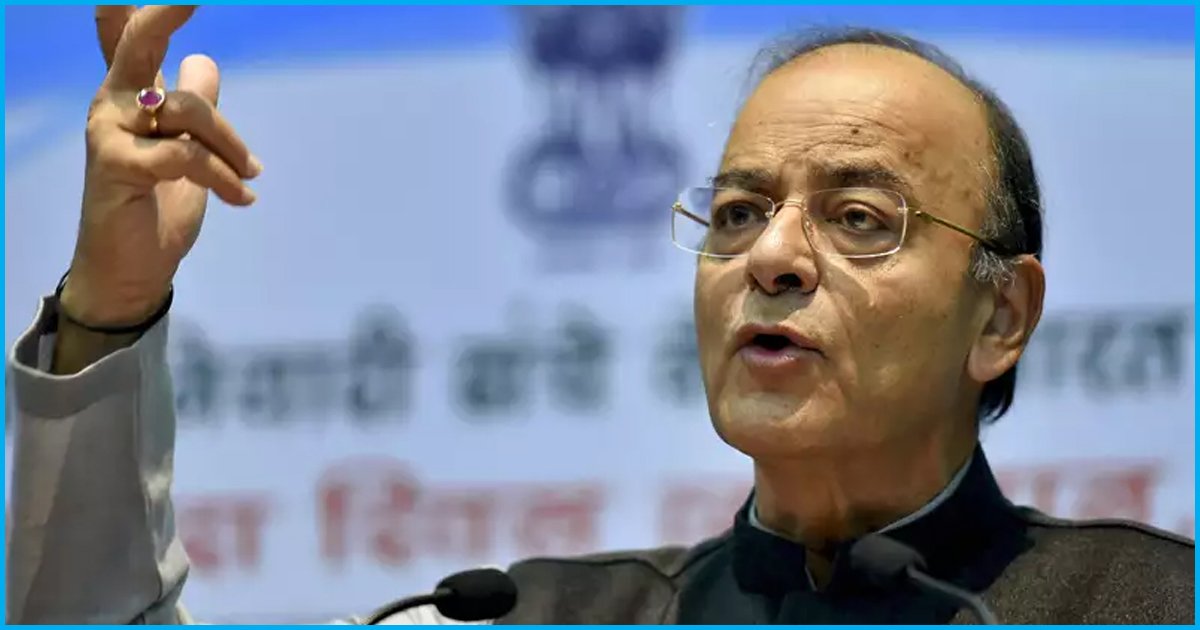

Lok Sabha Passed Amendment In FCRA: Exempts BJP & Congress For Taking Foreign Funds Illegally

16 March 2018 12:57 PM GMT

Yesterday, amidst Opposition shouting slogans and disrupting the Lower House of the Parliament, the entire Budget of our country was passed. Among that an amendment in the Foreign Contribution Regulation Act (FCRA) in the Finance Bill 2018 was also introduced.

What does it mean?

The amendment in Foreign Contribution Regulation Act (FCRA) in the Finance Bill 2018 may turn out to be helpful for the ruling Bharatiya Janata Party (BJP) and the opposition, Congress, who was held responsible by the Delhi High Court for accepting foreign funds from a London- based company Vedanta and its subsidiaries.

The amendment in FCRA in this year’s finance bill will make all the donations from the foreign companies, which aren’t considered foreign anymore, undisputed.

BJP and Congress found guilty of accepting foreign funds:

In 2014, ten days before the general elections, on a lawsuit filed by the Association of Democratic Reforms, the Delhi High Court found BJP and Congress guilty of accepting foreign investment from a company named Vedanta and its subordinates. The court instructed the Election Commission to take action against both. However, the BJP-led National Democratic Alliance (NDA) government did not follow the instructions and no steps were taken against BJP and Congress. Before the hearing in Supreme Court for this case, the amendment in FCRA through the Finance Bill was introduced.

The amendments in FCRA through Finance Bill 2016:

Initially, according to FCRA, any company having more than 50% FDI was considered a foreign company. The government made a retrospective alteration in the definition of “foreign company” in a section of FCRA, 2010 through the Finance bill in 2016.

After the amendment, the company that was being considered of foreign origins all along became an Indian company. The justifications given by the government for this were that some foreign companies wanted to invest in Corporate Social Responsibility (CSR) and initial FCRA guidelines were creating a hindrance for entry of foreign money.

The Hindu quoted Kiren Rijiju, minister for state for home affairs on the amendment as, “donations made by such (foreign shareholding) companies to entities including political parties will not attract provisions of the FCRA, 2010.” This amendment can also be considered a rather bold move of protecting BJP and Congress from any legal actions.

All the amendments in FCRA have been aimed at acquiring more foreign donations. The Representation of People Act instructs the declaration of donation above Rs 20,000, but rather than following it, the parties have found an alternative like acquiring donations of Rs 19,999. The government had been working hard to legalize the foreign funding received by the political parties.

Foreign Contribution Regulation Act 1976:

This act came into play during the Indira Gandhi government in 1976. FCRA prevents the political parties, electoral candidates, and judges from accepting contributions and funds from foreign companies. This act was introduced to restrain international input and interference from the in-house politics of the country because, during the cold war period, the Soviets, as well as the Americans, interfered in the domestic affairs of the post-colonial nations for the sake of their interests.

However, with time, the suspicion posed by the government melted away. As the economy opened up in 1991, foreign funds were accepted in the country with open arms. The Indian state had no issues regarding the foreign investments directed from donors such as the World Bank. As the government started taking in foreign investments, the Indian businessmen played their fortunes too. They began accepting foreign funds as well. Moreover, the political parties played along also despite the regulations that prohibited them from doing so.

The role of The Representation of People Act 1951:

This act deals with all things election and the correct way of conducting them. It also states the definition of a political party. This act in contrast to FCRA and says that the political parties can take in investments from companies and people. It further declares that if the donation is less than Rs.20,000, then the political parties do not need to announce it, all the donations made above this amount is required to be made public. However, other than this liberty, this act specifically points out that donation from foreign countries is not allowed. This is to prevent any foreign influence on the country’s political mechanism. According to FCRA, any company that has subsidiaries in other countries is considered a foreign company.

All section

All section