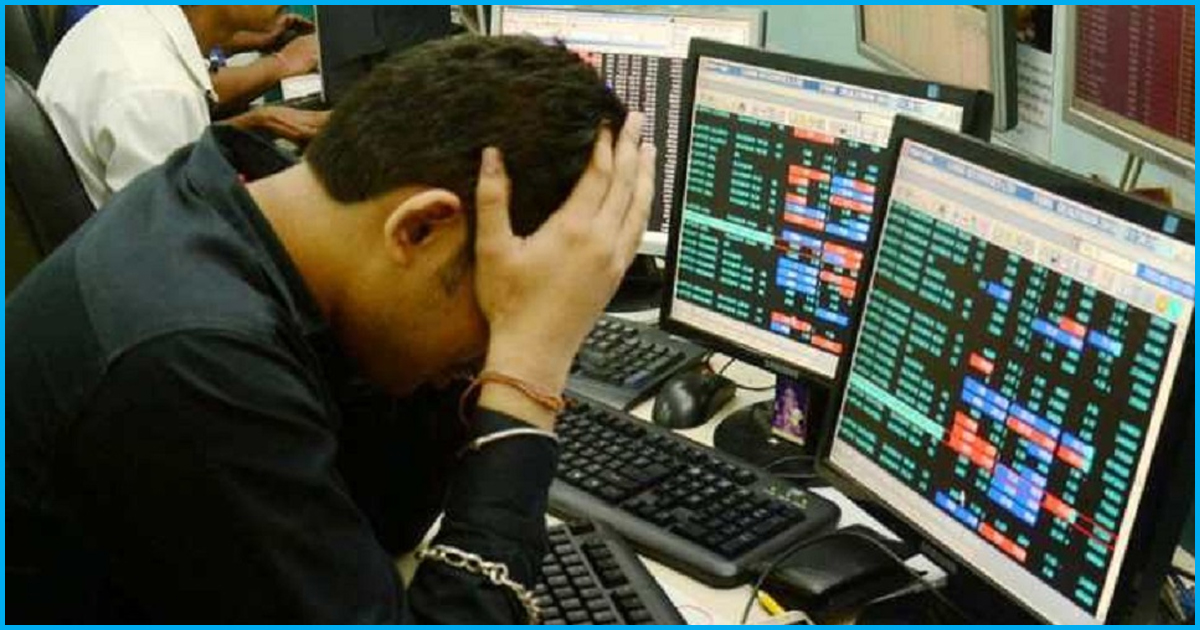

Sensex Nosedives 1000 Points, Investors Lose Rs 4 Lakh Crore In 5 Minutes

11 Oct 2018 7:54 AM GMT

Thursday morning was gloomy at Dalal Street as stock market investors lost as much as Rs 4 trillion (lakh crore) in no more than five minutes after the market in morning trade started on a weak note. All 30 Sensex stocks but one traded in red when the benchmark BSE Sensex lost over 1,000 points to trade below the 34,000-mark while the broader NSE Nifty remained under the 10,200-mark. The indices fell as low as 33,722 and 10,139 points, and global sell-off has been attributed as the reason behind this.

According to data available on BSE, the combined m-cap of BSE-listed companies lost as much as Rs 4 lakh crores, thereby bringing the market capitalisation to Rs 134.38 lakh cr. Reportedly, it was Rs 159.34 lakh crore on the last day of August. This is reported to have been one of the sharpest intraday plunges seen in the stock markets in recent times.

Why did the Indian stock market nosedive?

One of the main reason that is being cited for the weak market conditions is the slump in Asian markets which have been triggered by a sharp plunge in the US stock markets on Wednesday. The US stock markets’ sharpest one-day fall since February wiped out around $850 billion of wealth as prices of tech shares nosedived. The US investors feared that the rising interest rates could hurt their company profits, reported Economic Times.

Meanwhile, rupee also touched a new low as after opening 10 paise down at 74.31 against the dollar, the local currency hit its fresh record low of 74.46. This has made foreign investors slightly wary of investing in India. According to Moneycontrol, India was considered to be an ideal place for investment. However, situations started changing after the continuous fall of rupee against dollar. Reportedly, after selling shares worth Rs 10,824 crore in September, so far in October, FIIs net sold shares is worth Rs 14,097 crore.

Moreover, the International Monetary Fund’s statement which raises doubt on global financial stability in emerging markets also spooked the investors which propelled today’s fall, suggest media reports.

Also Read: RBI To Pump Rs 12000 Cr Liquidity Into Market To Meet Demands Of Festival Season

All section

All section