Reported By SOURJYA BHOWMICK | Originally published on catchnews|Image Source: intro world

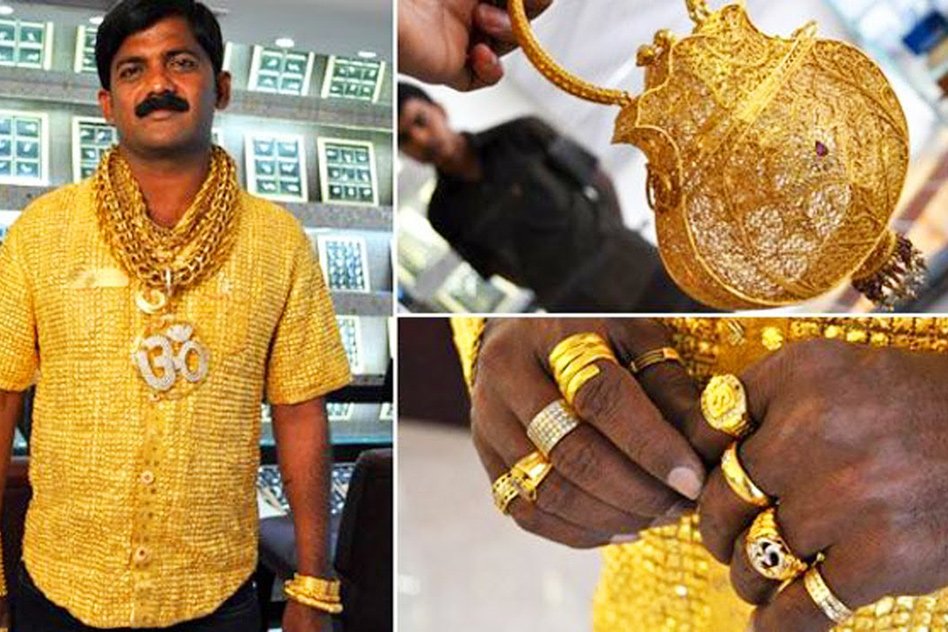

How gold obsessed is India? The numbers could stagger you. The central government has decided to mobilise gold lying idle with households and institutions by offering tax free interest on gold deposits.

The decision follows Finance Minister Arun Jaitley’s budget announcement of starting a gold monetisation scheme.The main objective is to steer a steady flow of money into the formal financial system, reduce reliance on gold imports and give an impetus to the gems and jewellery sector which can get gold as loan from the banks.In 1999, a similar scheme was initiated by the government which failed due to a low interest rate of 0.75-1%.The interest rate fixed this time is 1-1.5%.So, what are the key facts about India’s gold market that makes the government optimistic?

22,000 tonnes

- That’s the estimated amount of gold privately held in India at present

- This is roughly equivalent to three Eiffel Towers full of gold

60 lakh crore rupees

- That’s the scale of money the government expects will flow into the formal financial system if the scheme is executed

- The value of this privately held gold is more than three times the Non-Planned expenditure of the country in 2015-2016

- This includes the bulk of the government’s fixed expenses in terms of salaries, subsidies, interest payments, pensions etc

192 tonnes

- Or more than the weight of 30 African elephants

- That’s how much demand there was for gold in all forms by Indian consumers in quarter one of 2015

151 tonnes

- Or equivalent to the body weight of a blue whale

- That’s how much demand there was for gold jewellery in quarter one of 2015

19,645 crore rupees

- That was the estimated value of India’s gold import for the month of April, 2015

- This amount nearly doubles the allocation made for women and child development in budget 2015

- India’s gold import was up by 85% in the first quarter of 2015 as compared to the year before.

77%

- That’s the proportion of Indian consumers in 2013 who bought gold as investment, according to a survey by the World Gold Council (WGC) and Federation of Indian Chambers of Commerce and Industry (FICCI)

- Only 49% of the gold consumers in the survey were willing to deposit their gold to earn interest

557 tonnes

- That’s the amount of gold held by the Reserve Bank of India as of February 2015

- This is much, much less than what private individuals hold collectively

- Nonetheless, the World Gold Council recommends that Indian banks should start gold reserves, gold investment and a renewed gold monetisation scheme.

The Logical Indian is of the view that its time we participate in gold monetisation scheme and help our country to grow and reduce India’s reliance on gold import.

For more such stories visit Catchnews.com