Reserve Bank of India Governor Shaktikanta Das came under pressure at the apex banks’ board meet last week, as two external directors questioned the RBI over series of scams that remained unnoticed since 2018, The Economic Times reported.

The two board members referred to the losses suffered by Punjab National Bank which bankrolled jeweller Nirav Modi and his uncle Mehul Choksi, the several irregularities in Infrastructure Leasing & Financial Services (IL&FS) and the recent failure of Punjab & Maharashtra Co-operative (PMC) Bank.

In the case of PNB and PMC Bank, some officials took advantage of loopholes in the system to keep the RBI in dark regarding a substantial share of their exposures.

This comes at a time when the RBI is facing a lot of flak over its inspection and monitoring mechanism efficiency.

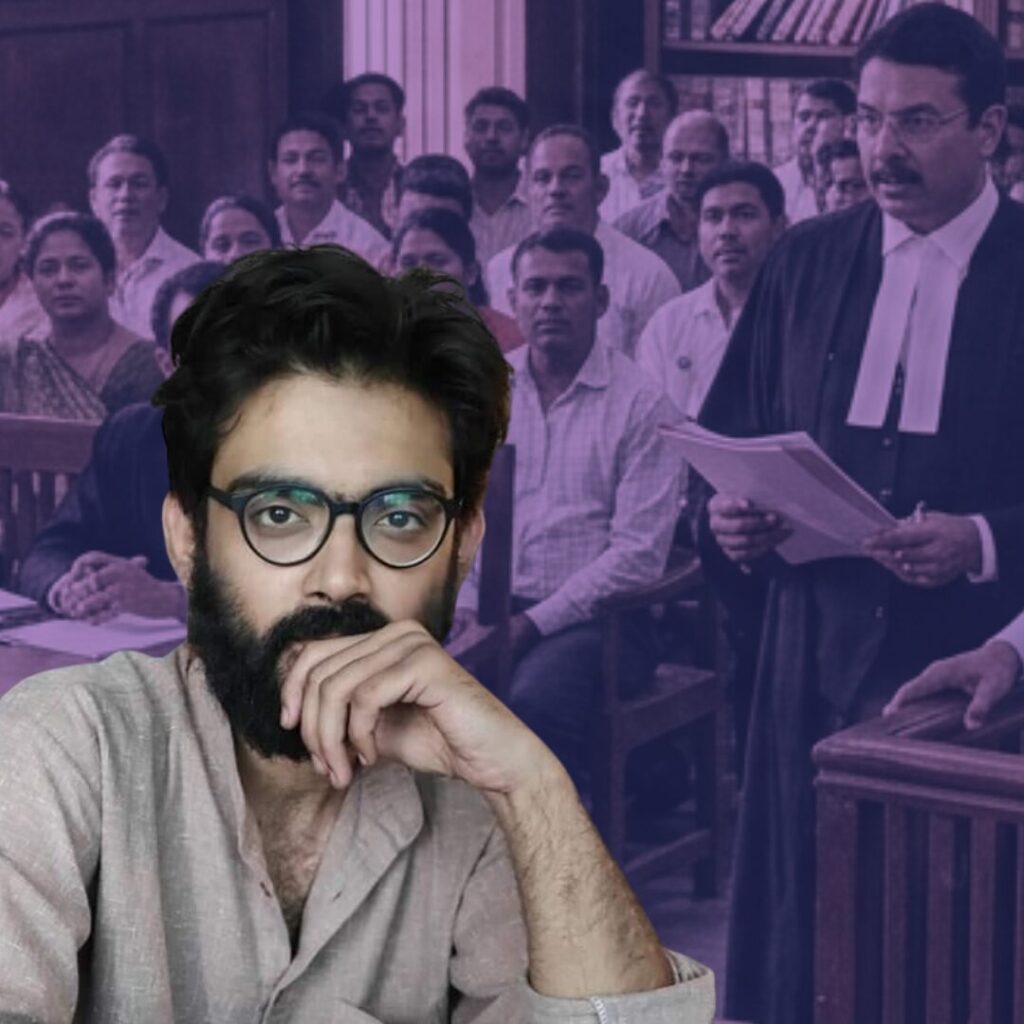

PNB Scam

In the PNB episode, Nirav Modi and his uncle Mehul Choksi, owners of high-profile jewellery brands, are accused of cheating PNB of over Rs 13,000 crore by obtaining Letters of Undertaking (guarantee to overseas banks for credit facility) fraudulently. The bank’s exposure to Nirav Modi escaped regulatory check as its SWIFT system (global financial messaging service) was not embedded into the bank’s core banking system (CBS).

The RBI later discovered that SWIFT-CBS systems were not implemented in several other banks as well.

“Any policy has ramifications, both positive and negative. There is plenty of blame to go around for the PNB fraud,” Rajan told News18 in March 2018 when the fraud broke out, claiming it to be a cyber-related fraud.

IL&FS Crisis

The role of auditors has also been questioned after the fall of India’s leading infrastructure finance company IL&Fs year ago.

IL&FS had over Rs 91,000 crore in debt. The default in payment of interest by the company raised concerns over its financial stability. Since September 12 last year, IL&FS defaulted on payments of interest more than seven times. IL&FS Financial Services defaulted in payment obligations of bank loans and failed to meet the commercial paper redemption obligations due on September 14.

The defaults jeopardised hundreds of investors, banks and mutual funds associated with IL&FS, triggering panic among equity investors.

PMC Fraud

The PMC Bank scam came to light last month when it was discovered that the bank created over 21,000 fictitious accounts, some in the names of dead people, to hide bad loans extended to Housing Development and Infrastructure Limited (HDIL).

According to its former MD Joy Thomas, the lender has an exposure of Rs 6,500 crore to HDIL.

The bank provided loans to the HDIL and its subsidiaries despite being aware of the dismal financials of the company. After the matter came to light last September, the RBI imposed operational restrictions on the lender.

“When a banker gives a bad loan and loses money, that’s not a crime; it’s bad banking and you may lose your job. But when you cover it up, that becomes a crime,” Omer Erginsoy, senior director at Kroll, a global fraud investigative agency told The Economic Times.

Also Read: Two Account Holders Of Crisis-Hit PMC Bank Suffer Cardiac Arrest, Another Commits Suicide