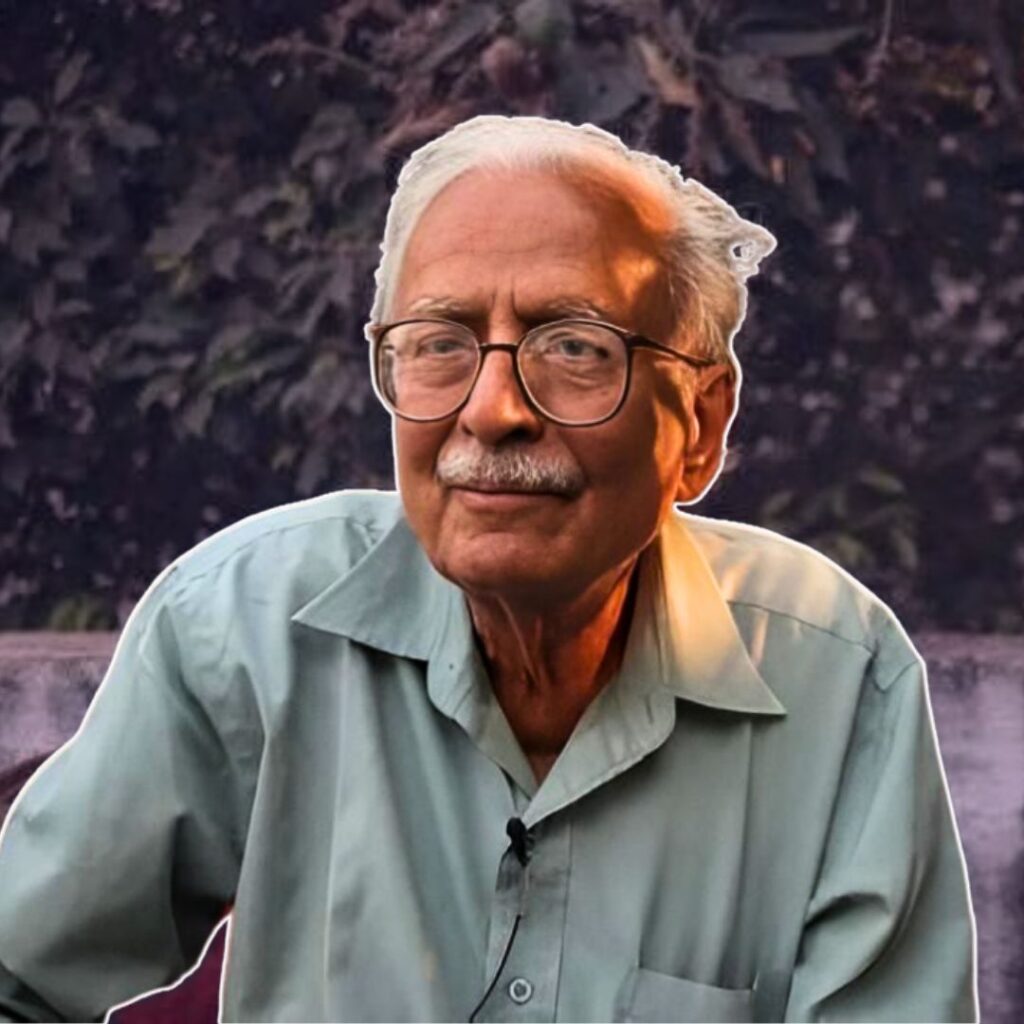

Reliance Industries Ltd (RIL) Chairman and Managing Director Mukesh Ambani joined the club of the world’s top ten richest people, after his real-time net worth jumped to $64.5 billion.

According to the latest rankings by the Bloomberg Billionaires Index, Ambani now stands at the ninth position, overtaking Larry Ellison of Oracle and France’s Francoise Bettencourt Meyers.

The Reliance chairman is now in the company of Amazon founder Jeff Bezos (f $160 billion), Bill Gates ($112 billion), Mark Zuckerberg ($90 billion) and Warner Buffet ($71.5 billion).

Shares of the company have doubled since March, up 6% from Rs 1,788.60/ share on the Bombay Stock Exchange on Friday before ending at Rs 1,759.50/ share.

The company largely benefited from the Jio platform, the telecom arm of Reliance Industries, debuted in December 2015, while the crash in oil prices caused uncertainty in a stake sale of Reliance’s oil and chemicals division.

The telecom giant attracted almost $15 billion, which is believed to be more than half the investment into any telecom companies in the world.

Following this, on Friday, Ambani in a statement released by the company announced RIL becoming ‘net-debt free’, after raising over Rs 1.68 lakh crore in 58 days.

‘I have fulfilled my promise to the shareholders by making Reliance net-debt free much before our original schedule of March 31, 2021,’ the statement read.

As the share prices shot up on Friday, Reliance also became the first Indian company to be valued at $150 billion or above Rs 11 lakh crore in rupee terms, The Week reported.

According to the media report, as of March 2020, Reliance had a net debt of Rs 1.61 lakh crore, and since then, the company raised Rs 1.68 lakh crore via a 24.7% stake sale in Jio Platforms and the rights issue that added another Rs 53,124 crore.

This comes amidst the huge crunch that the Indian economy is facing as a result of the global pandemic.

‘The combined capital raised has no precedence globally in such a short time. Both of these are also unprecedented in Indian corporate history and have set new benchmarks. This is even more remarkable that this was achieved amidst a global lockdown caused by the COVID-19 pandemic. Along with the stake sale to BP in the petro-retail JV (joint venture), the total fund raise is in excess of Rs 1.75 lakh crore,’ the statement as quoted.

Also Read: Assam Pollution Control Board Issues Notice, Tell Oil India Limited To Shut Down Baghjan Operations