RBI Keeps Repo Rate Unchanged: Key Takeaways From Monetary Policy Review

Writer: Navya Singh

Navya writes and speaks about matters that often do not come out or doesn’t see daylight. Defense and economy of the country is of special interest to her and a lot of her content revolves around that.

India, 6 Aug 2020 9:00 AM GMT

Editor : Shweta Kothari |

A broadcast turned digital journalist, Shweta Kothari heads the newsroom at The Logical Indian. She has previously worked with CNBC and NewsX as a news anchor and senior correspondent. Shweta holds a masters degree in journalism from the university of Sussex, UK and started her career with work placement with BBC in Scotland.

Creatives : Navya Singh

Navya writes and speaks about matters that often do not come out or doesn’t see daylight. Defense and economy of the country is of special interest to her and a lot of her content revolves around that.

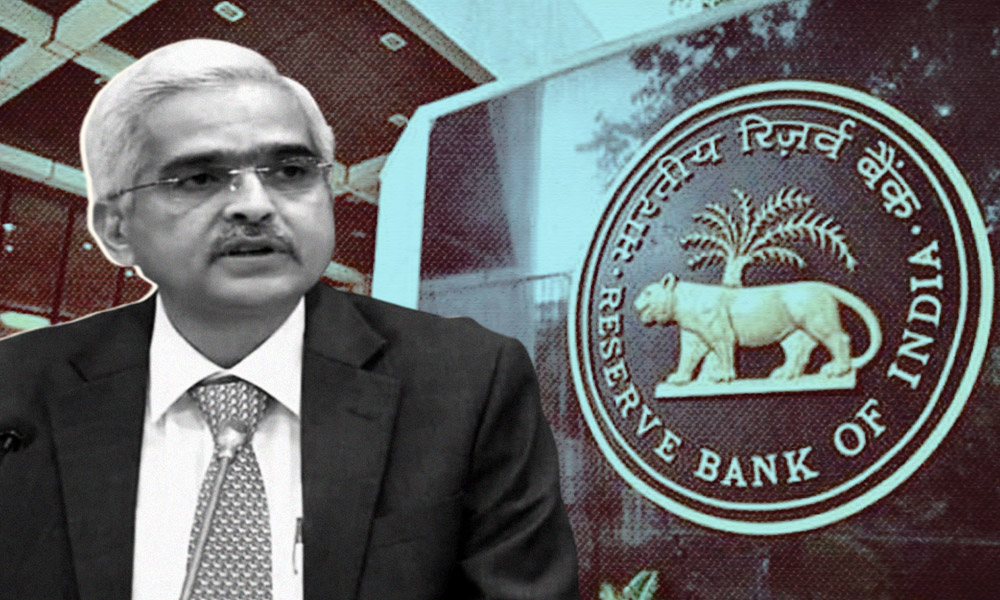

Global economic activity has remained fragile, surge in COVID cases has subdued early signs of revival, RBI Governor Shaktikanta Das said.

The Reserve Bank of India (RBI) left the repo rate unchanged at the current 4 per cent on August 6, after a three-day meeting of its Monetary Policy Committee (MPC). The six member committee decided to maintain its "accommodative" stance on policy, RBI Governor Shaktikanta Das said in a virtual address to media.

The RBI Governor said the Committee expects inflation to remain at elevated levels in the July-September period, and ease in second half of the current financial year on the back of "favourable base effect".

Following are some key highlights from the monetary policy decision:

- The RBI Governor said the war against COVID-19 is most intense at the current juncture.

- Regulatory response has to be dynamic, pro-active and balanced: RBI Governor Shaktikanta Das

- The central bank also kept the reverse repo rate, the interest rate at which the RBI borrows funds from commercial banks, unchanged at 3.35 per cent.

- The RBI has focused on keeping consumer inflation under control, within a medium-term target of 4 per cent.

- Rs 10,000 crore additional liquidity facility to be provided by National Housing Bank, NABARD: RBI Governor

- Shaktikanta Das said that loans against gold enhanced to 90% of the value from the current 75% to curb the COVID impact on households.

- Global economic activity has remained fragile, surge in COVID cases has subdued early signs of revival: Das

- With Covid-19 continuing to hit the economy, stressed MSME borrowers to be eligible for the restructuring of debt if their accounts are classified standard.

- India's economic growth to contract in the first half of fiscal beginning April 2020.

RBI allows lenders to provide a window to restructure loans of corporate, individual borrowers to ease Covid-19 impact, says Governor Das.

Also Read: Indian Banks' Bad Loans Could Rise To Highest In 20 Years: RBI Financial Stability Report

All section

All section