Govt Caps GST On Devices For Disabled At 5%; The Differently-Abled Demand Rollback

7 July 2017 7:41 AM GMT

After receiving flak over fixing the Goods and Services Tax (GST) between 5-18% on aids needed by the differently-abled to sustain everyday life, the government on Tuesday capped the tax on 22 assistive devices and rehabilitation aids for the physically challenged at 5%.

The items which will now attract 5% GST are:

- Braille writers and braille writing instruments

- Handwriting equipment like Braille Frames, Slates, Writing Guides, Script Writing Guides, Styli, Braille Erasers

- Canes, Electronic aides like the Sonic Guide

- Optical, Environmental Sensors

- Arithmetic aides like the Taylor Frame (arithmetic and algebra types), Cubarythm, Speaking or Braille calculator

- Geometrical aides like Combined Graph and Mathematical Demonstration Board, Braille Protractors, Scales, Compasses and Spar Wheels;

- Electronic measuring equipment such as Callipers, Micrometres, Comparators, Gauges, Gauge Block Levels, Rules, Rulers and Yardsticks

- Drafting, Drawing Aides, Tactile Displays

- Specially adapted Clocks and Watches

- Orthopaedic appliances falling under heading No.90.21 of the First Schedule

- Wheelchairs falling under heading No.87.13 of the First Schedule

- Artificial electronic larynx and spares thereof

- Artificial electronic ear (Cochlear implant)

- Talking books (in the form of cassettes, discs or other sound reproductions) and large-print books, braille embossers, talking calculators, talking thermometers

- Equipment for the mechanical or the computerised production of braille and recorded material such as braille computer terminals and displays, electronic braille, transfer and pressing machines and stereotyping machines

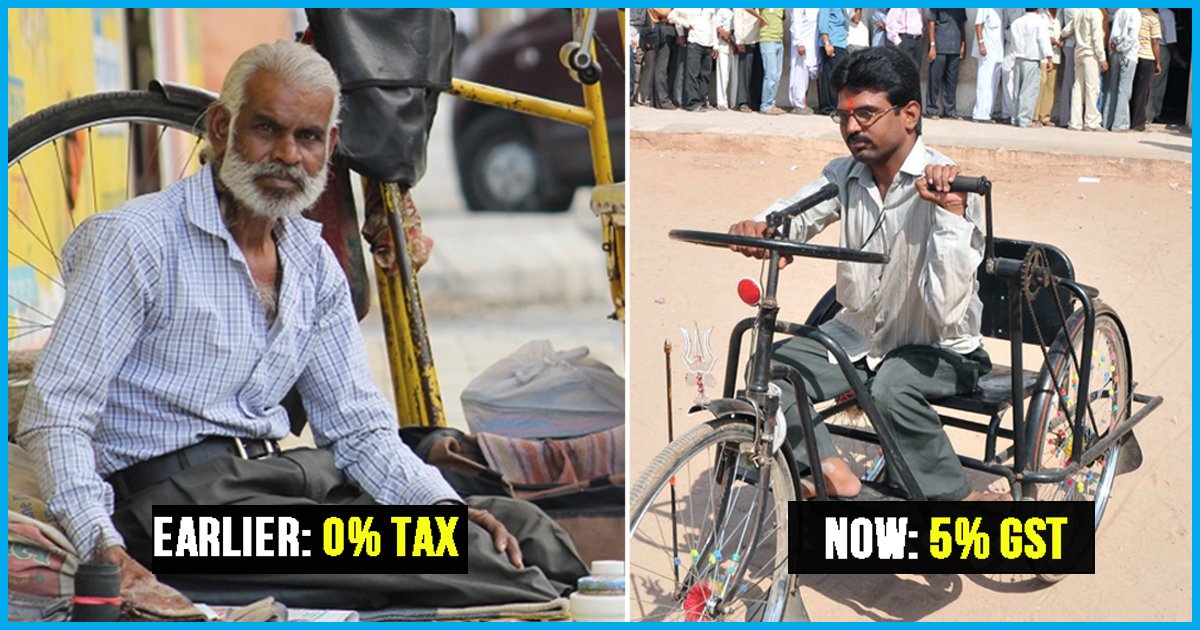

Earlier, goods for the differently-abled were included in different tax slabs (5%,12%,18%,28%) under GST:

Even 5% GST an additional load

The decision to tax aids and appliances for the disabled continues to draw flak despite the government’s decision to reduce GST and cap it at 5% for 22 categories of products.

Cars will continue to attract 18% GST even if they are retrofitted for a driver with a disability.

The differently-abled find it hard to make peace with the government’s decision to waive off tax on items like sindoor and bangles, but not daily products for their sustenance.

Government officials, while appreciating the sentiment, said their decision was driven by a desire to protect local manufacturers, avoid an inverted tax structure (where there is a huge disparity between taxes on intermediate goods and those on the finished products), and keep the new tax rate at the same level or lower than the old one, reported Hindustan Times.

“This is the government that launched the Accessible India campaign and Inclusive India campaign. I don’t understand why they should charge people to walk with a cane,“ says Nirmita Narasimhan, policy director, The Centre for Internet and Society,” as reported by The Economic Times.

The economic burden on the differently-abled is further increased as public transports in the country are not provisioned with affordable aids.

“Most of us can’t step out of our houses as roads, pavements and public transport are inaccessible,“ said Javed Abidi, a wheelchair user and the director of National Centre for Promotion of Employment for Disabled People.

Abidi and others fought to do away with taxes on aids since 2000 to reduce the financial burden. “We could bring down tax rates, sometimes as high as 20%, on various items to 5%. In 2006, it became zero and the last decade was the most important one for disability rights. Instead of making aids more affordable, we are now going back 10 years and charging 5% again,“ he said.

“Before the GST-regime, aids and implements used by handicapped persons as components and parts thereof attracted zero percentage VAT, as per Maharashtra government, Kerala government, etc. Similar was the position of most Indian states where goods used by differently-abled people were exempted from taxes,” Chirag Chauhan told The Logical Indian. He is a chartered accountant, who started a petition to urge the government to exempt goods used by the differently-abled from being taxed.

“If it is, in fact, One Nation One Tax, then why are taxes on the differently abled people being imposed when it did not exist earlier?” questions Chauhan.

The Logical Indian community stands in solidarity with the differently-abled citizens of our country. Goods used by them are needed for their everyday survival and should be treated as basic consumer products like milk, fruits and vegetables, foodgrain and cereals, which are exempted under GST.

An online petition to urge the government to change the GST rate for disability goods to zero was started on July 4, you can sign it here.

Also read: Differently-Abled To Pay Tax For Goods Under GST Which Were Earlier Exempted

All section

All section