Exclusive| Originally Published On India Samvad

New Delhi: Can we afford to buy a commodity at a price which is almost double of the market rate? We might not afford to waste our money, but the government may have a large heart to do so.

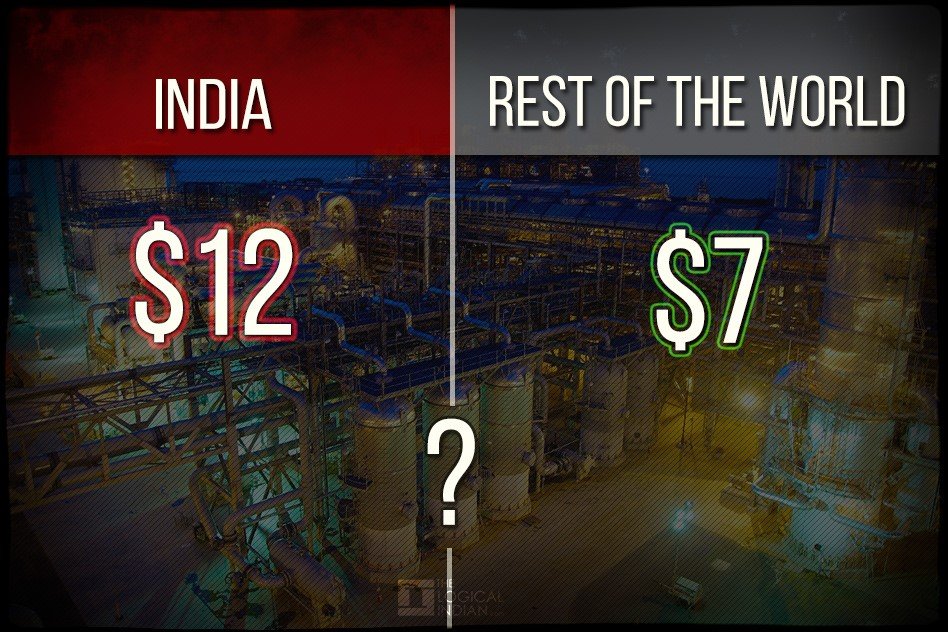

Believe it or not Liquefied Natural Gas(LNG) is available in open market at a price of US $7 per MMBTU, but India is buying it at the whopping rate of US $12 per MMBtu. The high price is being paid for the blunder committed by Indian officials while signing contracts for the purchase of gas in the past.

The LNG is imported by government-owned company Petronet,India ’s biggest company which imports LNG. The company is not only involved in irregularities in signing contracts but also in the controversial decisions taken in appointing the highest paid officials. Recently, Petronet made major changes in selection board for accommodating a Managing Director who was reportedly selected on a VIP’s recommendation. “ A core energy company is being run like a grocery shop. Politicians who cannot even define LNG are interfering in the recruitment of the highest officers of the company,” said a Joint Secretary who earlier worked in the Petroleum Ministry.

Petronet may appear to function like a corporate company, but the fact is that it is directly governed by Union Petroleum and natural gas ministry.

For instance, taxpayers in India are coughing US $12 while LNG is available in open market at half the price. Sources said that Petronet LNG is now being investigated for alleged irregularities by a committee in consultation with CVC.

Massive irregularities costing billion of dollars to taxpayers

Due to ill-conceived contracts, India is paying an exorbitant price, almost double of the open market rate to the Qatar-based Ras Gas company. Efforts of the government to re-negotiate the contract have not been fruitful. “ Mistakes have been done while we were signing the contracts with Ras Gas. Now how one can reverse or change the terms and conditions of the contracts,” said a former Secretary of the Union Petroleum Ministry.

The three widely reported irregularities in gas purchase contracts are briefly detailed below:

Ras Gas of Qatar and Petronas of Malaysia competed in an open tender for supply of LNG to Petronet over a 25-year period. Ras Gas won with a firm bid that would have translated to a floor or minimum price of $3 and a cap or maximum price of $4 per MMBTU for re-gasified LNG at Petronet’s Dahej terminal for 25 years. The offer followed the standard industry practice of crude oil-linked LNG prices with a firm floor and a firm cap.

This price bid was re-negotiated in July 1999 exclusively with Ras Gas without approaching the competing bidder. A formulation, hitherto unknown in the world for long-term LNG contracts, was coined. Under this unique formulation Petronet agreed to buy LNG, on take-or-pay basis, at a fixed price at the mid-point of the quoted floor and the cap for the first five years; followed by an annual increase equal to 33 percent of the originally bid cap, for each of the next five years. For the balance 15 years, LNG price was linked directly to the average price of crude in the immediately preceding five years without any floor or cap.

Even a rudimentary analysis would have demonstrated that at a discount rate of 10 percent the net present value of payments in the first 10 years, under the negotiated formulation, would be at least19 per cent higher than that under the Ras Gas bid. And, for the net present value under the negotiated formulation to be equal to that under the Ras Gas bid, over the 25-year life of the contract, average crude oil prices would need to remain under $13/barrel for every five-year period starting year 6 through year 25! The rest, as they say, is history.

On April 27, 2015, the petroleum and natural gas minister informed Parliament that Petronet LNG was being investigated for alleged irregularities in gas purchase contracts. Importantly, he noted that the findings of a government committee constituted for this enquiry “are under examination in consultation with Central Vigilance Commission” (CVC).

Exclusive India Samvad Bureau