Image Courtesy: gg2 | financialexpress | moneyexcel

We all get to see the profits the big companies from India are making. How often do we realize that the biggest companies of India sit on a huge pile of debt? The debt which arises due to various reasons including stalled or delayed projects, mergers and acquisitions, operational inefficiencies and other reasons.

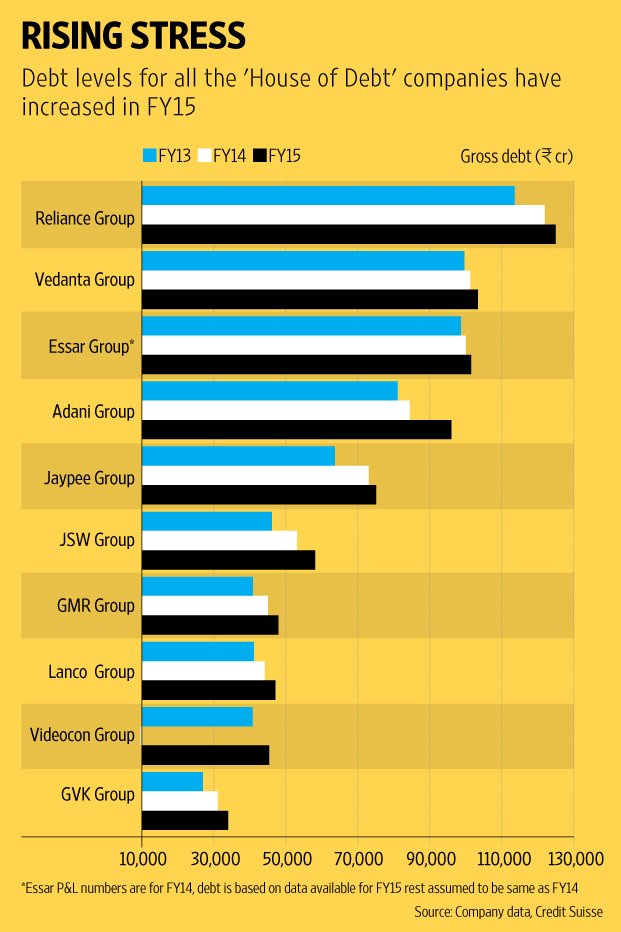

The top ten companies with the largest debt are listed below:

Image Source: fpindia

Image Source: fpindia

The debt in numbers as evident in the graph is staggering, to say the least. It raises many questions and leads to many inferences. Let us look at some of them.

1.) Why should people be concerned about the numbers?

In a UBS AG report, it is mentioned that the loans given to the top ten companies with the highest debt adds up to 12% of the loans in the banking system in India and it also adds up to 27% of the corporate loans in India. It is common people’s savings which go to the companies as loans.

2.) Have there been any remedial measures taken in reducing the bad loans?

Unfortunately, NO. The same UBS AG report says, “Loan approvals to potentially stressed companies have risen 85% since 2011-12 as banks continued to lend to such borrowers despite deteriorating cash flows and increased debt on their balance sheets”. Even the RBI Governor Raghuram Rajan had commented that bad loans to corporates are like a “ticking dynamite” which has the potential to shake the stability of the banking system of India.

Why are the banks especially the public sector banks in which government has stakes and a say in disbursing of loans continuing to lend loans to companies with huge debt. The banks had to swallow a bitter pill in the case of Kingfisher where almost the entire value of the brand got eroded to 6 crores. Government being representatives of the people should be safeguarding and smartly investing people’s precious savings for better returns than loaning companies whose debt record is poor.

The Logical Indian demands the government to hold the bank authorities accountable for the loans dispersed. We request the government to act as a guardian of people’s savings and not as a channel through which a few corporate enterprises get easy loans. We request the government to form an expert committee under a competent individual perhaps like Mr Raghuram Rajan (RBI Governor) to review the loans lent and the approval process to make the banking sector work better.